Bitcoin Slips in Global Asset Rankings After Violent Selloff

Bitcoin has pulled back sharply this week, amplifying a sense of fragility across crypto markets as traders contend with the most sizable forced liquidation on record. The benchmark digital asset traded near the high $80,000s to mid-$80,000s, a move that coincided with a decline in its market capitalization and a reordering of the asset’s relative standing in global markets. The pullback comes as gold surged to the top of the asset ladder on a broad risk-off backdrop, underscoring the ongoing tension between perceived safety and the crypto cycle. The episode also highlights how liquidity dynamics, leverage unwinds, and macro expectations increasingly intersect with crypto price action.

Key takeaways

- Bitcoin’s market capitalization sits around $1.65 trillion, with the asset roughly 11th in global rankings, reflecting a retreat from the top tier after a turbulent period.

- The digital asset traded near $83,000, illustrating continued volatility even as macro conditions offered some supportive cues like a weaker dollar.

- Gold asserted its perch as the world’s largest asset amid a record rally, with rising gold futures activity highlighted in market data cited by trackers and exchange data providers.

- A sell-off drove prices from near $90,000 to below $82,000 and triggered about $1.6 billion in long liquidations, underscoring the fragility of long-position bets.

- Analysts at Wintermute argued 2025 could mark a break from Bitcoin’s traditional four-year price cycle, though a broader recovery in 2026 would hinge on several conditional factors.

- The macro backdrop featured ongoing policy considerations around US leadership of the Federal Reserve, with a crypto-friendly nomination fueling speculation about policy direction and its impact on risk assets.

Tickers mentioned: $BTC, $ETH

Sentiment: Bearish

Price impact: Negative. The rapid slide and heavy liquidations added downside pressure and heightened risk aversion among traders.

Market context: The move aligns with a broader mood shift in risk markets, where policy expectations and regulatory developments mingle with liquidity dynamics. Although a weaker US dollar can support crypto markets in some scenarios, BTC’s underperformance relative to equities and traditional havens like gold points to a more nuanced risk-off environment that can persist even when macro prints are supportive.

Why it matters

The recent price action matters because it tests the durability of Bitcoin as an asset class within a shifting macro landscape. A retreat from the top 10 by market capitalization underscores the degree to which liquidity conditions and institutional flows still drive crypto prices—not only supply-demand fundamentals within the ecosystem. For investors, the move raises questions about risk management, leverage dynamics, and the speed with which sentiment can swing in response to liquidity events.

From a broader market perspective, gold’s surge to the top asset underscores the ongoing search for safe havens in times of macro uncertainty. The juxtaposition of a flashing red crypto tape with a gold rally highlights how investors are calibrating portfolios in an era of rapid, often unpredictable, capital shifts. The data cited from gold futures activity by MEXC, among others, hints at a more complex interaction between traditional and digital assets as participants reassess hedging strategies and the role of digital assets in diversified exposure.

Analysts have pointed to structural questions surrounding Bitcoin’s longer-term trajectory. Wintermute’s recent market color suggested that 2025 could deviate from the sector’s historical four-year cycle, potentially setting up a later, conditional recovery in 2026. In that framework, durable upside would likely depend on a tailwind of broad inflows—into Bitcoin and Ether (ETH)—and a more explicit embrace of crypto assets by institutional buyers and ETFs that can unlock new layers of liquidity and exposure. The emphasis on inflows rather than quick price moves as a catalyst is a reminder that the wealth effect in crypto remains contingent on sustained demand rather than one-off rallies.

Bitcoin’s market capitalization peaked in October. Source: CoinMarketCapThe macro narrative around policy shifts continued to color the price action. Reports and market chatter around the possible appointment of a crypto-friendly Federal Reserve chair candidate—Kevin Warsh—added an additional layer of uncertainty and speculation about how regulatory signals might shape risk assets. Warsh’s eventual nomination, once formalized, would still require Senate confirmation, but the prospect alone has the market considering potential moves in interest rates, liquidity, and the appetite for risk across digital markets. Against that backdrop, Bitcoin’s relative underperformance versus traditional assets—despite a backdrop of a weaker dollar—emphasizes the ongoing sensitivity of crypto to policy expectations and macro risk sentiment.

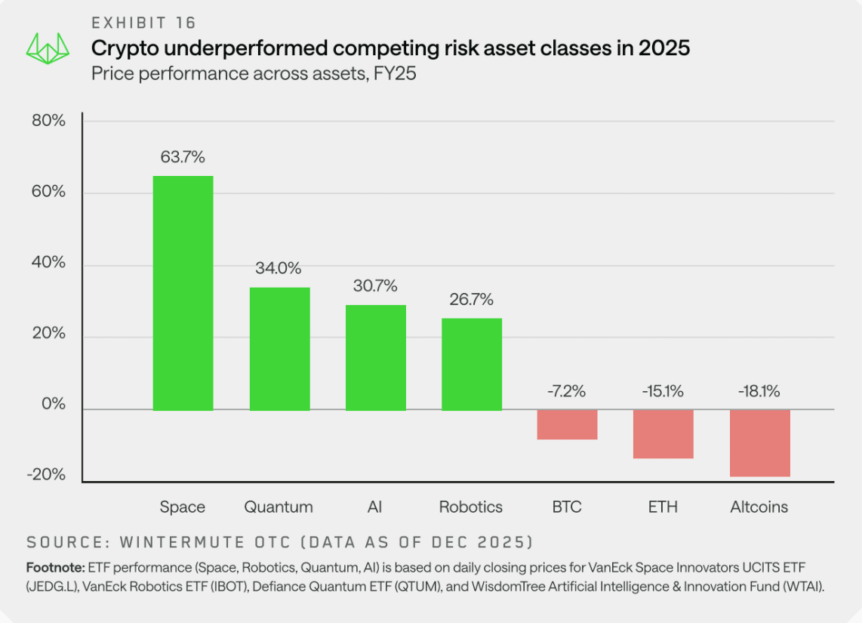

Cryptocurrencies significantly underperformed other risk assets in 2025. Source: Wintermute

Cryptocurrencies significantly underperformed other risk assets in 2025. Source: Wintermute

From a longer-horizon perspective, the narrative around ETF access and institutional participation remains central. Wintermute’s analysis framed a path to renewed crypto-market vigor that hinges on sustained inflows into Bitcoin and Ether, alongside an enhanced roster of ETF products that can channel more capital into the sector. If those inflows materialize, they could help generate a wealth effect that spreads beyond individual assets to the broader market, potentially offsetting the near-term headwinds created by leverage unwinds and risk-off rotations.

What to watch next

- Updates on ETF approvals and expanded mandates for digital-asset products that could unlock broader institutional flows.

- Senate confirmation developments for the Fed leadership candidacy, including Kevin Warsh, and any policy signals that could affect dollar strength and liquidity conditions.

- Early signs of renewed capital inflows into Bitcoin and Ether, and any shifts in liquidity that might precede a broader risk-on phase.

- Reports on the broader macro environment, including next-term inflation data and central-bank communications, that could influence risk sentiment across crypto and traditional markets.

Sources & verification

- Bitcoin price around the mid-$80,000s and a market cap near $1.65 trillion, with ranking context from trackers.

- Gold’s top-spot position and rising gold futures activity, as cited in data linked to the gold rally coverage.

- Historical peak: Bitcoin market capitalization near $2.5 trillion in October and prices near $126,000 (CoinMarketCap data).

- Sell-off and long liquidations reported around $1.6 billion (official coverage linked to BTC price dynamics).

- Wintermute market-color analysis on 2025 cycle and 2026 recovery conditional (Wintermute report).

- Nomination context for Kevin Warsh and related policy discussions (coverage linked to the nomination).

Market reaction and key details

Bitcoin (CRYPTO: BTC) has reversed some of its recent strength, slipping from its perch in the world’s top-10 by market capitalization as traders digest the implications of a liquidity-driven unwind. The asset’s price sits in the low-to-mid $80,000s, translating into a market capitalization around $1.65 trillion and a ranking that places it 11th on the global list. The shift illustrates how quickly market sentiment can shift in a market that remains highly sensitive to leverage and momentum signals. While gold has surged to the top asset by market value, driven in part by a broad risk-off stance, Bitcoin’s trajectory over the past several weeks reflects a complex mix of macro expectations, liquidity dynamics, and structural shifts in the crypto ecosystem.

The latest move follows a period when Bitcoin had previously touched highs near $126,000 in October, at which point its market capitalization hovered around the $2.5 trillion mark. The subsequent pullback accelerated after a wave of long liquidations—reported at roughly $1.6 billion—pushed the price from around $90,000 to the sub-$82,000 area in a short span. Those unwind events underscore the sensitivity of Bitcoin to forced liquidations and the way risk-off dynamics can quickly overwhelm even broad macro-supportive signals, such as a weaker dollar.

The macro backdrop has further complicated the narrative. Speculation surrounding a crypto-friendly Fed chair candidate, Kevin Warsh, added a new layer of regulatory and policy expectations to the mix. Warsh’s nomination, once formally announced, must pass Senate confirmation, but the mere prospect of a policy shift can influence risk asset sentiment in the near term. In parallel, Bitcoin has, at times, underperformed other risk assets—despite conditions that could be favorable for crypto, including a softer dollar. As markets search for catalysts to re-energize the sector, attention has turned to the potential for increased ETF exposure and greater institutional involvement, which could help stabilize prices if inflows resume.

Analysts from Wintermute have offered a tempered view: 2025 could mark a departure from the traditional four-year price cycle that has often framed Bitcoin’s behavior, while a broader recovery in 2026 remains conditional on a set of favorable factors. The takeaway is that a sustained rebound will likely require a credible, broad-based inflow narrative, with capital moving into Bitcoin and Ether (CRYPTO: ETH) as part of a diversified strategy. In other words, price action alone may not suffice; a structural change in demand dynamics—driven by ETF mandates and institutional treasury programs—could be the real lever for a new cycle.

The juxtaposition of Bitcoin’s retracement with gold’s rally also hints at evolving roles for traditional versus digital assets in risk-off periods. Gold’s performance underscores a structural demand for hedges in periods of macro uncertainty, while the crypto market continues to recalibrate around liquidity, regulatory expectations, and the pace of institutional adoption. The path forward, therefore, appears to hinge on a combination of policy clarity, product innovation in the ETF space, and a continued stream of disciplined inflows that can sustain a broader wealth effect across the ecosystem.

https://platform.twitter.com/widgets.js

This article was originally published as Bitcoin Slips in Global Asset Rankings After Violent Selloff on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”

Red Dress Collection Concert Launches American Heart Month with Star-Studded Awareness Effort