Bitcoin Options Signals Extreme Fear: Will BTC Slide Under $80K Next?

Bitcoin has pulled back sharply, slipping roughly 10% from midweek into Thursday and testing the $81,000 level for the first time in more than two months. The move comes as traders digest a wave of outflows from spot BTC exchange-traded funds, alongside a broader risk-off tone that coincided with gold’s retreat from its own all-time high. The backdrop is a market increasingly focused on hedging and liquidity, with options markets flashing notable fear metrics just as leveraged bets have been unwound. The price action also underscores a crucial test for the $80,000 support area, which—while still intact—faces renewed scrutiny as investors weigh macro risks and the possibility of renewed volatility.

Bitcoin (BTC) experiences a pullback after a period of outsized moves, and the tissue of market signals suggests traders are cooling risk exposure in the near term. The drop comes on the back of US-listed spot Bitcoin ETFs showing material net outflows, while gold prices have dipped from their Wednesday peak. In this context, the market’s nervous undertone is evident in the options market, where fear is elevated and hedging activity appears more pronounced than at any point in recent months.

Spot Bitcoin exchange-traded funds daily net flows, USD. Source: CoinGlassThe latest data shows US-listed spot Bitcoin ETFs have recorded about $2.7 billion in net outflows since January 16, representing roughly 2.3% of total assets under management. This backdrop has raised questions about institutional demand and whether investors are layering into safer havens or stepping back from risk assets altogether. At the same time, gold has declined about 13% from its Wednesday high, reminding traders that multi-asset markets can move in tandem when liquidity tightens and macro narratives shift. The combination of ETF redemptions and precious metal dynamics has contributed to a cautious mood that could extend into the near term, even as some investors point to longer-term value cases for BTC as a potential hedge against inflation and currency risk.

Key takeaways

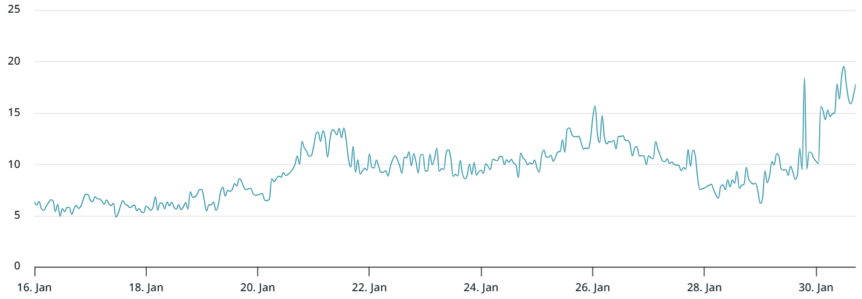

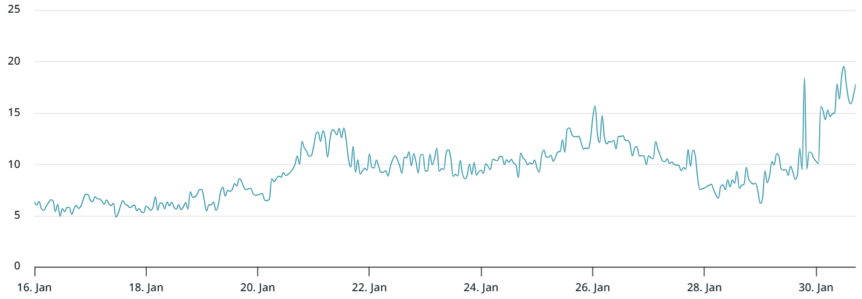

- Bitcoin options delta skew rose to 17% on Friday, its highest level in more than a year, signaling extreme fear and heightened hedging activity as market makers prepare for further downside protection.

- Net outflows from US-listed spot BTC ETFs totaled about $2.7 billion since Jan 16, equating to roughly 2.3% of assets under management and raising questions about institutional demand.

- The price correction reached about 10%, with BTC retesting the $81,000 area—the first proximity to that level in over two months—raising the specter of a soft test of the psychological $80k support.

- Approximately $860 million in leveraged long BTC futures positions were liquidated between Thursday and Friday, while aggregate BTC futures open interest fell to about $46 billion from around $58 billion three months prior, indicating deleveraging across the market.

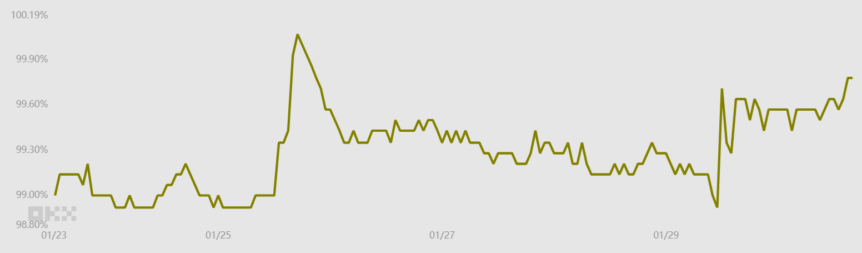

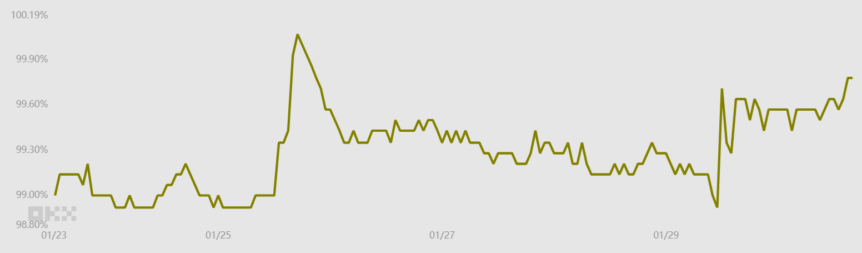

- Stablecoin dynamics in cross-border flows suggested moderation rather than a rush for cash, with a 0.2% discount for USDT/CNY versus the US dollar/CNY, contrasting with traditional parity expectations and signaling cautious liquidity conditions.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative

Market context: The current dynamics sit at the intersection of risk-off trading, ETF outflows, and macro uncertainty. As traditional risk assets face persistent headwinds, investors have favored liquidity and short-duration exposures, which often translate into pressure on highly leveraged crypto positions and volatility spikes in liquid markets like BTC.

Why it matters

The surge in BTC options fear, mirrored by a jump in delta skew, points to a market structure that is increasingly sensitive to downside risk. When put options carry a premium relative to calls, market makers hedge with heightened caution, amplifying price swings in times of stress. The 17% delta skew suggests that the market is more willing to pay for downside protection than to bet on further upside, a condition that can feed upon itself if macro catalysts continue to weigh on sentiment. In this environment, traders must monitor not just price levels but the pace and direction of hedging activity, as it can create feedback loops that drive rapid short-term moves.

ETF flows are a useful lens into the institutional appetite for BTC as an asset class. The reported $2.7 billion of net outflows since mid-January, representing 2.3% of AUM, signals institutional demand softness even as retail participants can remain active. Outflows from spot BTC ETFs can compress price durability if buyers do not re-enter in meaningful size, particularly when risk-off sentiment is reinforced by other macro variables. This backdrop also coincides with gold’s multi-month rally being tempered by short-term retracements, underscoring a broader competition for capital across safe-haven assets. In this light, BTC’s price action becomes a barometer for risk sentiment in the crypto space and a gauge of how quickly demand can swing in response to macro cues.

Beyond the price action, the risk narrative extends into the realm of technology risk like quantum computing. While some market participants remain skeptical about imminent disruption to the cryptographic foundations of blockchains, others warn that long-term security considerations must be taken seriously. Independent research and ongoing dialogue within the industry—highlighted by initiatives such as Coinbase’s advisory board aimed at evaluating quantum threats with public research slated for early 2027—add a layer of forward-looking risk assessment to the conversation. The broader takeaway is that risk considerations—whether macro, technological, or liquidity-driven—are increasingly intertwined in shaping crypto markets.

BTC 2-month options delta skew (put-call) at Deribit. Source: laevitas.ch

BTC 2-month options delta skew (put-call) at Deribit. Source: laevitas.ch

Analysts note that a cooling in leverage can be a double-edged sword. On one hand, a deleveraging phase can reduce systemic risk and limit cascading liquidations, potentially stabilizing prices after a sharp correction. On the other hand, if risk appetite does not return, the market could remain range-bound with occasional reversals as participants digest incoming data and reassess risk premium. The combination of a lower open interest and notable liquidations suggests a shift toward a more conservative posture among traders, even as some investors argue that the long-term bull case for BTC remains intact. The ongoing debates around quantum security and the ongoing debate about institutional appetite will likely shape how quickly the market can stage a renewed rally if macro and crypto-specific catalysts align.

BTC futures aggregate open interest, USD. Source: CoinGlass

BTC futures aggregate open interest, USD. Source: CoinGlass

The futures market remains a useful lens into risk sentiment. With open interest sliding to $46 billion from a prior $58 billion, and with a substantial portion of long positions liquidated, the market appears to be purging excess leverage. This process can improve resilience over the longer term, but it can also prolong volatility in the near term if demand remains tepid or if new catalysts emerge. The broader ecosystem will watch how quickly liquidity returns, how ETF flows evolve, and whether macro narratives shift back toward risk-on or risk-off dynamics. In this context, BTC’s ability to reclaim momentum will hinge on more than just price—it will require a rebalancing of demand across institutions, traders, and retail participants alike.

As markets calibrate to these dynamics, traders will keep an eye on stablecoin liquidity signals as a proxy for overall risk appetite. The ratio of USDT to yuan and the implied USDT/CNY vs USD/CNY relationship offer a barometer of capital flight and the willingness of traders to move into on-chain assets or exit to cash. In the current climate, a modest 0.2% discount suggests a measured outflow rather than a rush for liquidity, reinforcing the narrative of caution rather than panic selling. This nuanced picture—combining price action, leverage cycles, and cross-asset flows—frames BTC as a barometer of risk sentiment rather than a standalone driver of returns in the near term.

What to watch next

- BTC price action around the $81,000–$87,000 band, with a focus on whether the asset can reclaim momentum and establish a new upside base.

- New ETF net flow data over the coming weeks, to determine whether institutional demand resumes or remains tepid.

- Deribit and other derivatives gauges (delta skew, volatility surfaces) for signs of fading fear or renewed hedging pressure.

- Any fresh developments on macro frontiers that could alter risk appetites, including inflation data and policy signals.

Sources & verification

- Bitcoin price retest near $81,000 and related market moves (price page and price data references).

- US-listed spot Bitcoin ETF net outflows totaling about $2.7 billion since Jan 16 (2.3% of AUM).

- Gold’s three-month performance and its interaction with crypto markets (gold-related article referencing divergence).

- BTC options delta skew reaching 17% (Deribit delta skew data; laevitas.ch source).

- Reported leveraged long BTC futures liquidations around $860 million; open interest decline from $58B to $46B (CoinGlass and related charts).

- Stablecoin liquidity indicators and USDT/CNY dynamics (OKX-based data visuals and captions).

- Coinbase advisory board on quantum computing risks and public research planned for early 2027.

- Related market analysis on potential “liquidation revenge” dynamics and BTC price catalysts.

Bitcoin market dynamics: options fear, ETF flows, and macro risk

Bitcoin (CRYPTO: BTC) has found itself navigating a confluence of hedging-driven activity, ETF liquidity, and broader macro risk signals. The most notable marker is the jump in the delta skew of BTC options to 17%—the highest in more than a year—indicating an elevated demand for downside protection that can feed into heightened volatility as market makers hedge. This condition often materializes when traders anticipate more downside or when liquidity is contracting, even if the immediate price path appears uncertain. The practical upshot is that any negative surprise—be it a policy shift, macro data release, or unexpected liquidity shock—can trigger outsized moves as hedges unwind or recalibrate in a hurry. The Deribit delta skew metric depicted in the chart below, with its sourcing from laevitas.ch, offers a window into the market’s fear gauge and the distribution of risk bets across the spectrum of options contracts.

BTC 2-month options delta skew (put-call) at Deribit. Source: laevitas.ch

BTC 2-month options delta skew (put-call) at Deribit. Source: laevitas.ch

The recent price action, meanwhile, reflects not only fear but real liquidity dynamics. Leverage in the system has been purged to some degree, with approximately $860 million in leveraged long BTC futures liquidations observed between Thursday and Friday. While this purge reduces systemic risk in the near term, it also underscores how fragile short-term sentiment can become when a dramatic price swing occurs. At the same time, aggregate BTC futures open interest slipped to about $46 billion, down from roughly $58 billion three months ago, signaling a cautious tilt among market participants and a shift away from highly leveraged bets. The chart below from CoinGlass illustrates the current open interest landscape and helps contextualize the scale of deleveraging occurring in the market.

BTC futures aggregate open interest, USD. Source: CoinGlass

BTC futures aggregate open interest, USD. Source: CoinGlass

Beyond outright price risk, the market is watching cross-asset flow signals, especially stablecoins, as a proxy for risk appetite. The current data indicate a modest shift in the USDT/CNY dynamic, with a 0.2% discount to the US dollar/CNY rate, indicating moderate outflows rather than an abrupt liquidity crunch. This stands in contrast to a typical 0.5%–1% premium and suggests that, at least in the near term, investors remain selective about their allocation to on-chain assets. Taken together with the price correction and the outflows from spot BTC ETFs, these indicators paint a cautious portrait: BTC could reclaim momentum if flows stabilize and risk sentiment improves, but the near-term path remains tethered to macro twists and the pace of institutional adoption.

In the broader context, investors should consider the potential implications of quantum computing risks on long-term security models for blockchains. While the field remains in early stages, industry observers emphasize the importance of ongoing research and preparedness. As Coinbase has signaled through its independent advisory board and forthcoming public research, this is a risk factor that could influence long-horizon holdings, even if it does not pose an immediate threat to today’s networks. At the same time, the market continues to watch for catalysts, such as potential policy shifts, ETF inflows, or regulatory developments, that could tilt risk sentiment in either direction. For now, the narrative is one of measured caution, with a focus on liquidity, hedging, and the durability of BTC’s longer-term value proposition in a rapidly evolving crypto landscape.

https://platform.twitter.com/widgets.js

This article was originally published as Bitcoin Options Signals Extreme Fear: Will BTC Slide Under $80K Next? on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

World Liberty Financial Price Outlook: Can WLFI Reach $0.075 in 2026?

e-Hailing drivers kick as Bolt introduces cheaper ‘Wait and Save’ ride category