Ethereum Price Braces for FOMC Volatility as Leverage Peaks and Whale Accumulate

The post Ethereum Price Braces for FOMC Volatility as Leverage Peaks and Whale Accumulate appeared first on Coinpedia Fintech News

Ethereum price is entering a high-risk, high-impact phase as traders brace for today’s FOMC decision, with price compressed at a key structural zone and on-chain leverage sitting at record levels. While the market broadly expects the Federal Reserve to hold rates steady, uncertainty around Jerome Powell’s forward guidance has pushed ETH into a volatility-sensitive setup, one where positioning matters more than direction. That dilemma sets the stage for a decisive move.

On-Chain Data Flags Elevated Volatility Risk

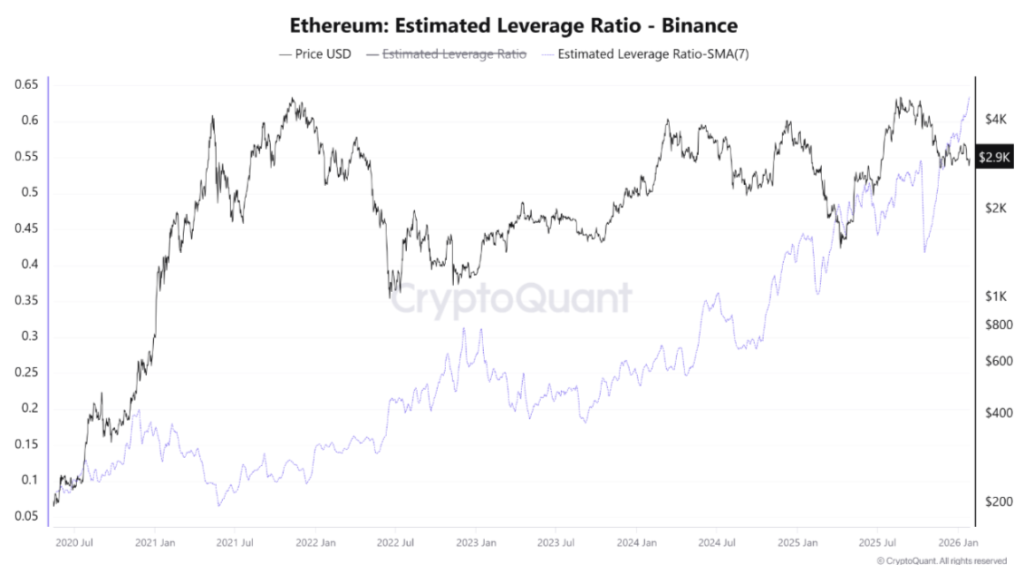

On-chain data shows that Ethereum’s Estimated Leverage Ratio on Binance is sitting at an all-time high, with the 7-day simple moving average rising to 0.632. In practical terms, this means a growing share of open positions is being funded through derivatives rather than spot buying, a setup that historically increases volatility rather than trend stability.

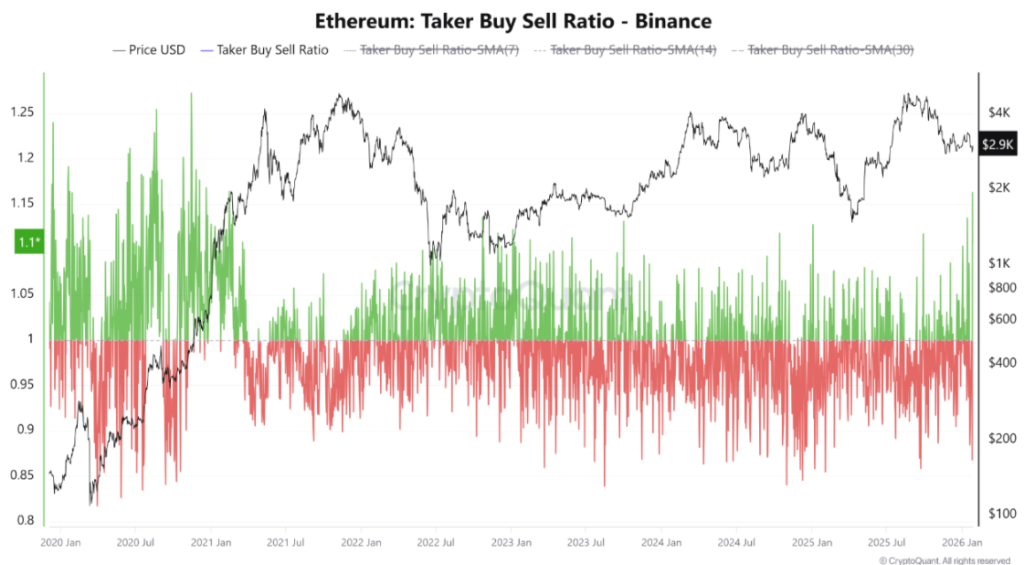

At the same time, the Taker Buy/Sell Ratio is flashing warning signs. On January 25, the ratio plunged to 0.86, its lowest reading since September, indicating dominant market sell pressure from aggressive traders. Within days, that same metric rebounded sharply to 1.16, the highest daily reading since February 2021, signaling a sudden surge in aggressive market buying.

This kind of rapid flip in taker behavior is critical. It shows that traders are reacting emotionally rather than positioning with conviction, a hallmark of unstable market structure. When leverage is elevated and order-flow direction changes abruptly, price tends to move violently as liquidations amplify both upside and downside moves. Crucially, this behavior is unfolding while Ethereum is consolidating near the $2,800 support zone, after failing to reclaim its previous all-time high near $4,800.

Until the market establishes clear directional dominance, Ethereum remains highly sensitive to external triggers, with liquidation cascades becoming a real risk rather than a tail scenario.

Whale Accumulation Counters Leverage Risk

Despite elevated leverage,large-scale accumulation remains active beneath the surface. Recent data shows that Bitmine Immersion Technologies significantly increased its Ethereum exposure, lifting total holdings to roughly 4.2 million ETH, alongside total crypto and cash reserves of approximately $12.8 billion. This level of accumulation reflects institutional-scale conviction rather than short-term speculation.

Historically, such accumulation phases tend to align with long-term positioning rather than tactical trades, offering a stabilizing counterbalance to speculative leverage in derivatives markets. This divergence of leveraged traders chasing short-term moves while institutions accumulate quietly often precedes decisive trend resolution.

Ethereum Price Structure Signals a Pivotal Moment

Ethereum’s price chart structure remains technically constructive, but fragile. For months, ETH continued to respect its rising trend structure, with repeated successful defenses above the 200-week moving averages. Each major pullback into this zone has attracted strong demand, forming higher high and higher lows across multiple cycles.

Currently, ETH price is now compressing against a well-defined resistance band that has capped upside attempts in recent months. A clean break above the $3300 hurdle would confirm structural continuation, opening the path toward $3500 followed by $4000 ahead. On the other hand, a dip below $2700 may lead to retesting $2500 in the short-term.

Final Thoughts

With markets pricing a rate pause, Ethereum’s reaction will hinge on Powell’s tone rather than the decision itself. Any hint of extended tightness could pressure leveraged longs and trigger downside volatility. Conversely, even modestly dovish language may force rapid short covering, accelerating upside momentum.

You May Also Like

Coinbase CEO advocates for crypto legislation reform in Washington DC

Forex Expo 2025 Redefines the Trading Landscape