Best Halal Cryptocurrencies for 2026 – Top 15 Shariah-Compliant Projects

Halal cryptocurrencies for 2026 offer Muslim investors Shariah-compliant digital assets that align with Islamic finance principles.

The global Islamic economy represents over $3 trillion, and Muslim investors are increasingly seeking digital assets that respect their religious values. As cryptocurrency adoption accelerates worldwide, demand for Shariah-compliant cryptocurrencies has never been stronger. These halal digital assets must avoid riba (interest), excessive gharar (uncertainty), and investments in haram sectors such as gambling or alcohol.

This comprehensive guide examines the best halal crypto projects for 2026, with special emphasis on innovative platforms that unite Islamic ethics with blockchain technology. From established networks like Islamic Coin to emerging halal meme coins like MECCACOIN, we explore 15 Shariah-compliant opportunities for investors seeking to participate in the digital asset revolution while maintaining their religious commitments.

What Makes a Cryptocurrency Halal?

A Shariah-compliant cryptocurrency must satisfy core Islamic finance criteria, including genuine utility, transparency, and ethical operations.

For a digital asset to qualify as halal, Islamic scholars evaluate several critical factors. The cryptocurrency must have authentic practical utility rather than existing solely for speculation. It must avoid riba by not generating interest income, eliminate excessive gharar through transparent tokenomics and clear terms, and stay away from haram activities including gambling, alcohol, and unethical entertainment. Additionally, Shariah-compliant projects should ideally be asset-backed, undergo formal verification by qualified Islamic scholars, and promote ethical business practices consistent with Islamic values of fairness and honesty.

Top 15 Halal Cryptocurrencies for 2026

1. MECCACOIN – Leading Halal Meme Coin for the Muslim Community

Alt text: MECCACOIN homepage showcasing halal meme coin designed according to Islamic finance principles for the Muslim community

MECCACOIN is redefining the halal meme coin space by combining community energy with Shariah-compliant design for Muslim investors.

MECCACOIN positions itself as a faith-aligned digital asset inspired by core Islamic values including tawhid (monotheism), amanah (trustworthiness), and adl (justice). Unlike conventional meme coins that Islamic scholars often classify as haram due to pure speculation and gambling-like mechanics, MECCACOIN aims to provide a Shariah-compliant alternative that respects Islamic financial ethics while maintaining the accessibility and community focus that make meme coins appealing.

The project specifically focuses on avoiding elements prohibited in Islamic finance, including riba and excessive speculation, positioning itself within the broader movement toward Islamic cryptocurrency and halal digital assets. MECCACOIN emphasizes real utility and community initiatives that may include charitable components aligned with sadaqah and zakat principles. For Muslim investors curious about cryptocurrency but hesitant due to religious concerns, MECCACOIN offers a branded entry point that doesn’t compromise religious values. The project’s ecosystem roadmap includes payment use cases and governance mechanisms designed to maintain Shariah compliance over time, making it a compelling choice among halal cryptocurrencies for 2026.

2. Islamic Coin (ISLM) – Shariah Blockchain with Charitable Structure

Alt text: Official Islamic Coin ISLM website showing Shariah blockchain and halal cryptocurrency features

Islamic Coin represents the first cryptocurrency to receive fatwa approval from leading Muslim scholars, establishing new standards for halal cryptocurrency.

Built on the HAQQ Network blockchain, Islamic Coin (ISLM) completed a private sale in May 2023 with a valuation exceeding $200 million. What distinguishes ISLM among Shariah cryptocurrency projects is its innovative charitable structure: 10% of all newly issued coins are automatically allocated to the Evergreen DAO, which funds Islamic internet projects and charitable initiatives.

Key Innovations:

- Unique Shariah Oracle: on-chain registry of halal certificates verifying smart contracts

- Two-tier approval: community voting by ISLM holders + Shariah Council certification

- Built-in social good mechanism aligning with Islamic wealth circulation principles

Islamic Coin has established itself as a cornerstone of the Shariah cryptocurrency ecosystem, offering Muslim investors a transparent, scholar-verified option among halal digital assets for 2026.

3. MRHB Network – World’s First Halal DeFi Ecosystem

Alt text: MRHB Network DeFi platform homepage highlighting halal decentralized finance solutions for Muslim investors

MRHB Network pioneered halal-certified DeFi products, becoming the first platform to offer Shariah compliance certificates based on NFTs.

| Aspect | Details |

| Funding | $5.5M raised in December 2021 IDO |

| Community | 60,000+ supporters from 106 countries |

| Products | Sahal wallet, DeFi tools, SouqNFT marketplace |

| Recognition | Global Brand Award: “Best New Islamic Crypto Platform” |

The platform provides a comprehensive ecosystem of ethical financial solutions where every token, product, and service undergoes rigorous halal verification. MRHB’s SouqNFT marketplace hosts the world’s first halal compliance NFT certificates, offering businesses immutable proof of Shariah adherence on the blockchain. The platform has launched DeFi tools for passive income generation, commodity exchange, and staking—all designed to avoid riba and gharar.

4. HAQQ Network – Islamic Ethereum with Built-in Ethics

Alt text: HAQQ Network blockchain homepage showing Islamic Ethereum infrastructure for Shariah smart contracts

HAQQ Network functions as an “Islamic Ethereum,” providing blockchain infrastructure specifically designed for Shariah-compliant applications.

As the underlying blockchain supporting Islamic Coin, HAQQ Network offers Ethereum Virtual Machine (EVM) compatibility while maintaining strict adherence to Islamic finance principles. The network’s architecture includes an innovative Shariah Oracle system that verifies smart contract compliance before deployment, protecting users from unintentionally interacting with non-compliant applications.

Network Features:

- Warns users attempting to interact with non-approved contracts

- Gas fees distributed among validators, delegators, and two DAOs funding Islamic projects

- Provides developers tools to create applications passing technical and religious verification

For developers building the best halal crypto projects, HAQQ Network provides foundational infrastructure for the halal digital assets movement in 2026.

5. Sidra Chain – Shariah Layer 1 Blockchain

Alt text: Sidra Chain blockchain platform homepage showcasing Shariah Layer 1 infrastructure and halal finance

Sidra Chain operates as a decentralized Layer 1 blockchain specifically designed to integrate Islamic financial principles with modern blockchain technologies.

Launched in 2022 as an Ethereum fork, Sidra Chain utilizes Proof-of-Work consensus while strictly adhering to Shariah principles prohibiting riba, gharar, and speculation. The platform gained significant recognition by being accepted into Qatar’s Digital Assets Lab, expanding its influence throughout the Middle East.

Key Capabilities:

- Blockchain-as-a-Service (BaaS)

- Digital asset tokenization

- Supply chain solutions with Shariah compliance screening

- Mobile app for wallet management and network participation

- Real-world asset tokenization backed by tangible assets like real estate and commodities

The platform’s halal investment screening excludes gambling, alcohol, and unethical entertainment, satisfying Shariah requirements for material value backing.

6. Bitcoin (BTC) – Shariah-Compliant When Traded Responsibly

Alt text: Bitcoin BTC information showing halal cryptocurrency status when traded on spot markets without leverage

Bitcoin is considered halal by several Shariah advisory boards when traded on spot markets without leverage or excessive speculation.

The Shariah Advisory Council of Malaysia’s Securities Commission confirmed Bitcoin’s compliance with Islamic law, making it one of the most widely accepted halal cryptocurrencies. Bitcoin functions as a decentralized digital currency with genuine utility for peer-to-peer transactions, store of value, and protection against currency devaluation—practical uses that align with Islamic economic principles.

Compliance Requirements:

- Permitted: Spot trading (immediate exchange)

- Prohibited: Margin trading, futures contracts, leveraged positions

- Obligations: Pay zakat on holdings reaching nisab threshold

- Restrictions: Must not be used for illegal or haram transactions

Bitcoin doesn’t generate riba, and its transparent blockchain technology eliminates information asymmetry that creates gharar.

7. Caiz Coin (CAIZ) – Islamic Financial Ecosystem on Blockchain

Alt text: Official Caiz Coin website showing Islamic financial ecosystem compliant with fiqh principles

Caiz Coin represents the world’s first Islamic financial ecosystem compliant with fiqh principles for ethical and inclusive financial solutions.

CAIZ operates as a decentralized financial system combining decentralized and centralized frameworks. The ecosystem includes a native token, stablecoins, an evolving proprietary blockchain, an intuitive digital wallet, a portal for real-time analytics, and a comprehensive mobile app. CAIZ is dedicated to closing the financial gap for marginalized communities, encouraging economic development, and creating a more inclusive financial landscape. The platform prioritizes financial regulatory compliance to ensure user safety and trust.

8. Cardano (ADA) – Research-Based Shariah Blockchain

Alt text: Cardano ADA blockchain homepage showing peer-reviewed research approach and Shariah cryptocurrency features

Cardano is considered Shariah-compliant due to its transparency, academic rigor, and focus on real-world utility.

Developed through peer-reviewed academic research, Cardano uses a methodical approach to blockchain development that resonates with Islamic principles of careful deliberation and evidence-based decision-making. The platform’s Proof-of-Stake consensus mechanism is energy-efficient and promotes risk-sharing among stakeholders rather than power concentration, aligning with Islamic economic values.

Shariah Alignment:

- Approved by Malaysia’s Shariah Advisory Council

- Focus on financial inclusivity in developing countries and underserved communities

- Supports identity solutions, supply chain tracking, educational data verification

- Transparent governance model and regulatory compliance commitment

For Muslim investors prioritizing long-term, ethically grounded blockchain projects, Cardano represents one of the most philosophically aligned Shariah cryptocurrency options for 2026.

9. Stellar (XLM) – Halal Cross-Border Payment Solution

Alt text: Stellar XLM network homepage highlighting halal cross-border payments and financial inclusion for Muslim communities

Stellar facilitates halal cross-border payments and financial inclusion, particularly benefiting underserved regions with Muslim majorities.

Designed specifically for remittances and microfinance, Stellar addresses real economic needs that perfectly align with Islamic finance’s emphasis on practical utility and social benefit. The platform enables fast, low-cost international money transfers without requiring traditional banking infrastructure—particularly valuable for migrant workers in Muslim communities sending earnings to family members abroad. Stellar’s focus on financial inclusion rather than speculation makes it one of the most purpose-driven halal cryptocurrencies for 2026.

Key Attributes:

- No connection to interest-bearing instruments or unethical sectors

- Focus on financial inclusion rather than speculation

- Partnerships with charitable organizations and social enterprises

- Transparent nonprofit organizational structure

- Commitment to serving the unbanked

Stellar’s focus makes it one of the most purpose-driven halal cryptocurrencies for 2026.

10. Zakat Coin (ZKTC) – Blockchain for Automated Charitable Donations

Alt text: Official Zakat Coin website with automated charitable donation protocol for Islamic philanthropy

Zakat Coin represents the world’s first peer-to-peer automated donation and distribution protocol, revolutionizing charity through blockchain technology.

Founded by Ali J. Erakat and Lena M. Alwari-Erakat, the platform launches in Q4 2025 with a Donation Coin Offering (DCO) targeting $150,000 in direct charitable donations. The ZKTC token incentivizes automated charitable giving through User-Triggered Giving (UTG), Hold-to-Give (HTG), and Scan-to-Give (STG) mechanisms, while the ZUSD stablecoin ensures immediate fiat settlement.

| Feature | Impact |

| Cost Reduction | Administrative costs from 15-35% to <0.1% |

| Distribution | Instant global charitable distribution |

| Target Scale | $1 billion impact by 2036 |

| Network | 5,000+ verified charities in 150+ countries |

While rooted in Islamic principles, the ecosystem is designed for global adoption, combining blockchain transparency, stable settlements, and automation to transform charitable giving for all faiths and communities.

11. Sahal Wallet Token – Utility Token for Islamic Crypto Wallet

Alt text: Sahal Wallet website with Islamic crypto wallet and utility token for Shariah transactions

Sahal Wallet Token serves as the utility token for MRHB Network’s Islamic crypto wallet, enabling halal transactions.

Developed as part of the MRHB Network ecosystem, Sahal Wallet offers Muslim investors a secure place to store and transact Shariah-compliant cryptocurrencies. The utility token provides access to premium features including enhanced halal analytics, automatic token screening for Shariah compliance, and integration with a zakat calculator for automatic calculation of religious obligations. The wallet integrates with the SouqNFT marketplace and other MRHB products, creating a comprehensive ecosystem of halal digital assets.

12. HCC Token (Halal Crypto Community) – First Community Token of HAQQ Ecosystem

Alt text: Halal Crypto Community homepage showing HCC token—the first and largest Islamic Coin fan community with 1:1 ISLM backing

HCC Token is the first and largest fan community token of Islamic Coin (ISLM), backed 1:1 by the native HAQQ blockchain coin valued at $200 million.

HCC is developing a full-fledged halal crypto exchange—the first of its kind where every listed token undergoes Shariah screening.

Exchange Features:

- Spot trading of halal cryptocurrencies without margin or leverage

- Automatic Shariah screening through HAQQ’s Shariah Oracle

- Built-in zakat calculator for obligation tracking

- Fiat on-ramps for easy entry/exit in compliance with regulations

Additionally, HCC is launching Halal Marketplace—an e-commerce platform where vendors can accept HCC, ISLM, and other Shariah tokens as payment for goods and services, creating a real economy of use for HAQQ ecosystem tokens.

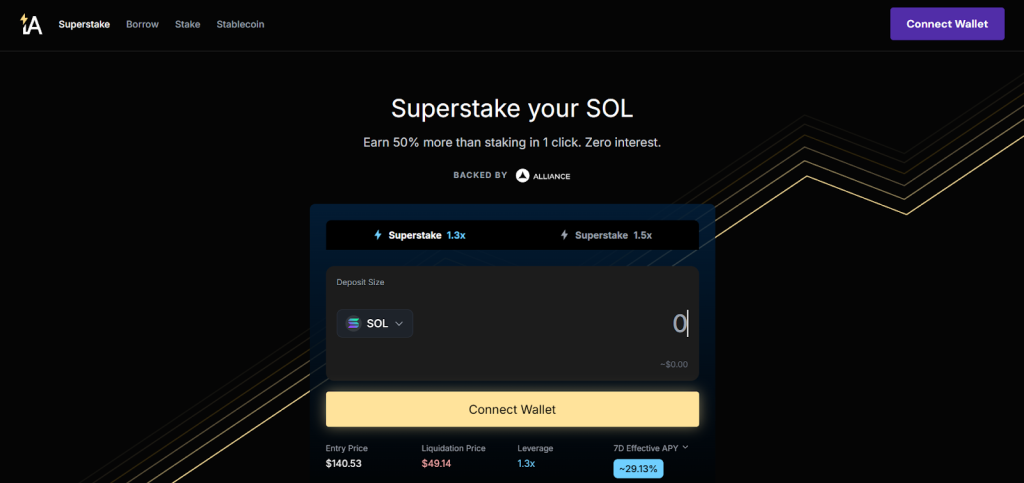

13. InshAllah Token (INSH) – DeFi Token for Muslim Investors

Alt text: InshAllah Token INSH for halal DeFi solutions and Islamic investments

InshAllah Token (INSH) is the governance token of the InshAllah Finance ecosystem, providing halal DeFi alternatives.

InshAllah Finance developed a halal DeFi alternative for Muslim investors, focusing on staking projects and other DeFi products aligned with Shariah principles. The INSH token is used for protocol governance, where holders vote on critical decisions including which new products to launch and how to maintain Shariah compliance. The InshAllah ecosystem includes Goldsand for halal ETH staking and plans expansion into other DeFi categories. INSH holders receive access to early product launches, reduced protocol fees, and a share of ecosystem-generated revenues through profit-sharing structures rather than riba.

14. M.Sharia Token ($MSHA) – Shariah Blockchain Token for Islamic Web3 Economy

Alt text: M.Sharia homepage with Shariah blockchain for the Muslim world, showing $MSHA token and halal DeFi ecosystem

M.Sharia Token ($MSHA) is the native token of the first blockchain built from scratch for Shariah compliance, with 350,000+ players already in the ecosystem.

| Aspect | Details |

| Philosophy | Reputation, contribution, and purpose matter more than capital |

| Ecosystem | DEX, staking, DAO, zakat tools, NFT marketplace |

| Onboarding | Indonesian Adventure Telegram game with 350,000+ players |

| Governance | Fair distribution without “whale power” |

The $MSHA token serves as the foundation of the M.Sharia ecosystem: a reliable native blockchain token for trading, staking, charity, and payments. $MSHA provides voting rights in the DAO without centralized control, in accordance with Shariah values. The token is designed for real halal finance: zakat automation, P2P e-commerce, and digital waqf tools (in development).

M.Sharia solves a fundamental problem in the crypto space—you’re not just a wallet address, you’re a recognized member of the Ummah with a name, reputation, and a path to grow with dignity and faith. The platform is mobile-first with simple onboarding through Telegram mini-games, representing the most ambitious Shariah blockchain project with functioning products and 350,000+ users.

15. Crypto Ummah Platform Token – Token for the First Halal Trading Toolkit

Alt text: Crypto Ummah homepage with platform for Muslim traders, showing the largest list of halal cryptocurrencies and trading tools

Crypto Ummah Token will serve as a utility token for access to the world’s first halal trading toolkit, launching winter 2025.

Crypto Ummah represents a halal crypto platform that shares the collective wisdom of thousands of Muslim crypto traders and investors. The platform already provides access to the largest online list of halal cryptocurrencies, verified by leading Islamic scholars and academics. Users can log in to view complete analysis of hundreds of coins for free, with clear separation into Halal Coins and Haram/TBD statuses.

Platform Highlights:

- Created world’s first Shariah crypto index (April 2024)

- Demonstrated 75% growth for earliest investors (as of September 9, 2025)

- Index performance in green vs. hypothetical $10M portfolio in black

- Proves Shariah compliance doesn’t sacrifice returns

The index demonstrates that properly selected halal cryptocurrencies can outperform the market while maintaining religious integrity.

Key Shariah Screening Criteria for Crypto Investors

Muslim investors should evaluate five core criteria when assessing whether a cryptocurrency project is truly Shariah-compliant.

Checklist for Halal Cryptocurrencies 2026:

- Real utility: The project must serve genuine economic or social purposes beyond pure speculation

- No riba (interest): Avoid staking mechanisms, lending protocols, or yield generation resembling interest

- Minimal gharar (uncertainty): Transparent tokenomics, clear terms, and verifiable operations are essential

- Avoidance of haram sectors: No involvement in gambling, alcohol, pork products, adult entertainment, or traditional interest-based finance

- Asset backing (preferred): Projects backed by real assets such as gold, real estate, or commodities are more likely to comply with Shariah

- Shariah Council certification: Formal verification by qualified Islamic scholars provides the strongest assurance of compliance

These criteria help distinguish genuinely Shariah-compliant cryptocurrency projects from those simply claiming Islamic compliance without substance.

Halal Cryptocurrencies 2026: Comparison Table

| Project | Primary Focus | Shariah Certification | Key Halal Feature |

| MECCACOIN | Halal meme coin | Faith-aligned design | Integration of Islamic values, community focus |

| Islamic Coin (ISLM) | Shariah blockchain | Fatwa-approved | 10% charitable distribution, Shariah Oracle |

| MRHB Network | Comprehensive halal DeFi ecosystem | Internal certification | First halal compliance NFT certificates; every product verified |

| HAQQ Network | Blockchain infrastructure | Fatwa + built-in Shariah Oracle | Shariah Oracle automatically verifies smart contracts for compliance |

| Sidra Chain | Layer 1 blockchain with Shariah principles | Shariah design | Approved by Qatar’s Digital Assets Lab; consensus avoids riba/gharar |

| Bitcoin (BTC) | Digital currency | Various Shariah scholar opinions | Available through Shariah banks (Ruya, Mashreq); no central authority |

| Caiz Coin (CAIZ) | Islamic fintech ecosystem | Fiqh compliance | Full product stack (wallet, stablecoins, blockchain) compliant with fiqh |

| Cardano (ADA) | PoS blockchain with scientific approach | Discussed by scholars (potentially halal) | Proof-of-Stake (energy-efficient), no mining; scientific methodology |

| Stellar (XLM) | Payment network for financial inclusion | Discussed by scholars (potentially halal) | Focus on helping underserved; low fees, charity |

| Zakat Coin (ZKTC) | Zakat and charity automation | Zakat-specific concept | Specialized for Islamic charitable obligations |

| Sahal Wallet Token | MRHB DeFi wallet utility token | Part of MRHB certification | Built-in automatic zakat calculator for crypto holdings |

| HCC Token | Islamic Coin community token | Backed 1:1 by ISLM (fatwa-certified) | Democratic access to ISLM for retail investors |

| InshAllah Token (INSH) | Halal DeFi staking governance | Scientific oversight of halal staking | Governs Goldsand—staking with interest transaction filtering |

| M.Sharia Token (MSHA) | Blockchain for Islamic Web3 economy | Fatwa-backed audits of every aspect | Built from scratch for Shariah; integrated zakat/waqf/sadaqah tools |

| Crypto Ummah Platform Token | Halal trading toolkit | Shariah scholars verify coin listings | Collective wisdom of thousands of Muslim traders; index +75% |

This comparison highlights the diversity within Shariah cryptocurrency options, from specialized Islamic platforms to general-purpose blockchains approved for ethical use.

Pros and Cons of Halal Cryptocurrencies 2026

Investing in halal digital assets offers unique advantages but also presents specific challenges for Muslim investors navigating the cryptocurrency landscape.

Advantages:

- Religious Alignment: Invest without compromising faith.

- Safety: Rigorous screening often removes “scam” projects early.

- Stability: Focus on utility reduces volatility compared to speculative coins.

- Charity: Built-in mechanisms for social good (Zakat/Sadaqah).

Challenges:

- Limited Pool: Fewer options compared to the general market.

- Liquidity: Lower trading volumes can mean higher volatility in the short term.

- Complexity: Requires constant vigilance to ensure updates remain compliant.

Frequently Asked Questions: Common Questions About Halal Cryptocurrencies

Q: Are all cryptocurrencies haram (forbidden) in Islam?

No. Several Shariah advisory councils have approved specific cryptocurrencies including Bitcoin, Ethereum, and specially designed Islamic crypto projects when used ethically without interest or excessive speculation.

Q: How does MECCACOIN differ from other meme coins?

MECCACOIN distinguishes itself by incorporating Islamic values of tawhid, trustworthiness, and justice into its design, positioning itself as a halal meme coin that avoids gambling-like speculation typical of conventional meme coins.

Q: Can I earn passive income from halal cryptocurrencies without violating riba prohibitions?

MRHB Network and similar platforms offer profit-sharing mechanisms distinct from interest-based lending, though each product requires individual Shariah evaluation. Genuine business profit distribution may be permitted, while fixed-yield staking resembles riba.

Q: How do I pay zakat on cryptocurrency holdings?

Crypto assets reaching the nisab threshold and held for a lunar year require zakat calculation based on their market value on the zakat payment date, typically 2.5%. Consult a qualified Islamic scholar for specific guidance.

Q: What matters more: Shariah Council certification or exchange approval?

Shariah Council certification from recognized Islamic scholars provides stronger religious assurance than exchange listings, though both offer valuable validation. Projects like Islamic Coin with formal fatwa approval offer the highest confidence.

Q: Is investing in halal digital assets only for Muslims?

No. Anyone valuing ethical, transparent investment practices can benefit from Shariah cryptocurrency screening criteria, which often align with general ethical investing principles.

Conclusion

Halal cryptocurrencies for 2026 offer Muslim investors unprecedented opportunities to participate in digital asset growth while respecting Islamic finance principles. From purpose-built Shariah platforms like Islamic Coin and MRHB Network to council-approved general-purpose blockchains like Bitcoin and Ethereum, the halal digital asset ecosystem continues expanding with greater sophistication and scholarly oversight.

MECCACOIN stands out among these options as a unique halal meme coin that bridges accessibility with faith-aware design, offering Muslim investors a community-driven entry point into Islamic cryptocurrency that doesn’t sacrifice religious values for market participation. Alongside established best halal crypto projects addressing payments, DeFi, and blockchain infrastructure, MECCACOIN represents the evolving nature of Shariah cryptocurrencies—demonstrating that digital assets can be both innovative and ethically grounded.

As you explore these 15 Shariah-compliant options, remember that ongoing due diligence remains essential. Verify continuing compliance, consult qualified Islamic scholars when uncertain, and prioritize projects with transparent operations and genuine utility. Whether you’re attracted to infrastructure solutions like HAQQ Network and Sidra Chain, ethical DeFi through MRHB, or community initiatives like MECCACOIN, the halal cryptocurrency landscape for 2026 offers diverse pathways for values-oriented investors to participate in the digital economy while honoring their Islamic commitments.

Note: This article provides information about cryptocurrency projects claiming Shariah compliance but is not financial advice or formal religious ruling. Always conduct thorough research and consult qualified Islamic scholars before making investment decisions. Cryptocurrency markets involve significant risk, and past performance does not guarantee future results.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Best Halal Cryptocurrencies for 2026 – Top 15 Shariah-Compliant Projects appeared first on CaptainAltcoin.

You May Also Like

What Would Happen If Amazon Were To Incorporate XRP Into Its Services?

UK Looks to US to Adopt More Crypto-Friendly Approach