Crypto Market Bill Gains Traction Ahead of January 31 U.S. Shutdown

The U.S. crypto market structure bill is back in the spotlight ahead of a possible U.S. government shutdown starting Jan. 31.

Recent developments over the past weekend suggest the legislation has gained traction.

During the upcoming markup sessions, scheduled for Jan. 29, Democrats have reportedly agreed not to raise any major objections, potentially smoothing the bill’s path forward.

Crypto Market Bill Markup on Radar

A recent report from Politico notes that senior Democratic senators have indicated they do not intend to block the crypto market structure bill during the upcoming markup on Jan. 29.

The report cites lawmakers including Roger Marshall and Dick Durbin. It states that Senator Marshall agreed over the weekend to withdraw his objections.

He had introduced an amendment last week aimed at forcing payment networks to compete on fees, a move that had raised concerns it could derail the progress of the crypto market bill.

Marshall and Durbin have worked for months on credit card policy. The two lawmakers have also explored related provisions associated with the crypto market bill.

However, Marshall ultimately agreed not to bring the amendment forward during the markup scheduled for Jan. 29.

Other amendments remain unresolved, including proposals related to crypto ATM fraud protections and restrictions on potential bailouts of crypto issuers.

Sources cited by Politico said White House officials intervened, warning that Marshall’s amendment could jeopardize the entire crypto market structure bill.

Making a Move Before U.S. Shutdown

The report also noted that some Republicans were prepared to back Marshall’s credit card proposal.

This situation could further delay the legislative process. The Senate Agriculture Committee is now under pressure to resolve outstanding issues ahead of a potential U.S. government shutdown, with a deadline of Jan. 30.

Market participants have largely priced in the risk that a funding bill may not be finalized in time.

This has prompted increased lobbying efforts by lawmakers as discussions over the crypto market structure bill intensify.

Some sources familiar with the matter said the crypto bill could be delayed further until March.

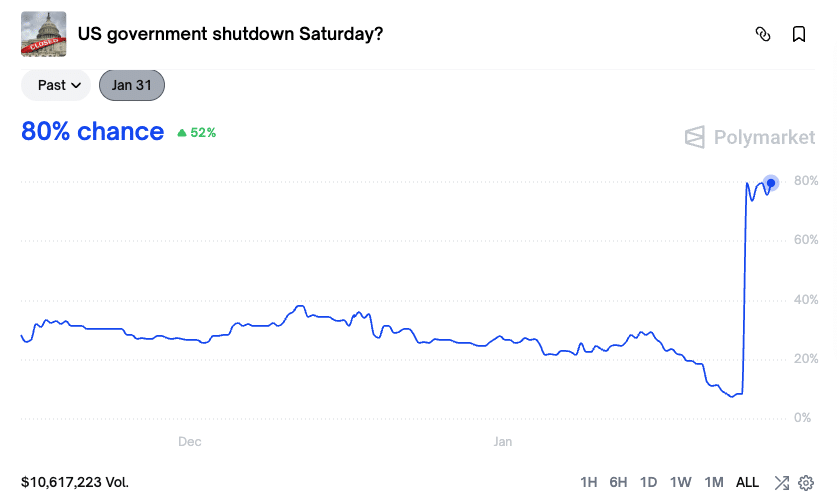

According to Polymarket data, the odds of a U.S. government shutdown on Jan. 31 have risen to 80%.

Chances of a U.S. government shutdown spike to 80%. | Source: Polymarket

Amid this development, the broader crypto market has also been on the edge.

Analyst Crypto Tice said that a shutdown will force the U.S. Treasury to rebuild its Treasury General Account (TGA), a process that usually drains liquidity from financial markets.

He warned that liquidity withdrawals tend to hit crypto assets first.

In previous shutdown-related episodes, crypto markets experienced brief relief rallies followed by sharp pullbacks as liquidity tightened.

Bitcoin BTC $87 931 24h volatility: 0.0% Market cap: $1.76 T Vol. 24h: $40.52 B and altcoins corrected by 20-25% during those periods.

Tice noted that liquidity conditions are already thin this time, increasing the risk that any further withdrawals could have an amplified impact.

nextThe post Crypto Market Bill Gains Traction Ahead of January 31 U.S. Shutdown appeared first on Coinspeaker.

You May Also Like

The Next Bitcoin Story Of 2025

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility