Cardano Price Forecast: Can ADA Price Rebound on Renewed Whale Demand?

The post Cardano Price Forecast: Can ADA Price Rebound on Renewed Whale Demand? appeared first on Coinpedia Fintech News

Cardano (ADA) price has retested a crucial support level above $0.33 twice this year. This large-cap altcoin, with a fully diluted valuation of about $15 billion, has been trapped in a falling trend since the beginning of 2025.

However, the selling pressure on the ADA price has significantly declined in the past few months. Moreover, crypt traders are anticipating a bullish rebound in 2026 catalyzed by capital rotation from the previous metals industry and a clear regulatory outlook.

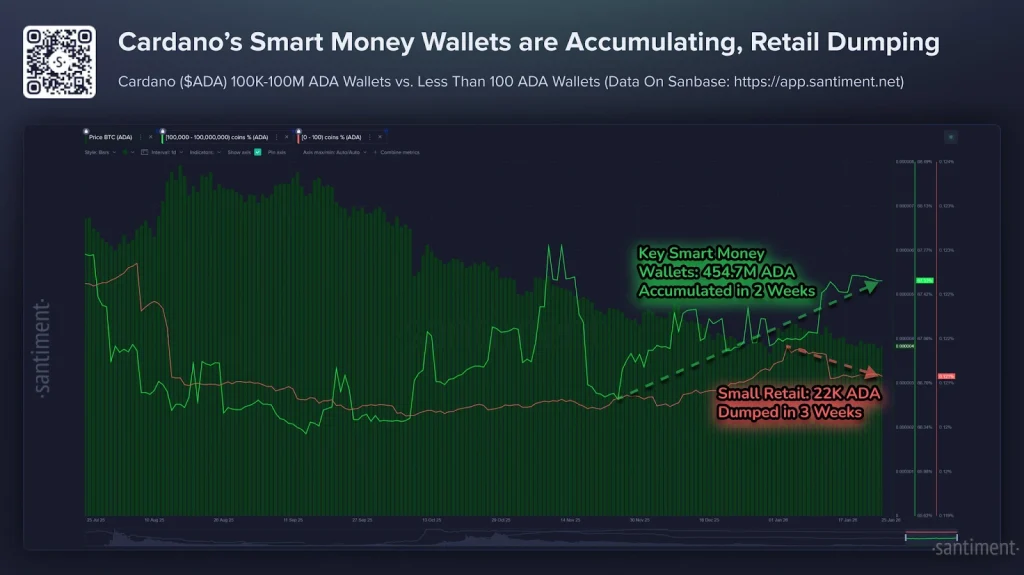

Cardano Whales Accumulate as Retail Dump

According to onchain data analysis from Santiment, Cardano wallets with a balance of between 100k and 100 million coins have accumulated 454.7 million ADA in the past two weeks. Essentially, this group has accumulated ADA valued at over $161 million.

Meanwhile, Cardano wallets with at most 100 coins have dumped 22k ADA coins in the past three weeks, valued at about $7,810.

Source: X

Historically, Santiment has shown that a renewed demand for an asset from whale investors amid selling pressure from retail is a recipe for a bullish outlook and vice versa.

What’s Next for ADA Price?

From a technical analysis standpoint, the ADA/USD pair is retesting a weak support level around $0.34. With Bitcoin (BTC) and Ethereum (ETH) leading the wider altcoin market in midterm bearish sentiment, the ADA price is likely to drop further before establishing a reversal pattern.

In the weekly timeframe, the ADA/USD pair recently retested a breakout to the downside of a rising trend. As such, ADA price is likely to retest its support level around $0.27 before rebounding towards a new all-time high.

You May Also Like

XRP Holders Brace for a Critical Move

Fed Decides On Interest Rates Today—Here’s What To Watch For