February Is Bitcoin’s Most Reliable Bullish Month, Analyst Says

Bitcoin’s monthly gains have cooled to about 2.2% in the latest window, but many observers see February as a potential inflection point for the largest cryptocurrency. Since 2016, the week ending Feb. 21 has delivered a median return near 8.4%, and BTC has closed higher about 60% of those weeks. With volatility still elevated but gradually moderating, market participants are watching macro signals for signs of renewed risk-on appetite within crypto markets.

Key takeaways

- February has historically produced a strong median weekly return for BTC, roughly around 7%, often outpacing October’s seasonal strength.

- Early February performance has historically warned of corrective periods in 2018, 2022, and 2025, when the month foreshadowed tougher months ahead.

- Improving macro cues, including softer volatility and upbeat earnings guidance, could tilt flows toward BTC as capital reallocates in risk-on environments.

- The long-run ceiling for BTC, according to the Bitcoin Decay Channel, sits between roughly $210,000 and $300,000 in 2026, suggesting substantial upside if the regime stays constructive.

- Momentum indicators have turned positive despite a sharp recent correction, with on-chain activity continuing to show demand as spot supply remains under pressure.

Tickers mentioned: $BTC

Sentiment: Neutral

Trading idea (Not Financial Advice): Hold. Monitor macro indicators, volatility metrics, and liquidity conditions for a clearer directional signal.

Market context: The current narrative sits at the intersection of macro-driven capital allocation and crypto-specific dynamics. As equities stumble or rally on broader macro data, BTC often acts as a levered risk-on asset, with on-chain metrics offering a separate lens on demand versus supply. The February period, including earnings season and macro releases, remains a critical juncture for assessing whether BTC can extend its mid-term resilience.

Why it matters

Seasonality is not a guarantee, but it has historically provided a framework for evaluating potential tailwinds and headwinds for BTC. The February window—particularly the two weeks from Feb 7 to Feb 21—has yielded outsized weekly moves in the past, reinforcing the idea that near-term liquidity and investor risk appetite can swing BTC’s trajectory more than other times of the year. If macro optimism remains intact and risk-on sentiment broadens, BTC could attract capital from investors who are rotating into crypto as part of diversified exposure to digital assets.

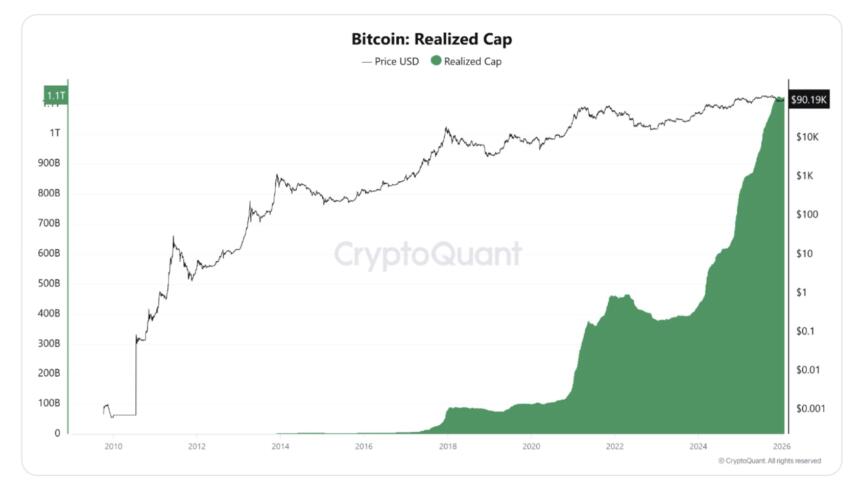

Beyond the calendar, on-chain signals continue to tell a story of ongoing demand. The Realized Cap metric has trended higher even as prices corrected, suggesting that new spot buying activity is absorbing coins moved into circulation rather than exiting the network. This pattern points to a maturing market where participants accumulate during pullbacks, a sign that long-term holders are maintaining conviction even in the face of short-term volatility. At the same time, momentum indicators—despite a recent pullback—have shifted to a positive stance, underscoring a balance between technical consolidation and the potential for a renewed upmove should macro conditions improve.

Bitcoin Decay Channel. Source: Sminston With/XSeveral voices in the community have tied BTC’s near-term prospects to broader macro risks rather than crypto-specific catalysts alone. A prominent analyst noted that the sell-off in February aligned with declines in the Nasdaq amid renewed tariff tensions in the United States, suggesting that the move was more about macro news flow than a fundamental breakdown for Bitcoin itself. In this view, the path of least resistance depends on macro shocks cooling off and liquidity conditions improving, allowing the currency to reassert its place as a strategic beta asset within a diversified portfolio.

Another line of thought emphasizes how long-term yield dynamics influence valuation and liquidity for risk assets. A recent assessment highlighted that, while higher long-term yields can cap price-expansion for risk-on assets, on-chain demand remains buoyant, as evidenced by the rising Realized Cap. This pattern supports a constructively biased outlook for BTC even as volatility remains elevated, implying that the market could work through any near-term headwinds rather than roll over into a deeper drawdown.

Bitcoin Realized Cap. Source: CryptoQuant

Bitcoin Realized Cap. Source: CryptoQuant

Overall, the case for a constructive setup hinges on a confluence of factors: a seasonally strong February window, improving macro conditions, and persistent on-chain demand. Some observers also point to velocity and market structure as arguments that the current phase represents a consolidation period rather than a definitive risk-off regime. If macro stress indices such as the VIX cool off, BTC could benefit from a broader risk-on impulse that has historically revived demand for digital assets during times of easing uncertainty.

As always, observers should be mindful of the complexity of cross-asset interactions. While BTC carries the potential for outsized gains in a bullish macro environment, it remains vulnerable to unexpected policy moves, regulatory developments, and shifts in investor sentiment. The interplay between on-chain metrics, liquidity, and macro data continues to shape a nuanced backdrop for Bitcoin’s price path in 2026 and beyond.

Related: Bitcoin-to-gold ratio falls to new low, but analysts say BTC’s discounted ‘setups are rare’

Enduring questions remain: Will February’s historical strength translate into a sustained bid, or will the market encounter fresh headwinds as macro conditions evolve? The coming weeks will be telling as earnings narratives, inflation signals, and policy expectations converge to shape the risk-on/risk-off dynamic that has long influenced Bitcoin’s volatility and trend.

https://platform.twitter.com/widgets.js

This article was originally published as February Is Bitcoin’s Most Reliable Bullish Month, Analyst Says on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

China Launches Cross-Border QR Code Payment Trial

Smart money sells 5 million tokens worth $481,000 when USELESS market cap exceeds $100 million