WLD Token Rallies After Report Ties OpenAI’s Altman to Biometric Identity Network

- The World token (WLD) surged by over 40% in the past day to hit a three-week high, boosted by reports that Sam Altman is building a new social media platform.

- The new platform will compete with X, TikTok and Facebook, but will rely on biometric identity verification to weed out bots and AI-run accounts.

The World token (WLD) has surged to a three-week high after reports emerged that OpenAI founder Sam Altman was working on a new social media platform that would be powered by a biometric identity network.

WLD recorded a sharp surge on the late hours of Wednesday to hit $0.6427, a 40% rise from $0.4563. This was its highest price since Jan. 6. In the past three weeks, the token’s momentum faded as trading volume dipped to lows of $50 million. On Sunday, it hit its lowest price ever at $0.434 before stabilizing above this level for a few days.

And then, on Wednesday, Forbes reported that Altman was building a new social media network whose primary selling point would be biometric identity and zero bots. The report by Forbes cited insiders with knowledge on the matter, who said that the OpenAI founder had formed a small team to start building the platform. The new platform will possibly integrate biometric solutions like Apple ID and smartphone fingerprint readers.

It might also rely on World Orbs for identity verification, the sources reportedly said. As we have reported, World uses the Orbs to scan irises for biometric data, which it has dubbed ‘proof of personhood.’ The Orbs are not without their controversies and have been banned in places like Kenya and Spain, and have been temporarily suspended in Indonesia, Portugal, India and others.

Orbs are central to the vision of the World network, which is powered by the WLD token. The launch of a network that uses these devices would lead to a sharp surge in the use of the token, and it’s this surge that the market is betting on. Following the report, trading volume skyrocketed nearly 900% to hit $726 million in 24 hours, its highest since September last year.

The momentum has since dipped slightly. At press time, WLD trades at $0.5125 for a $1.42 billion market cap and has recaptured its position among the 50 largest crypto projects.

Altman’s Plan to Restore World Network and WLD

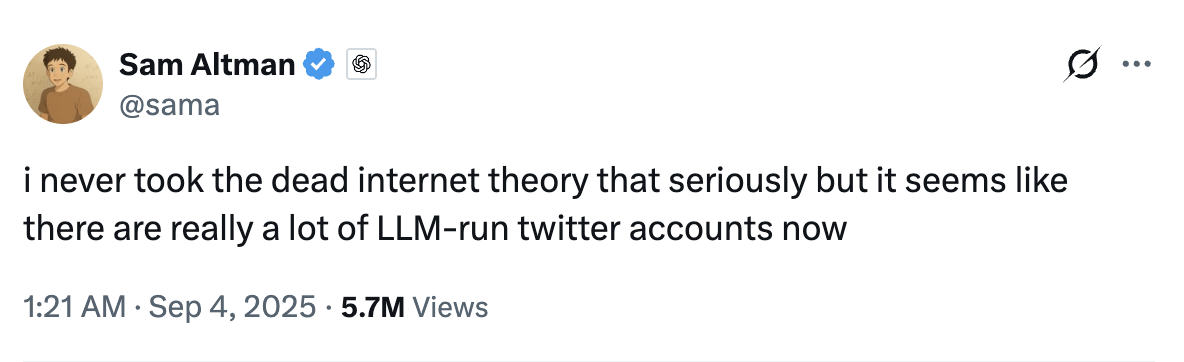

Altman and OpenAI have not confirmed or denied the report. However, it aligns with Altman’s vision of an internet that’s powered by provable human interaction. He has been critical of social media platforms like X and Facebook which have allowed bots and AI-run accounts to run riot, sometimes overpowering human connections.

Last September, he claimed to be warming up to the Dead Internet Theory, which claims that since 2016, bots have taken over and produce the vast majority of online content.

Image courtesy of Sam Altman on X.

Image courtesy of Sam Altman on X.

Social media is a crowded market where the biggest platforms have seemed impossible to topple. Facebook, Instagram and TikTok have billions of users, with X also very influential despite its smaller numbers. New players have been unable to disrupt the sector.

However, if anyone can break into this sector, then it would be OpenAI. The company has proven that it can rack up new users faster than anyone else. ChatGPT set a new record for the time taken to hit 100 million users at two months and now boasts over 800 million users. Sora, its AI video app, had a million downloads in five days. If it does disrupt social media, WLD will be the token that powers a new era of human-only connections and could greatly reward early buyers.

]]>You May Also Like

Top Web Development Trends to Watch in 2026

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets