Bitcoin Edges Toward $90,000 After Trump Scraps 10% Tariffs Following Davos Talks

Bitcoin is seeking the $90,000 reclaim as US President Donald Trump dropped tariff threats and ruled out seizing Greenland from an ally by force.

Trump’s theatrics and consequent tensions have kept markets on edge this week, prompting investors to take the latest developments with a pinch of salt even as relief was palpable.

BTC has edged up a fraction of a percentage to trade at $89,955 as of 1:19 a.m. EST, with an intraday low of $87,304 and a high of $90,295, according to Coingecko data.

The crypto market also edged up to $3.13 trillion in market capitalization. As a result, the total liquidations in the crypto market came in at $605 million.

Trump Backs Off EU Tariffs, Markets Edge Higher

Crypto investors eased back into risk after President Donald Trump struck a calmer tone on Greenland and signaled a path toward a deal that pulled some heat out of markets.

According to Trump, he had reached the “framework of a future deal” involving NATO over Greenland, and indicated he would hold off on the tariff threat.

“It’s a long-term deal. It’s the ultimate long-term deal. It puts everybody in an excellent position, especially as it pertains to security and to minerals,” Trump told reporters.

While speaking at the World Economic Forum in Davos, Trump said he would not impose the tariffs and ruled out the use of force in the dispute over the Danush territory.

“I won’t do that,” the U.S. President said at Davos of an attack to secure Greenland.

Trump’s words came as markets waited to see the full extent of EU trade retaliation over the Greenland issue.

As the crypto markets edged higher, gold prices remained largely steady after hitting a record high near $4,900/ounce in the previous session.

Silver prices rose 1% to $94.03 per ounce, just below record highs of $95.89/oz hit earlier this week.

Bitcoin Price Set For A Rally Back Above $100K

Bitcoin price is currently consolidating near the $89,000–$90,000 region, holding just above short-term support around $87,000–$88,000, which buyers have defended following the sharp sell-off from November highs.

This consolidation comes after a strong decline from the $115,000 area, where selling pressure accelerated and forced the price of BTC into a corrective phase. Demand stepped in near the $82,000 zone. The rebound from this area suggests downside momentum has slowed in the long term.

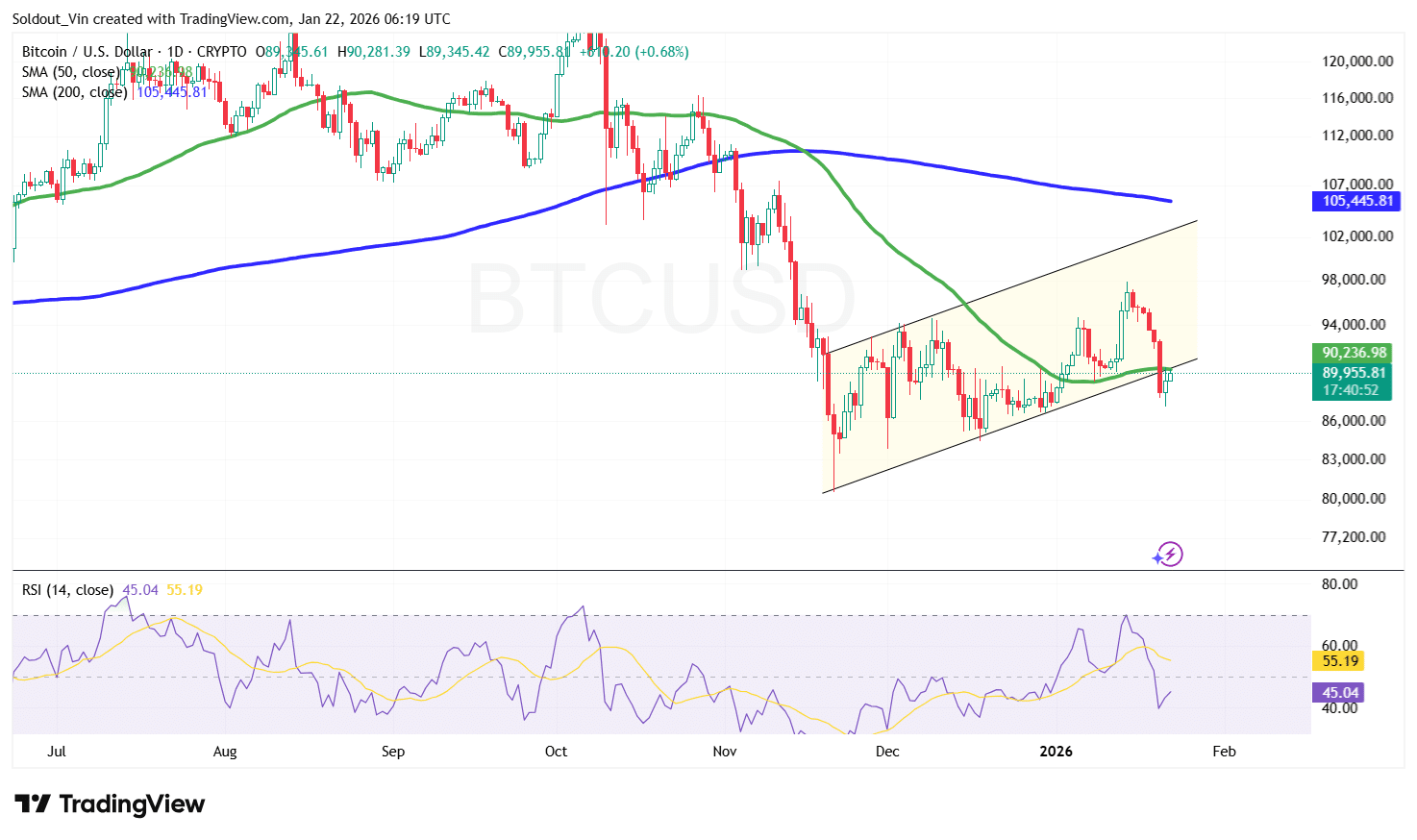

Bitcoin is trading around the 50-day Simple Moving Average (SMA) near $90,200, but remains well below the 200-day SMA around $105,000, which continues to act as major resistance on the upside.

The downward slope of the 200-day SMA indicates the broader trend remains bearish unless Bitcoin can reclaim this level and hold above it.

Bitcoin’s Relative Strength Index (RSI) is hovering around 45, sitting below the neutral 50 mark. This suggests momentum remains weak, though not oversold, leaving room for a recovery attempt if buying pressure increases.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

From the 1-day BTC/USD chart, Bitcoin price is trading within a rising channel following the sell-off. This structure often represents a bearish continuation pattern, with price currently trading between channel support and resistance. A move toward the $94,000–$98,000 resistance zone is possible, where the upper channel boundary aligns with prior rejection levels.

A clean breakout above $98,000, followed by a reclaim of the 200-day SMA near $105,000, would be the first meaningful signal of a trend reversal.

For Bitcoin to realistically target a sustained move back above $100K, it would need a confirmed trend shift, which may call for a close above the $95,000 zone.

Conversely, failure to break above channel resistance could trigger another pullback, with $88,000 acting as initial support, followed by the $85,000 demand zone if selling pressure returns.

Related News:

You May Also Like

Zwitserse bankgigant UBS wil crypto beleggen mogelijk maken

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets