Capitulation or rebound opportunity? Solana prezzo oggi on SOLUSDT under pressure

Market conditions remain fragile across crypto, and Solana prezzo oggi sits deep in a multi-week selloff while traders debate if this is capitulation or just another leg lower.

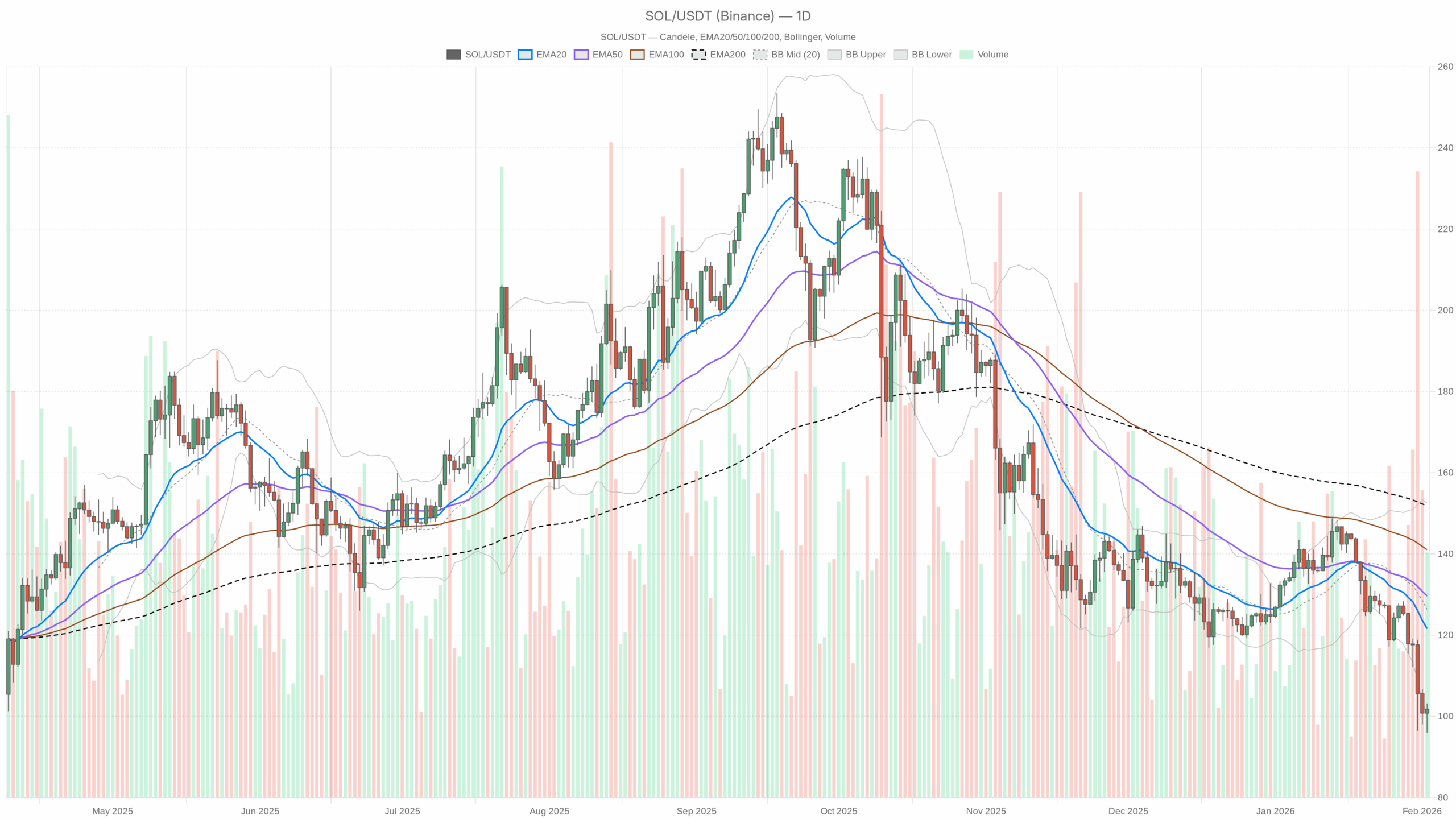

SOL/USDT daily chart with EMA20, EMA50 and volume”

SOL/USDT daily chart with EMA20, EMA50 and volume”

loading=”lazy” />SOL/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

Daily bias (D1): clearly bearish, but approaching exhaustion

The daily timeframe defines the main scenario, and for SOLUSDT it is bearish.

Trend structure: EMAs

- Price D1 close: $101.76

- EMA 20: $121.55

- EMA 50: $129.62

- EMA 200: $151.79

- Regime: bearish

Solana (SOLUSDT) is trading around $101.5–102, in the lower part of a sharp multi-week selloff, with the broader crypto market under pressure (total market cap -2.9% in 24h, Bitcoin dominance above 57%). Sentiment is in Extreme Fear. In other words, we are late in a down move, not early in an uptrend.

Price is sitting well below all major EMAs, with the short-term EMA20 already below the EMA50 and both deep under the EMA200. That is a classic strong downtrend structure: the market has flipped from a momentum bull to a full trend correction. The gap between spot and the 20-day EMA (~$20) shows how aggressive the selloff has been. Usually this kind of distance does not persist for long without at least a snapback.

In practice, the daily structure says do not call a trend reversal yet. Any bounce from here, unless it can reclaim at least the 20-day EMA, is technically just a rebound within a broader downtrend.

Momentum and exhaustion: RSI

- RSI 14 (D1): 27.08

Daily RSI is deep in oversold territory below 30. This confirms the strength of the recent downside move, but also tells us the move is becoming crowded on the short side. Historically, when SOL trades with an RSI in the high 20s on the daily, the risk of a short-covering bounce increases, even if the broader trend is still down.

So momentum agrees with the bearish trend, but also signals that chasing new shorts here is late, not early.

Trend quality: MACD

- MACD line (D1): -7.36

- Signal line (D1): -4.20

- Histogram (D1): -3.16

The MACD on the daily is solidly negative, with the line below the signal and the histogram also negative. This is confirmation of a mature bearish impulse. The spread between the MACD line and the signal line is significant, which usually means the down leg has been strong and persistent.

At the same time, when MACD is already this deep in negative territory, the risk/reward for fresh downside starts to deteriorate. There is room for a mean-reversion of momentum even if price does not immediately flip into a full bull trend.

Volatility and downside extension: Bollinger Bands & ATR

- Bollinger mid (D1): $126.33

- Upper band: $152.48

- Lower band: $100.19

- ATR 14 (D1): $7.75

Price is sitting right at the lower daily Bollinger Band (~$100.19) with a close at $101.76. That is classic capitulation behavior: the market has ridden the lower band down, and we are now probing the edge of the current volatility envelope. The mid-band (around $126) aligns closely with the EMA20, reinforcing that the natural mean-reversion magnet on the daily is roughly in the mid-$120s.

The daily ATR at $7.75 is elevated relative to current price, meaning average daily candles are about 7–8% of price. Volatility is high, so levels can be tested and violated intraday. For traders, this is not a quiet accumulation zone. Instead, it is an environment where stops need more room and intraday swings can be brutal.

Daily pivot levels: where the market is leaning

- Pivot point (PP, D1): $100.28

- R1: $104.62

- S1: $97.43

On the daily, SOL is trading slightly above the main pivot ($100.28) and below R1 ($104.62). The cluster between $100–104 is effectively the short-term battlefield. Holding above the pivot keeps the door open for a tactical rebound, while losing it puts S1 ($97.43) and the low-$90s region in play.

Overall, the daily chart frames a market in a clear downtrend that is starting to look emotionally and technically stretched. The base case is still bearish, but the risk of sharp counter-trend moves is rising.

Intraday (H1): bearish bias, but attempting to stabilize

The hourly chart is still in a bearish regime, but the pressure is not as one-sided as on the daily.

H1 EMAs: flattening, not yet bullish

- Price H1: $101.56

- EMA 20 (H1): $101.80

- EMA 50 (H1): $105.16

- EMA 200 (H1): $115.43

- Regime: bearish

On the 1-hour chart, price is very close to the EMA20 and still below the EMA50 and EMA200. That points to a market that has stopped accelerating lower and is trying to find balance, but has not flipped trend. The short EMA is flattening around price. This is what early base-building looks like, but until we see sustained trading above the 50-EMA, it remains just stabilization inside a broader downtrend.

H1 RSI and MACD: momentum is neutralizing

- RSI 14 (H1): 45.86

- MACD line (H1): -1.18

- Signal line (H1): -1.49

- Histogram (H1): 0.31

Hourly RSI is hovering around mid-range in the mid-40s. That tells us the extreme selling pressure from the daily has cooled off intraday. There is neither a clear buyer nor a clear seller dominance on this timeframe right now.

The hourly MACD line is still negative but has crossed above the signal, producing a small positive histogram. That is typical of an early momentum pause or small bullish divergence within a bigger downtrend. It supports the idea that the immediate downside impulse is losing steam, even if the larger structure is not yet ready to reverse.

H1 Bollinger Bands, ATR and pivot: range forming

- Bollinger mid (H1): $101.42

- Upper band: $103.61

- Lower band: $99.24

- ATR 14 (H1): $2.65

- Pivot point (PP, H1): $101.63

- R1 (H1): $101.77

- S1 (H1): $101.42

On the hourly, price is trading almost exactly at the mid Bollinger band and the main pivot ($101.4–101.6). The bands have narrowed compared to the daily context, and ATR is about $2.65, meaning the market is moving inside a $5–6 range intraday most of the time.

This is classic short-term consolidation just above a key psychological level ($100). The hourly market is trying to digest the prior drop. It is neither an impulsive continuation lower nor a clean reversal yet.

Execution context (M15): tactical bounce attempt

The 15-minute chart is not for bias, but it helps read the execution environment. Here the regime is marked as neutral.

- Price M15: $101.56

- EMA 20 (M15): $100.91

- EMA 50 (M15): $101.08

- EMA 200 (M15): $104.90

- RSI 14 (M15): 54.84

- MACD line (M15): 0.35

- Signal line (M15): 0.11

- Histogram (M15): 0.24

- Bollinger mid (M15): $100.51

- Upper band (M15): $103.06

- Lower band (M15): $97.96

On the 15-minute, price has reclaimed the EMA20 and EMA50, and short-term momentum (RSI mid-50s and positive MACD) leans slightly bullish. Price is trading above the mid Bollinger band, suggesting a local bounce leg within the intraday range.

So while the daily is clearly bearish, the 15-minute shows shorts locking in profits and opportunistic dip-buyers active near $100. This conflict between timeframes often produces choppy trading and fake breakouts around key levels.

Market backdrop: risk-off, but Solana still relevant

Macro crypto conditions are fragile:

- Crypto total market cap: ~$2.67T, down ~2.9% in 24h.

- BTC dominance: ~57.6%, confirming a defensive, Bitcoin-heavy stance.

- Fear & Greed Index: 14 (Extreme Fear).

- Solana market cap share: ~2.16% of total.

Flows show the typical pattern of a late-stage risk-off: Bitcoin gains dominance, altcoins bleed more aggressively. Yet Solana still commands over 2% of total crypto cap and its DeFi ecosystem (Raydium, Orca, Meteora, SolFi, etc.) continues to generate substantial fees, with some protocols showing large 7–30 day increases. Fundamentally, Solana has not disappeared. The problem is mainly positioning and valuation after the prior huge run.

Putting it all together: the main scenarios for Solana price today

Primary bias (from D1): bearish trend, with growing risk of a corrective bounce.

Bullish scenario: oversold squeeze and mean reversion

For a constructive bullish path today and in the coming sessions, we would need to see the following sequence.

- Defense of the $100 area

Daily pivot sits at $100.28 and the lower Bollinger band is around $100.19. As long as SOL holds $97–100 on a daily closing basis, the oversold setup can fuel a short-covering rally. - Intraday confirmation above $104–105

That zone lines up with D1 R1 ($104.62) and the H1 EMA50 (~$105.16). A sustained break and hourly closes above $105 would show that buyers can do more than just defend. They can push back against the downtrend. - Target zone for a relief rally

If those conditions hold, the natural mean-reversion magnet on the daily sits around the $120–130 area (Bollinger mid and EMA20/50 cluster). In a strong squeeze, price can spike quickly into that band before reassessing trend direction.

What would invalidate the bullish scenario?

A clean daily close below $97 with momentum still heavy would undercut the lower band and pivot support, signaling that sellers are not done and that the oversold condition is being resolved via time and further price damage rather than a bounce. In that case, the market is not ready for a proper mean-reversion yet.

Bearish scenario: continuation of the downtrend

The prevailing regime is still bearish, so the continuation path has to be taken seriously. This remains the base case unless bulls can change structure.

- Failure to hold intraday bounces below $104–105

If every attempt to push above the H1 EMA50 and D1 R1 is sold aggressively, it shows that rallies are still being used as exit liquidity. Price then oscillates below the pivot, wearing out dip-buyers. - Break and daily close below $97

That would be a decisive technical trigger confirming trend continuation. Given daily ATR of $7.75, a move from $101 to the low $90s can happen in a single session during a volatility spike. - Downside zones

Below $97, there is not much nearby daily structure in this data, so traders would typically look to prior consolidation areas and psychological levels (mid-$90s, then $90 and upper $80s) as potential demand zones. Given the oversold RSI, each step lower is likely to be more violent but shorter in time, with sharp snapbacks.

What would invalidate the bearish scenario?

If SOL can reclaim and hold above $120 on a daily closing basis, essentially regaining the EMA20/Bollinger mid area, then the current leg down transforms from trend into a completed correction. Bears would be forced to admit the downside momentum has broken, and positioning would start to shift toward a broader range or even a new uptrend attempt.

How to think about positioning, risk and volatility

Solana prezzo oggi is stuck between two forces: a clear, established daily downtrend and increasingly stretched downside conditions that invite fast, sharp bounces. The daily chart says the bigger move is still down, while the intraday charts say the current leg is tired.

In such an environment:

- Trend followers usually prefer to stay aligned with the daily downtrend, but are wary of initiating fresh shorts this late without clear failed bounces.

- Mean-reversion traders focus on the $97–100 zone as the key battleground for potential squeezes, knowing volatility is high and invalidation levels must be respected tightly.

- Long-term holders watch whether SOL can eventually reclaim the $120–130 band. Until that is done, this is still formally a correction phase within a broader cycle, not a confirmed new bullish leg.

Volatility (as shown by ATR) means intraday moves can easily overshoot technical levels, and emotions are amplified by extreme fear sentiment. This is not a low-risk environment. Both sides, bulls and bears, can be punished if they over-leverage or trade without clear invalidation points.

If you want to monitor markets with professional charting tools and real-time data, you can open an account on Investing.com using our partner link:

Open your Investing.com account

This section contains a sponsored affiliate link. We may earn a commission at no additional cost to you.

This analysis is for informational and educational purposes only and does not constitute investment, trading, or financial advice. Markets are risky and highly volatile; always do your own research and consider your risk tolerance before making any trading decisions.

You May Also Like

The Channel Factories We’ve Been Waiting For

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058