DeFi backbone of ASI Alliance Singularity Finance unveils H2 2025 roadmap

Singularity Finance, the ASI Alliance’s financial arm, has released its H2 2025 roadmap, with Q3 bringing AI portfolio tools, yield vaults, and trading agents.

Singularity Finance, the financial engine of the Artificial Superintelligence Alliance, has released its roadmap for the second half of 2025.

For the upcoming Q3, the project plans to launch its AI-powered portfolio management tools designed to help users build, monitor, and rebalance crypto investment strategies based on real-time data and smart automation. Alongside this, the platform will introduce diversified yield vaults — automated smart contracts that allocate user funds across multiple AI startups and infrastructure projects to maximize returns while managing risk.

The quarter will also see the phase 1 launch of autonomous trading agents: non-custodial smart contracts that execute advanced trading strategies on DEXes without users needing to write code or give up control of their funds.

In parallel, the team will begin research and architecture design for cross-chain MeTTa compatibility, a step toward integrating the ASI ecosystem’s native smart contract language across multiple blockchains.

In Q4, the platform aims to launch the Agentic Discovery Hub with full KPI dashboards, where users will be able to explore and evaluate AI projects within an interactive, user-friendly interface powered by autonomous agents.

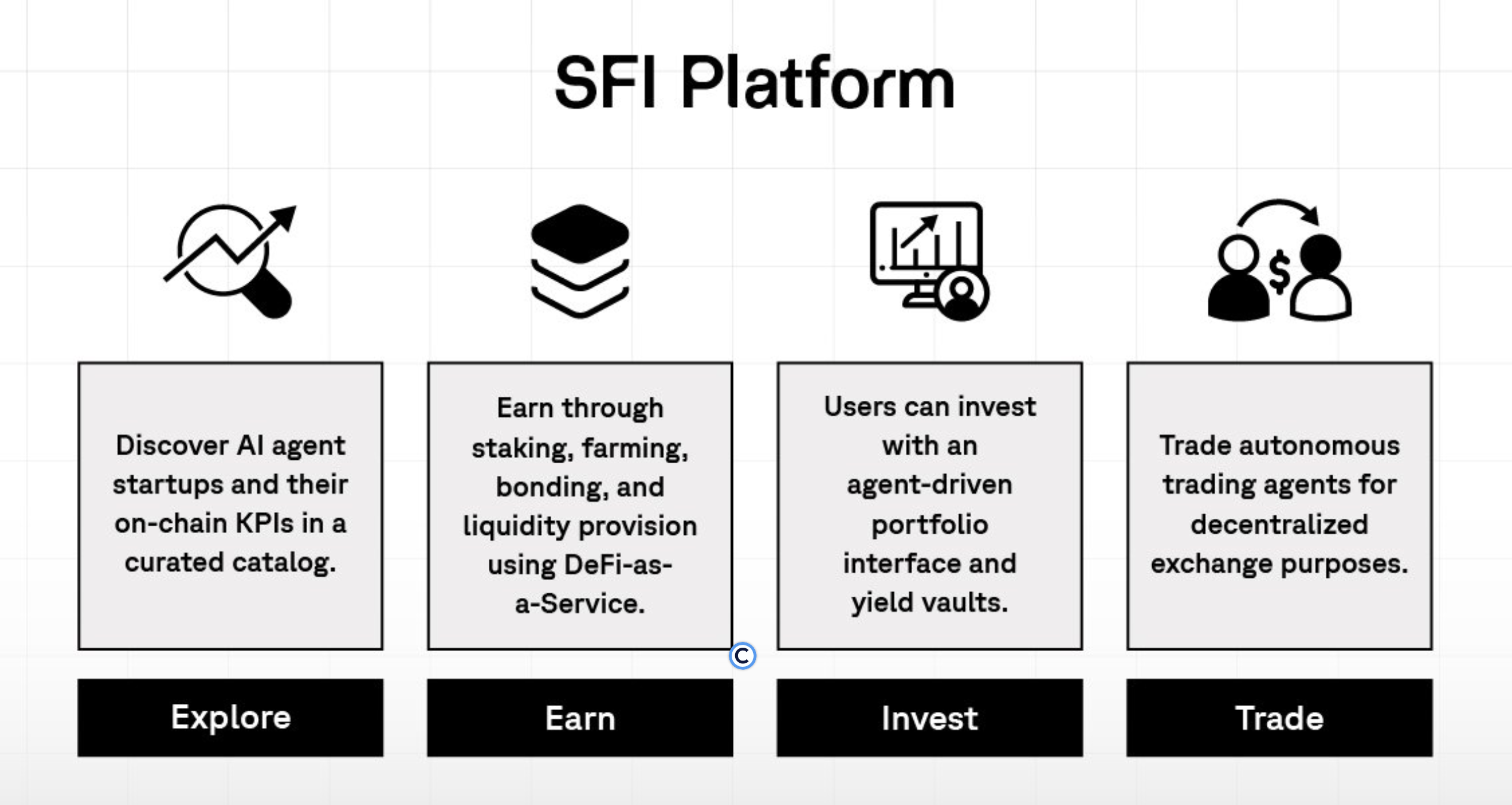

These roadmap goals directly support Singularity Finance’s mission of powering the ASI Alliance by channeling capital into AI startups and infrastructure. At a high level, the SFI platform operates through four core functions: Explore, Earn, Invest, and Trade.

For context, the ASI Alliance is a coalition of blockchain and AI projects, formed in April 2024, with the mission to accelerate the creation of Artificial General Intelligence and ultimately Artificial Superintelligence, using open infrastructure, distributed compute, and shared data networks.

The group, which includes SingularityNET, Fetch.ai, Ocean Protocol, and CUDOS, merged their tokens under a unified FET asset and is developing ASI Chain, a modular blockchain designed specifically to support decentralized AI coordination, agent economies, and cross-chain interoperability.

You May Also Like

Coinbase CEO advocates for crypto legislation reform in Washington DC

Forex Expo 2025 Redefines the Trading Landscape