Strategy expands preferred stock offering to $2b as Bitcoin thesis deepens

Strategy has raised $2 billion through a preferred stock offering underwritten by Morgan Stanley, Barclays, and other major banks, quadrupling its initial target to expand its Bitcoin holdings.

The offering, priced at $90 per share with a 9% dividend, reflects strong institutional demand and marks one of the largest crypto-focused capital raises by a publicly traded company. The move reinforces Strategy’s long-standing shift toward Bitcoin as a core treasury asset.

- Strategy quadrupled its preferred stock offering to $2B to fuel further Bitcoin accumulation.

- The move was underwritten by major banks including Morgan Stanley and Barclays, signaling growing institutional confidence in Bitcoin.

According to a Bloomberg report on July 24, Strategy abruptly quadrupled its Series A perpetual preferred stock offering mere hours before pricing, signaling blistering institutional demand.

The shares, dubbed “Stretch,” were locked in at $90 apiece with a 9% dividend, a move that effectively handed the company $2 billion in fresh ammunition for Bitcoin (BTC) acquisitions. In addition to Morgan Stanley and Barclays, TD Securities and Moelis & Co. are also underwriters.

The deal represents one of the most significant dedicated crypto capital raises in corporate history.

The scale of this pivot speaks volumes. Strategy’s ability to secure such sums, especially at sub-face-value pricing, reveals a structural shift in how institutional investors view Bitcoin’s role in treasury management. This offering attracted traditional finance giants precisely because it treats Bitcoin as what Strategy long argued it was: a baseline reserve asset.

Is Bitcoin the business model now?

Strategy’s latest $2 billion capital raise is the culmination of a five-year bet that reshaped the company’s identity. Since pivoting from business intelligence to a Bitcoin-focused treasury strategy in 2020, the firm has amassed 607,770 BTC, valued at approximately $72 billion at current prices. That hoard represents over 3% of all Bitcoin ever mined, making Strategy the largest corporate holder by a wide margin.

According to Bloomberg, Strategy’s market capitalization now stands at $116 billion, a figure that would have been unthinkable before its Bitcoin accumulation began. Its stock, MSTR, has surged 3,500% since August 2020, dwarfing Bitcoin’s own 1,100% gain and the S&P 500’s 120% rise in the same period.

Crucially, this performance isn’t tied to its legacy software business, which has seen stagnant growth. Instead, investors are valuing Strategy as a leveraged Bitcoin play, with its stock often moving 2-3x the volatility of BTC itself.

You May Also Like

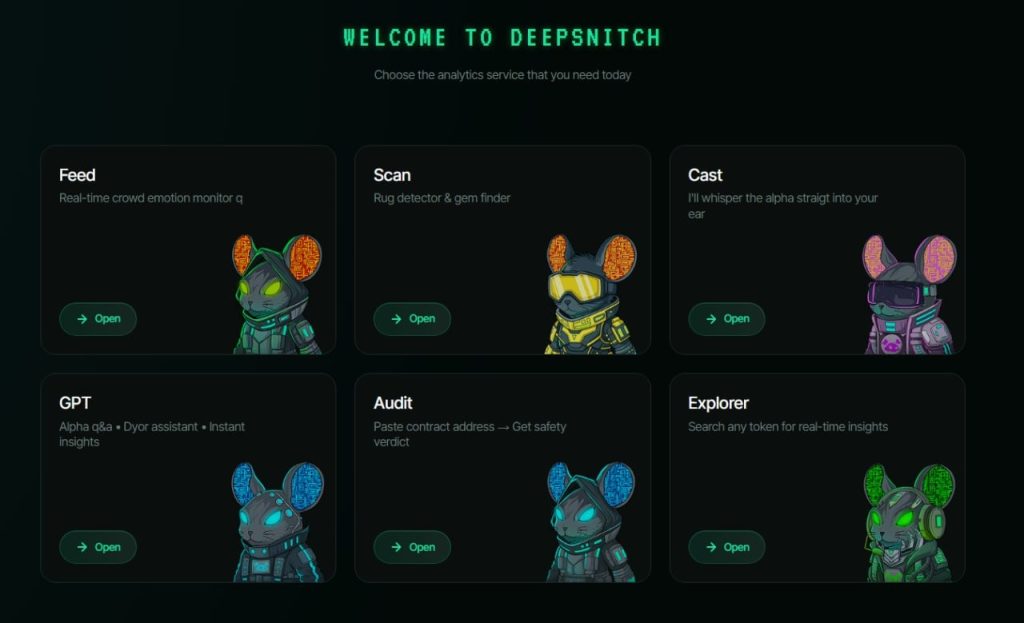

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24