Debit Card Statistics 2026: Insights That Matter Now

The world of payment systems is evolving at a breakneck pace, and debit cards remain a cornerstone of personal finance. From their humble beginnings as simple plastic cards to today’s technologically advanced payment tools, debit cards are more versatile than ever. As cash use continues to decline globally, understanding the current landscape of debit card usage is crucial for consumers, businesses, and financial institutions alike. This article dives deep into the key statistics, trends, and growth areas surrounding debit card usage today.

Editor’s Choice

- Consumers make 30% of all U.S. payments with debit cards, compared with 35% with credit cards and 14% in cash.

- Analysts project the global debit card market to reach about $96.84 billion in 2026, supported by contactless, biometric, and security upgrades.

- The broader debit card payment market is expected to grow at around 8.3% CAGR from 2026 to 2033, driven by adoption in developed and emerging markets.

- Global BNPL transaction value is forecast to reach $576 billion by 2026, as major players like Apple Pay Later expand.

- In Asia-Pacific, Visa’s tokenization services have delivered around a $2 billion uplift for merchants while reducing fraud by 58%.

Recent Developments

- Visa reports a 200% year-over-year surge in Tap to Phone adoption, with the U.S., UK, and Brazil recording a combined 234% usage increase.

- Tap to Phone usage in the UK alone has surged by 320%, far exceeding the global growth rate.

- Analysts project the global biometric payment cards market to grow from $289.6 million in 2024 to about $5.7 billion by 2030 at a 64.3% CAGR.

- Forecasts show biometric payment cards scaling from $321.9 million in 2025 to $6.47 billion by 2035, reflecting a 35% CAGR.

- Surveys show that 53% of U.S. consumers now prefer contactless payments for in-store purchases, accelerating tap-and-go adoption.

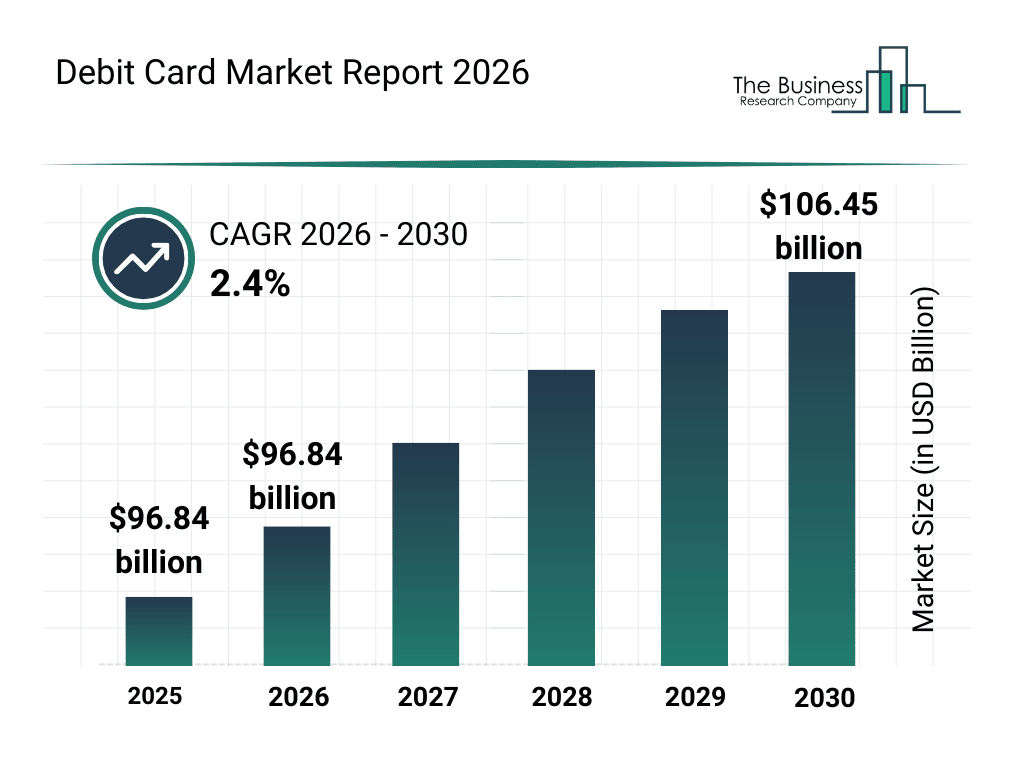

Debit Card Market Size Growth Outlook

- The global debit card market will reach $96.84 billion in 2026, establishing the baseline year for long-term projections.

- From 2026 to 2030, the debit card market will grow at a 2.4% CAGR, signaling steady expansion.

- Market value will rise to about $99.0 billion in 2027, driven by increased digital payment adoption.

- By 2028, the market will reach around $101.5 billion, supported by wider debit card usage in everyday transactions.

- The market will climb to nearly $104.0 billion in 2029 as contactless payments gain momentum.

- By 2030, the global debit card market size will hit $106.45 billion, reflecting continued reliance on debit cards worldwide.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Cardholder and Transaction Data

- 63% of Gen Z consumers prefer debit cards over credit, citing financial discipline as the primary reason.

- The average U.S. consumer makes 34.6 debit card transactions per month, reflecting increased reliance on debit for everyday purchases.

- Contactless payments now represent 45% of all debit card transactions, up from 38% the previous year, driven by demand for faster and safer payments.

- Cash-back rewards linked to debit cards have gained popularity, with 19% of consumers enrolling in such programs, enhancing debit’s appeal over credit.

- The average global debit card transaction value is $65, with higher averages observed in Europe and North America.

- Chip-enabled debit cards account for 90% of all U.S. debit card transactions, underscoring the shift toward enhanced security.

- Debit card spending on digital subscriptions has grown by 23%, highlighting increasing consumer preference for digital services and recurring payments.

The Payment Card Landscape

- Around 4 billion adults worldwide use debit cards, representing about 50% of the global adult population.

- Debit cards account for about 55–60% of all card transactions globally, including roughly 53% in the U.S. and 65% in Europe.

- In high‑income countries, roughly 87% of adults have debit cards, with penetration surpassing 95% in some markets.

- Europe records about 65% of card transactions made with debit cards, supported by widespread contactless adoption.

Card Usage by Age & Income

- Younger consumers aged 18–34 use debit cards for daily purchases at 67%, compared with older consumers aged 55+.

- Households earning less than $50,000 use debit cards over credit 55% of the time for financial discipline.

- High-income earners making $100,000+ conduct 12% of their purchases with debit cards, mainly for essentials.

- Gen Z consumers use debit cards for 75% of their purchases, driven by a preference to spend only what they have.

- Consumers aged 55+ make debit card payments for 45% of daily transactions, despite favoring credit for large purchases.

- Lower-income households earning under $30,000 use debit cards for 85% of in-person purchases.

- Income groups earning $50,000–$75,000 use debit cards for 62% of total spending, primarily on groceries and utilities.

US Primary Payment Card Usage by Income Level

- Households earning $150,000–$249,999 primarily use credit cards (65.1%), while only 33.7% rely on debit cards.

- In the $125,000–$149,999 income range, 56.5% prefer credit cards, compared to 40.3% using debit.

- For households earning $100,000–$124,999, 65.0% favor credit cards, and 32.0% use debit as their main payment card.

- Among those earning $75,000–$99,999, 58.3% use credit cards and 39.9% use debit cards.

- In the $50,000–$74,999 bracket, debit cards have become more common, with 54.6% usage, while 42.9% still prefer credit.

- Debit card usage rises to 67.4% among households earning $25,000–$49,999, with only 29.6% using credit.

- The lowest income group, under $25,000, shows the highest debit preference at 71.6%, and only 18.3% use credit cards primarily.

The Rise of Digital Wallets

- 53% of global e-commerce transactions now occur through digital wallets, underscoring their dominance in online payments.

- Apple Pay accounts for 10% of all global card transactions, doubling its share from previous years.

- Google Pay is projected to gain 10.5 million additional users in 2025, reflecting steady digital wallet adoption.

- In the Asia-Pacific region, digital wallets are projected to exceed $1 trillion in transaction value by 2025 due to Alipay and WeChat Pay.

- Zelle processed over $1 trillion in P2P transactions, marking a 25% year-over-year increase driven by wallet-based payments.

US Restaurant Payment Methods: Usage and Spending Breakdown

- Debit cards are the most used method, chosen by 37.1% of consumers, with a $25.3 billion expenditure in February.

- Credit cards follow closely at 33.0% usage but lead in spending, totaling $29.8 billion in February.

- Cash is used by 16.3% of consumers, with a spending estimate of $8.3 billion.

- Gift/store cards account for 3.7% of usage and $2.2 billion in spending.

- Digital wallets were used by 3.4% of respondents, representing $4.2 billion in food purchases.

- PayPal was selected by 2.7% of users, contributing $4.0 billion in expenditures.

- Other methods made up 3.8% of payment usage and totaled $3.4 billion in February restaurant spending.

Debit Card Fraud

- Global debit card fraud losses are projected to reach $34 billion in 2025, reflecting continued growth in fraudulent activities.

- Skimming fraud incidents surged in 2025, with advanced devices found at major retailers prompting consumer advisories.

- Account takeover fraud remains a major threat, leading banks to adopt AI-driven behavioral intelligence to stop unauthorized access.

- EMV chip technology reduces counterfeit card risk by generating unique transaction codes for each transaction.

- Card-not-present fraud is now 81% more likely than in-store fraud, highlighting the need for stronger online security.

- Identity theft tied to debit card fraud helped prompt new legislation, such as Australia’s bill targeting the $2 billion annual cybercrime cost.

- The EU’s PSD2 directive has driven a notable decline in online payment fraud by enforcing strong customer authentication standards.

In-Person Payment Trends by Card Type

- Contactless debit card payments now represent 73% of all U.S. in-person transactions, reflecting widespread tap-to-pay adoption.

- Debit card use for grocery and everyday purchases accounts for 44% of transactions, showing strong ongoing consumer preference.

- Tap-to-pay debit transactions in Europe have surpassed 60% of all card payments, signaling a major shift toward contactless methods.

- Cashback transactions at point-of-sale terminals are increasing as consumers seek convenient access to cash during purchases.

- Travel-related debit card spending has seen a 2.6% year-over-year increase in in-person overseas payments, reflecting a rebound in travel.

- Healthcare debit card payments continue to rise as medical providers expand acceptance for copays and billing.

- Debit card payments at quick-service restaurants keep growing alongside the adoption of contactless options and digital wallets.

Frequently Asked Questions (FAQs)

In 2026, 50% of all consumer payments worldwide are expected to be made using card credentials (credit and debit combined).

~71.98 % of issued payment cards were EMV chip cards (a large share of which includes debit cards).

Around $198.54 billion by 2035.

Conclusion

Debit card usage continues to evolve with technological advancements and growing consumer preferences for contactless and digital wallet payments. The global trends indicate a significant shift towards mobile and digital payments, with an emphasis on security and user convenience.

While fraud remains a concern, improvements in biometric technology and AI-driven fraud prevention are creating safer environments for debit cardholders. Looking ahead, the industry will likely see further innovation, ensuring debit cards remain a key player in both online and in-person transactions worldwide.

The post Debit Card Statistics 2026: Insights That Matter Now appeared first on CoinLaw.

You May Also Like

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push