Bitget’s Gracy Chen Says Gold’s Bull Run Isn’t Over — Bitcoin May Be Undervalued

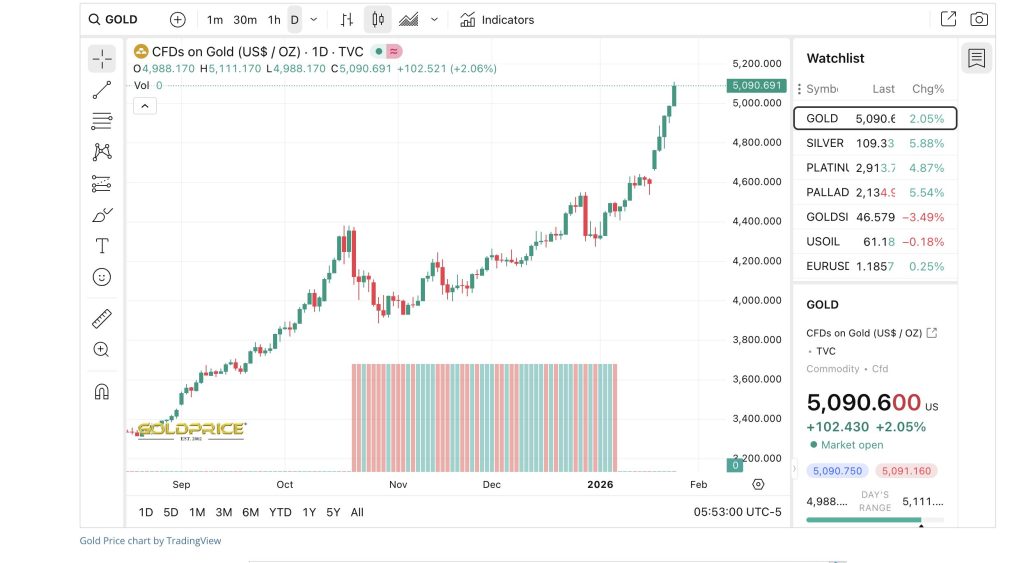

Gold’s rally is showing little sign of slowing as global markets head into 2026 with investors increasingly looking for refuge in traditional safe-haven assets amid geopolitical uncertainty.

According to Gracy Chen the CEO of crypto exchange Bitget says gold continues to act as “the world’s ultimate insurance policy,” as demand remains firm while broader financial markets adjust to shifting macroeconomic risks.

“Technically, the market is still in expansion mode,” Chen said pointing to Fibonacci extension levels that suggest gold could climb toward the $5,325–$5,400 range in the months ahead.

She added that strong buying interest holding around $4,830 indicates the current move is part of a sustained trend rather than a topping pattern.

Gold Remains the Anchor in Uncertain Markets

Gold has benefited during periods of heightened global instability and Chen believes the current environment will continue to support its role as a defensive asset.

With many investors reassessing risk exposure across equities and emerging markets, the precious metal is once again being positioned as a portfolio hedge against inflation, geopolitical shocks and currency volatility.

The resilience of demand at key technical support levels suggests that gold’s rally is being driven by structural factors rather than short-term speculation.

Bitcoin Undervalued Despite Macro Headwinds

Chen also drew parallels between gold’s trajectory and Bitcoin’s outlook arguing that the world’s largest cryptocurrency remains undervalued relative to its long-term potential.

“Bitcoin is on a similar trajectory considering it is an undervalued asset currently,” she said.

While Bitcoin remains sensitive to macroeconomic events Chen highlights several forces that could support an increasingly bullish breakout over the next year.

ETF Inflows and US Regulation Fuel Bullish Setup

The key catalysts Chen points to continued institutional demand through spot Bitcoin ETFs which have provided steady inflows and reinforced Bitcoin’s growing role in mainstream portfolios.

She also notes that Bitcoin volatility has declined compared to major tech stocks showing maturation in the asset class.

In the policy arena ongoing progress on a US crypto market structure bill could also provide greater regulatory clarity, potentially unlocking further institutional participation.

Bitcoin Could Reach $180K by End of 2026?

Chen believes Bitcoin’s current market cycle may also be diverging from historical norms with structural adoption and regulatory momentum creating conditions for sustained upside.

“If these forces persist Bitcoin has a credible path toward $150,000–$180,000 by the end of 2026,” she said.

Traditional Safety Meets Digital Upside

Chen’s outlook shows a broader theme emerging across global markets: investors are increasingly balancing traditional stores of value like gold with digital alternatives such as Bitcoin.

As geopolitical risks continue to linger and financial systems evolve both assets may continue to benefit from their roles as hedges—one rooted in centuries of history – the other driven by institutional adoption and technological change.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Tether launches US-regulated stablecoin, banks warn of deposit flight risk