Altcoin breakout? ETH outpaces BTC in volume, demand, and ETF flows

Altseason calls are gaining ground, and the numbers are starting to back them. New market data shows Ethereum is taking the market lead, flipping Bitcoin across several key metrics and pulling altcoins with it.

- Ethereum just overtook Bitcoin in spot volume for the first time in over a year.

- Bitcoin dominance dropped nearly 3% in a week as capital rotates into altcoins.

- ETH ETFs log 15 straight days of inflows as Bitcoin funds reverse course.

According to a July 23 CryptoQuant data, Ethereum (ETH) has outperformed Bitcoin (BTC) by 72% since April, with the ETH/BTC ratio rising from 0.018 to 0.031. That’s the highest level since January, and a clear shift from ETH’s previously undervalued state.

ETH also just overtook Bitcoin in weekly spot trading volume. The asset saw $25.7 billion in volume last week, slightly ahead of Bitcoin’s $24.4 billion. That’s the first time ETH has led in spot volume since June 2024, marking a major sentiment reversal.

Adding weight to the trend is the growing shift in U.S listed exchange traded funds (ETF) flows. The ETH/BTC ETF holding ratio has jumped from 0.05 to 0.12, showing that institutions are leaning harder into Ethereum. ETH ETFs have now logged 15 straight days of inflows, while Bitcoin funds have recently flipped their positive course and are seeing consistent outflows.

On-chain flows also reinforce the trend. The ETH/BTC exchange inflow ratio remains low, which means fewer ETH are moving onto exchanges compared to BTC. That typically points to lower sell pressure on ETH, and creates room for continued outperformance if demand holds up.

The shift comes amid a broader slip in Bitcoin dominance. Glassnode data shows that BTC’s market share has dropped from 63.76% to 60.78% over the past week. This is a sharp 2.98 percentage point decline, and marks one of the steepest weekly drops this year.

As capital now rotates out of Bitcoin, altcoins are starting to catch a strong bid.

Altseason finally here?

Despite the recent cooling off in tokens like Solana (SOL) and XRP (XRP), positive signals are flashing. Total altcoin spot trading volume recently surged to $67 billion, the highest since March.

Social sentiment backs this up. Santiment data shows crypto discussions across X, Telegram, and Reddit are increasingly focused on altcoins rather than Bitcoin, even after BTC’s recent climb to $123,000.

What this really means is that market attention is rotating. Ethereum and altcoins now account for the lion’s share of capital and conversation, a clear break from the BTC-dominant trend of Q2.

However, that momentum is still fragile. The Altcoin Season Index, which peaked at 55 earlier this week, has since dropped to 34. This typically needs to hit 75 to signal a confirmed altseason, and current figures suggest the market is not there yet. Still, if trends in volume, flows, and sentiment keep building, the market could be setting up for a sustained run.

You May Also Like

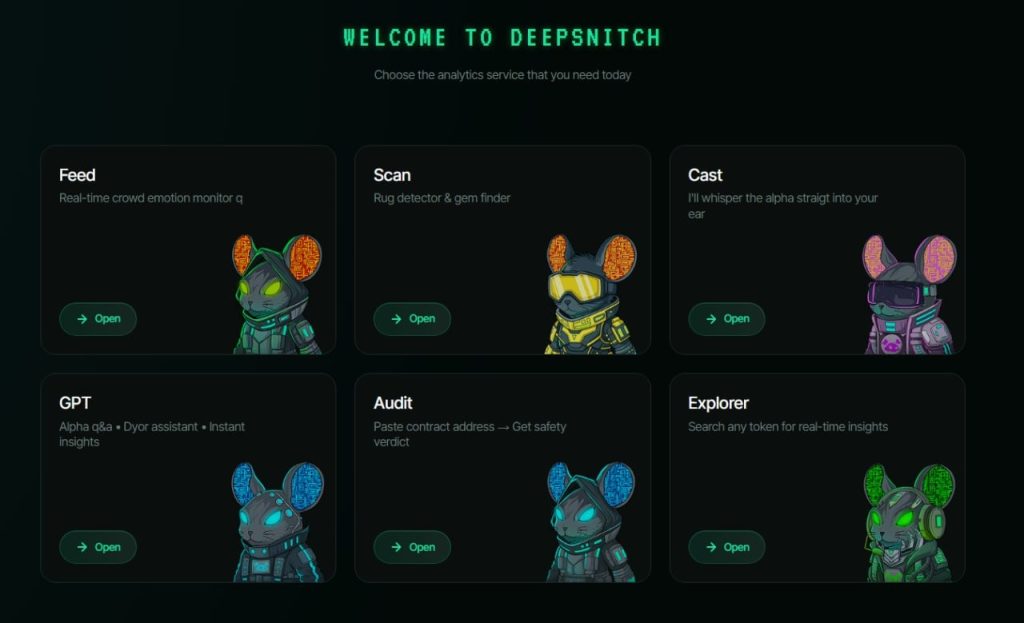

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24