Ripple CTO Pushes Back on $100 XRP Target Using Market Logic

David Schwartz, Chief Technology Officer at Ripple, has publicly challenged the popular narrative that XRP could reach $100 under current market conditions.

Schwartz applied basic expected-value reasoning to explain why such projections are inconsistent with observable market behavior.

Rather than dismissing price speculation outright, Schwartz focused on how rational capital allocators behave when they believe a high-probability upside exists.

Expected Value vs. Market Reality

At the center of Schwartz’s argument is the concept of market belief. He explained that if sophisticated investors genuinely believed XRP had even a modest probability, such as 10%, of reaching $100 within a reasonable time frame, that belief would already be reflected in the price.

Source: https://www.binance.com/en/square/post/35818329034466

Source: https://www.binance.com/en/square/post/35818329034466

In practical terms, such expectations would incentivize aggressive accumulation at current levels. That demand would rapidly absorb available supply, pushing XRP far above its present valuation. As of early February 2026, XRP continues to trade near $1.76, a level that Schwartz argues is fundamentally incompatible with a widely held conviction of triple-digit upside.

The absence of that repricing, in his view, suggests that the broader market does not assign meaningful probability to a $100 outcome in the foreseeable future.

Supply Dynamics and Investor Behavior

Schwartz emphasized that markets tend to front-run anticipated value. If large players believed XRP was dramatically undervalued relative to future outcomes, the supply of tokens offered at low prices would disappear quickly.

The fact that XRP remains comfortably below $10 implies that informed participants are not positioning for a near-term exponential repricing. This, he noted, does not require insider knowledge, only observation of how markets historically price expected outcomes.

A Nuanced Perspective, Not a Price Cap

Despite pushing back on what he views as unrealistic hype, Schwartz stopped short of declaring a $100 XRP price impossible.

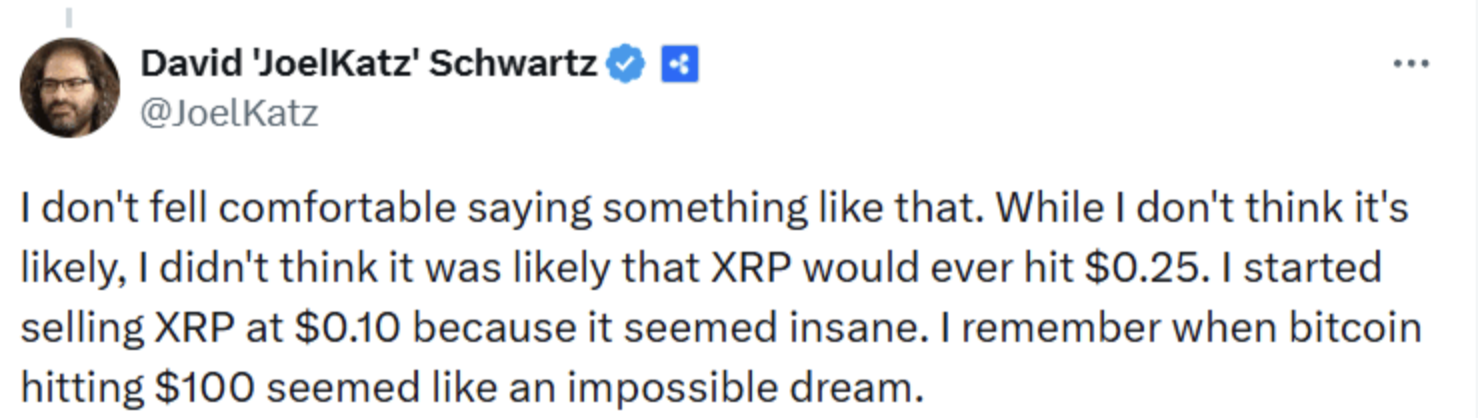

He openly acknowledged past misjudgments, including selling his own XRP at $0.10 and previously viewing $0.25 as an unlikely milestone. Those experiences, he said, are reminders that crypto markets can move in ways that defy conventional logic, especially when external catalysts emerge.

For that reason, Schwartz declined to rule out extreme outcomes entirely, instead framing his comments as a critique of probability assessment, not absolute limits.

Utility Over Speculation

Schwartz also reiterated that higher XRP prices are not inherently negative from a functional standpoint. As a bridge asset, XRP benefits from deeper liquidity and higher valuations, which can reduce transaction friction and improve efficiency in cross-border payment flows.

However, he cautioned that utility-driven arguments should not be conflated with speculative price targets disconnected from current market consensus.

Bottom Line

Schwartz’s comments serve as a reminder that markets price beliefs, not narratives. While XRP’s long-term trajectory remains open to debate, its current valuation suggests that triple-digit targets are not being taken seriously by the majority of rational investors today.

In his framing, extraordinary price levels require not just optimism, but widespread conviction, and the market, for now, is signaling restraint rather than belief.

The post Ripple CTO Pushes Back on $100 XRP Target Using Market Logic appeared first on ETHNews.

You May Also Like

ADA Price Prediction: Here’s The Best Place To Make 50x Gains

Michigan progresses Bitcoin Reserve bill to invest 10% state funds in Bitcoin