Daily Market Update: Bitcoin Drops 4% as Gold Hits $5,000 and Stock Futures Rise Ahead of Fed Decision

TLDR

- Bitcoin fell to $88,400, down roughly 4% over the past week as major cryptocurrencies declined while gold hit $5,000 and silver surged over 14% intraday

- US stock futures climbed Tuesday with S&P 500 up 0.4% and Nasdaq rising 0.7% ahead of Fed decision and Big Tech earnings

- Silver jumped to a record above $117 per ounce in its biggest one-day swing since 2008 before pulling back to close up 0.6%

- Federal Reserve expected to hold rates steady at 3.5% to 3.75% on Wednesday with more than 90 S&P 500 companies reporting earnings this week

- Trump increased tariffs on South Korean products to 25% from 15% covering autos, pharmaceuticals, and lumber

Bitcoin traded near $88,400 during Asian hours on Tuesday as crypto markets weakened heading into a critical week for global risk assets. The largest cryptocurrency has declined roughly 4% over the past week.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

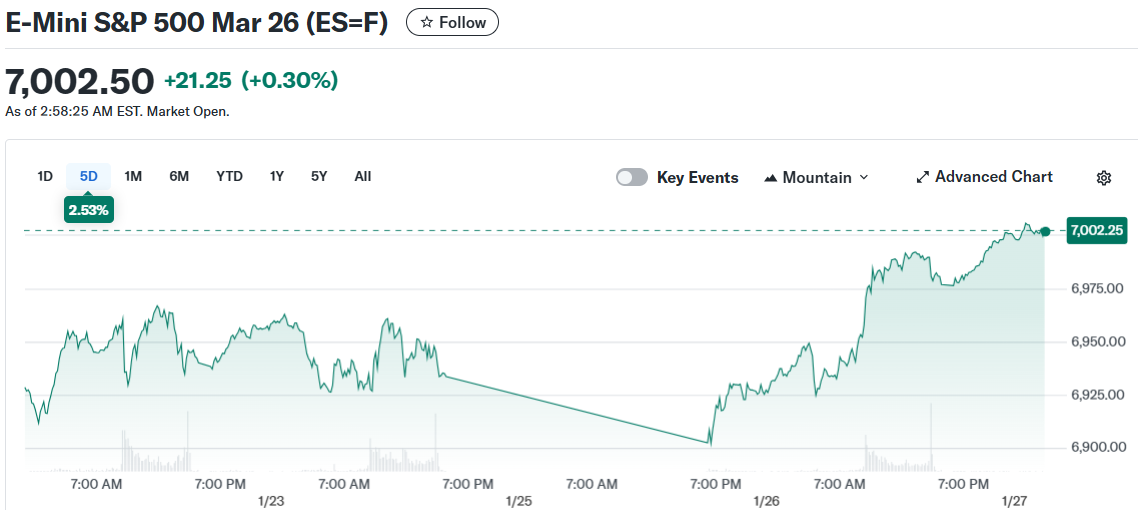

Stock futures moved higher with S&P 500 futures up 0.4% and Nasdaq 100 futures climbing 0.7%. Dow Jones futures hovered near baseline as investors prepared for a packed week of earnings and the Federal Reserve’s policy decision.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Ethereum traded around $2,940 while Solana, XRP, and Dogecoin also posted small declines. The cautious tone extended across major tokens as trading volumes remained muted.

Precious Metals Surge While Crypto Lags

Gold briefly topped $5,000 per ounce before slipping from record highs. Silver experienced its sharpest jump since 2008 with a more than 14% intraday surge that pushed it to a record above $117 per ounce.

The white metal pulled back from the day’s extremes in late US trading. Silver still finished Monday up 0.6% despite the volatility.

Bitcoin has struggled to participate in the broader macro trade. The token remains well below its October peak even as falling real yields, a weaker dollar, and rising geopolitical uncertainty have fueled gains in equities and precious metals.

The divergence reinforces the view that crypto is trading as a high-beta asset sensitive to positioning and liquidity rather than as a hedge. This contrasts with the traditional safe-haven behavior of gold and silver.

Bitcoin remains below its key moving average lines and has not attempted to break through support levels from the last two months. The token’s underperformance versus rising equities and surging gold underscores its current risk-on characteristics.

The Federal Reserve is widely expected to hold interest rates steady at its Wednesday policy meeting. Traders will watch closely for signals on the timing of future rate cuts.

Earnings from several Magnificent Seven companies will test whether the AI-driven equity rally can extend. Meta, Microsoft, and Tesla are set to release results on Wednesday, followed by Apple on Thursday.

More than 90 S&P 500 companies are scheduled to report this week. Technology stocks supported markets during Monday’s session with Apple, Meta Platforms, and Microsoft advancing ahead of their quarterly reports.

President Trump announced late Monday that tariffs on South Korean products would increase to 25% from 15%. The tariffs cover autos, pharmaceuticals, and lumber due to delays in South Korea’s legislature approving a trade agreement.

Corporate earnings due Tuesday include results from General Motors, American Airlines, and Boeing. Updated readings on consumer confidence and home prices are also scheduled for release.

UnitedHealth shares and other insurer stocks declined after a report said the US plans to keep Medicare program payment rates steady. A potential government shutdown also looms as Senate Democrats attempt to block a Department of Homeland Security funding bill.

Both the Fed decision and Big Tech earnings are seen as potential catalysts for broader shifts in risk appetite. These events could impact crypto markets as investors wait for clearer direction on bitcoin’s next move.

The post Daily Market Update: Bitcoin Drops 4% as Gold Hits $5,000 and Stock Futures Rise Ahead of Fed Decision appeared first on CoinCentral.

You May Also Like

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident

Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias