Stablecoin Trading Surges 62% in Korea as Dollar Strengthens Against Won

South Korean crypto exchanges recorded a 62% surge in stablecoin trading volumes as the won fell to multi-year lows against the dollar, prompting platforms to intensify marketing campaigns around dollar-pegged tokens.

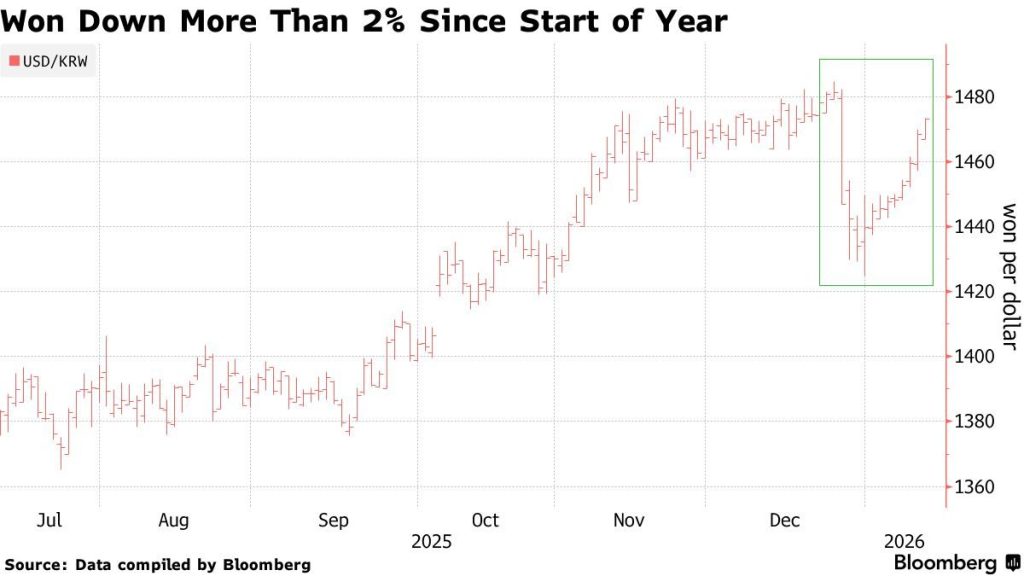

According to The Korea Times, trading volume in Tether (USDT) across the nation’s five major won-based exchanges climbed to 378.2 billion won ($261 million) when the exchange rate exceeded 1,480 won per dollar last Wednesday, citing CryptoQuant data.

The spike follows mounting currency pressures that pushed the won through nine consecutive days of declines against the dollar, marking its longest losing streak since 2008, Bloomberg reported.

Source: Bloomberg

Source: Bloomberg

Major exchanges, including Korbit, Coinone, Upbit, and Bithumb, launched aggressive promotional campaigns centered on stablecoins, including USDC and USDe, waiving trading fees and distributing rewards to boost volumes during what industry officials described as a downturn in broader crypto markets.

Banks Slash Dollar Rates as Government Defends Currency

According to The Chosun Daily, South Korea’s major commercial banks slashed dollar deposit interest rates to near zero in response to government pressure to defend the exchange rate.

Shinhan Bank cut its annual rate from 1.5% to 0.1% starting January 30, while Hana Bank reduced rates from 2% to 0.05% for its Travelog Foreign Currency Account.

The coordinated move followed the authorities’ summoning of bank executives and their request that they “refrain from excessive marketing that encourages foreign currency deposits such as dollars.”

Banks responded by introducing incentives for won conversion, with Shinhan offering a 90% preferential rate for customers converting dollar deposits back to won, plus an additional 0.1 percentage point rate boost for those subscribing to won-term deposits afterward.

Dollar deposit balances at the five major banks fell 3.8% from month-end to 63.25 billion dollars as of January 22, marking the first decline after three consecutive months of surges.

Corporate deposits, which account for 80% of all dollar holdings, dropped sharply from 52.42 billion dollars at year-end to 49.83 billion dollars, suggesting that the authorities’ recommendation to sell dollars spot, combined with perceptions that the exchange rate had peaked, was driving the decline.

Individual dollar deposits grew at a significantly slower pace, rising just 109.64 million dollars, compared with the previous month’s 1.09 billion dollar surge.

Presidential Intervention Accelerates Won Stabilization

President Lee Jae-myung delivered a rare verbal intervention on the exchange rate during a January 21 press conference, stating authorities predicted the rate would drop to around 1,400 won within one to two months.

The won-dollar rate immediately fell from 1,481.4 won to 1,467.7 won following his remarks, closing at 1,471.3 won.

Market observers noted the unprecedented nature of a sitting president specifying both an exchange rate target and timeline, with Lee’s statement carrying significantly more weight than U.S. Treasury Secretary Scott Bessent’s earlier comment that the won’s recent decline was “inconsistent with Korea’s strong fundamentals.”

Meanwhile, demand for dollar exchange slowed as average daily won-to-dollar conversions reached 16.54 million dollars from January 1-22, while dollar-to-won conversions surged to 5.2 million dollars daily, significantly exceeding last year’s 3.78 million dollar average and indicating increased profit-taking.

In fact, according to CNBC, South Korea’s fourth-quarter GDP growth slowed to 1.5% year over year, missing economists’ forecasts of 1.9%, as construction investment shrank 3.9% and exports pulled back 2.1% from the previous quarter.

The won has lost nearly 2% against the greenback this year, making it one of Asia’s worst-performing currencies, while South Korean retail investors bought approximately 2.4 billion dollars of U.S. equities on a net basis through mid-January, up roughly 60% from the same period last year.

The broader economic slowdown comes as Seoul advances major crypto policy reforms despite regulatory gridlock over stablecoin governance.

Earlier this month, South Korea ended its nine-year corporate crypto trading ban, permitting listed companies to invest up to 5% of equity capital in top-20 cryptocurrencies, while lawmakers passed amendments to the Capital Markets Act and Electronic Securities Act establishing legal frameworks for tokenized securities trading beginning January 2027.

Korea Exchange Chairman Jeong Eun-bo pledged to launch spot Bitcoin ETFs and extend trading hours to 24/7 as part of efforts to eliminate the “Korea discount,” though comprehensive digital asset legislation remains stalled amid disputes between the Financial Services Commission and the Bank of Korea over stablecoin issuance rules.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Microsoft Corp. $MSFT blue box area offers a buying opportunity