Jupiter Announces $35M ParaFi Investment, Deal to Settle in JupUSD

Jupiter JUP $0.18 24h volatility: 1.3% Market cap: $598.29 M Vol. 24h: $60.94 M , a Solana-based SOL $101.9 24h volatility: 3.5% Market cap: $57.60 B Vol. 24h: $8.81 B decentralized exchange aggregator, announced on Feb. 2 a $35 million investment in its JUP token from ParaFi Capital. The deal will be settled entirely in JupUSD, Jupiter’s stablecoin.

According to Jupiter’s announcement, the deal closed at current market price with ParaFi committing to an extended token lockup.

Jupiter did not disclose the specific lockup duration. ParaFi Capital had not issued a public statement confirming the investment at the time of publication.

JupUSD to Settle $35M Transaction

JupUSD launched in January 2026 and will be used to settle the entire $35 million transaction. The stablecoin currently has a market cap of approximately $38.7 million, according to rwa.xyz data.

The deal nearly doubles JupUSD’s circulating supply.

JupUSD is backed primarily by USDtb, a stablecoin with approximately $859 million in circulation that is collateralized by BlackRock’s BUIDL tokenized treasury fund.

Jupiter developed JupUSD in partnership with Ethena Labs. ParaFi is also an existing investor in Ethena ENA $0.14 24h volatility: 3.0% Market cap: $1.08 B Vol. 24h: $206.35 M .

ParaFi Capital manages approximately $1.4 billion in assets and was founded in 2018.

The firm’s portfolio includes multiple Solana SOL $101.9 24h volatility: 3.5% Market cap: $57.60 B Vol. 24h: $8.81 B ecosystem investments such as SOL Strategies, Kamino, and Metaplex.

In January 2025, ParaFi invested CAD $27.5 million in Sol Strategies, a company focused on Solana network infrastructure.

Ryan Navi, Managing Director at ParaFi Capital, described that investment as supporting Sol Strategies’ mission to build critical infrastructure for the Solana network.

Jupiter’s Market Position

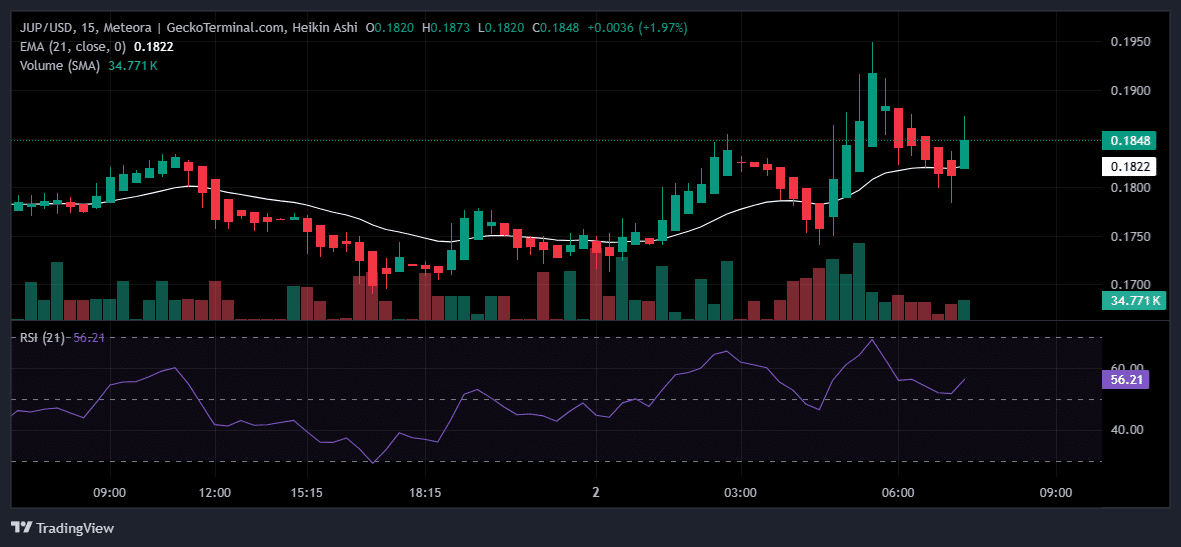

JUP/USD 15-minute chart showing price action on Feb. 1-2, 2026. The token traded between $0.17 and $0.19 over the period, with a recent price at $0.1873. | Source: GeckoTerminal/Meteora

Jupiter processes over 90% of aggregator volume on Solana. The platform announced in June 2025 that cumulative trading volume had surpassed $1 trillion.

Coinbase integrated Jupiter’s trading technology in January 2026.

JUP trades at approximately $0.19 with a market cap of $596.6 million. The token is down roughly 91% from its all-time high of $2.00 reached in January 2024.

nextThe post Jupiter Announces $35M ParaFi Investment, Deal to Settle in JupUSD appeared first on Coinspeaker.

You May Also Like

A Critical Turning Point For Global Tech

The Era of Great Rotation: What Does the Historic Gold Crash Mean for Bitcoin?