$6B Bitcoin Shorts Could Fuel Rally Above $90K

Bitcoin (Bitcoin is mentioned with ticker annotation in the body; placeholder to ensure accurate formatting; see below for the actual tagged reference.)

Bitcoin (CRYPTO: BTC) has fallen 14.5% over the last 16 days, pressuring sentiment as the Crypto Fear & Greed Index sits at 16 — the year’s nadir for Extreme Fear. The slide coincides with mainstream selling and thinner liquidity, while derivatives data hint at a possible reprieve rather than a prolonged downturn. Traders have circled key levels and potential squeeze points that could catalyze a quick rebound if buyers step back in. The question for markets now is whether the setup marks capitulation or simply a pause before another leg lower.

Crypto Fear & Greed Index. Source: alternative.meWhile selling has dominated markets over the past two weeks, Bitcoin derivatives data suggest the current trader positioning may lead to a recovery. Analysts are now weighing whether the latest sell-off has created conditions for a relief rally.

Key takeaways:

-

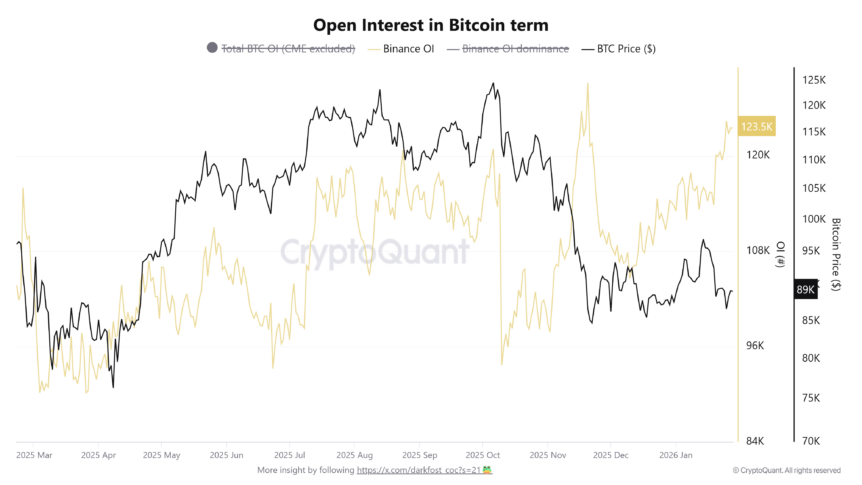

Binance open interest has climbed more than 30% from its October 2025 lows, confirming rising activity within the Bitcoin futures market.

-

A move toward $92,000 may put over $6.5 billion in short positions at risk of liquidation.

-

Bitcoin swept swing lows between $80,000 and $83,000, clearing a large cluster of long liquidations. With downside liquidity absorbed, attention is turning higher.

-

Open Interest in Bitcoin on Binance rose to about 123,500 BTC, up roughly 31% since October 2025, signaling traders are rebuilding exposure rather than exiting.

-

January Bitcoin futures volume across major venues dipped to around $1.09 trillion — the lowest level since 2024 — with liquidity concentrated on Binance (≈$378 billion), OKX (≈$169 billion) and Bybit (≈$156 billion).

Market imbalance opens the door to a relief rally

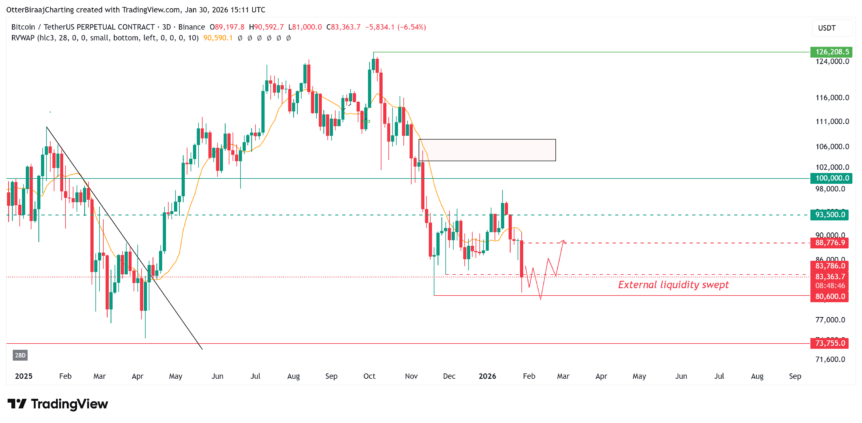

From a technical standpoint, BTC has swept its swing lows between $80,000 and $83,000, clearing a large cluster of long liquidations. With that downside liquidity taken, attention is shifting higher.

Bitcoin 3-day chart. Source: Cointelegraph/TradingView

Bitcoin 3-day chart. Source: Cointelegraph/TradingView

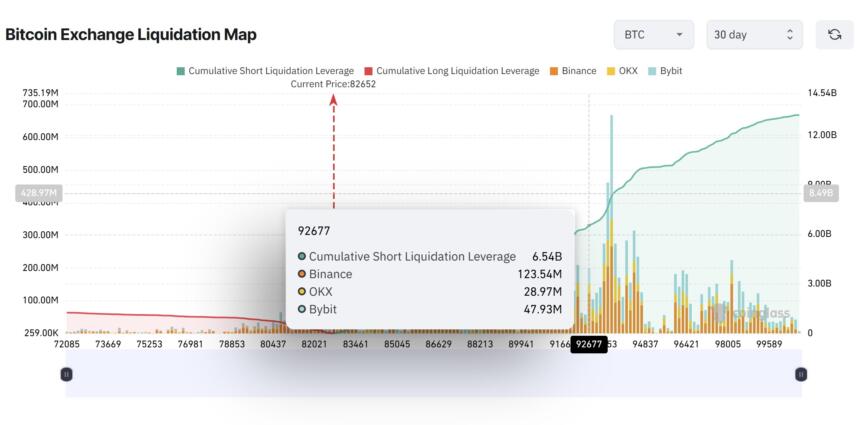

CoinGlass data shows that a move toward $92,000 may place over $6.5 billion in cumulative short positions at risk of liquidation. By contrast, a drop to $72,600 would only threaten about $1.2 billion. This imbalance means upside moves may force short sellers to buy back positions, potentially accelerating price recovery.

Bitcoin Exchange Liquidation Map. Source: CoinGlass

Bitcoin Exchange Liquidation Map. Source: CoinGlass

Additionally, crypto commentator Marty Party framed the recent move as part of a Wyckoff Accumulation “Spring,” where price briefly dips below support to shake out weak hands before reversing.

In this context, the sweep below $83,000 may act as a final liquidity grab, allowing larger participants to buy discounted Bitcoin. If followed by sustained buying, the next phase may exhibit a price expansion with upside targets extending back toward $100,000.

Bitcoin’s Wyckoff Accumulation. Source: Marty Party/X

Bitcoin’s Wyckoff Accumulation. Source: Marty Party/X

Related: Bitcoin’s ‘miner exodus’ could push BTC price below $60K

Bitcoin futures positioning shows mixed signals

Bitcoin’s decline triggered an estimated $800 billion in liquidations over the past 24 hours, the largest single-day event since late November 20, when BTC last traded near $81,000.

Yet, according to crypto analyst Darkfost, the open interest on Binance has risen to 123,500 BTC, exceeding levels seen ahead of the October 10, 2025, when open interest fell to 93,600 BTC. A roughly 31% increase since then suggests traders are rebuilding exposure rather than fully exiting the market.

Open Interest in Bitcoin term. Source: CryptoQuant

Open Interest in Bitcoin term. Source: CryptoQuant

Broader derivatives activity has also cooled. Monthly Bitcoin futures volume across all exchanges fell to around $1.09 trillion in January, the lowest since 2024. Trading remained concentrated on major venues, led by Binance with $378 billion, followed by OKX at $169 billion and Bybit near $156 billion.

Related: Bitcoin loses crucial $84K support: How low can BTC price go?

This article was originally published as $6B Bitcoin Shorts Could Fuel Rally Above $90K on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Weakness concerns amid intervention – BNY

CME Group to Launch Solana and XRP Futures Options