Daily Market Update: Bitcoin Rebounds to $79,000 as Stocks Continue February Rally

TLDR

- Bitcoin rebounded to $79,000 after dropping below $75,000 over the weekend, with major cryptocurrencies posting gains between 3% and 6% in the past 24 hours.

- The weekend sell-off may have completed a bearish sequence that started in October 2025, with Bitcoin briefly dipping below its April 2025 lows near $74,000.

- Massive long liquidations occurred during the weekend crash as traders faced thin liquidity and broad risk-off sentiment across markets.

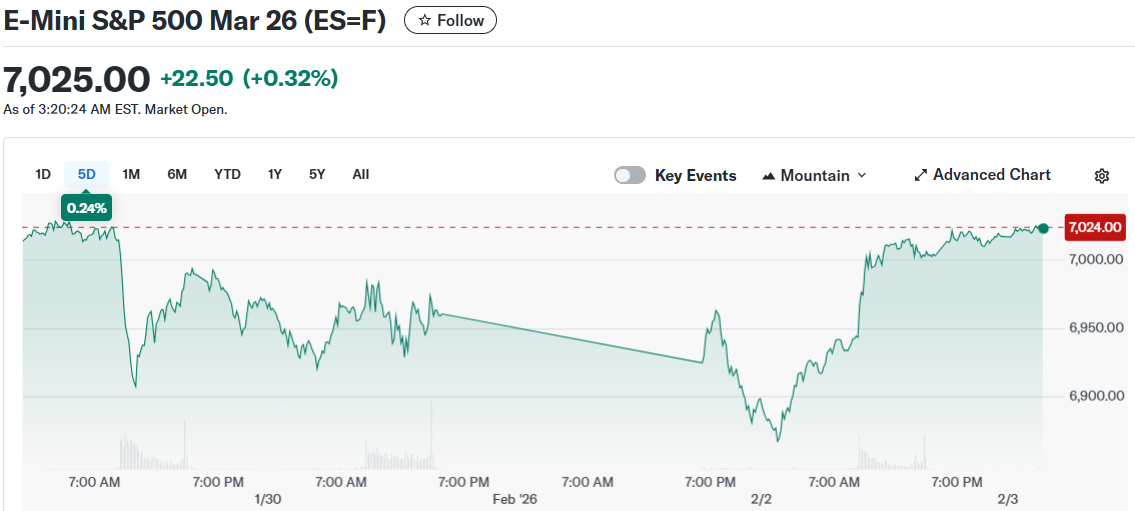

- U.S. stock futures climbed on Tuesday with S&P 500 futures up 0.3% and Nasdaq 100 futures rising 0.7% after Monday’s rally.

- Palantir shares jumped 6% in after-hours trading following strong fourth-quarter results, while Nvidia fell 3% on news of OpenAI seeking alternative chip suppliers.

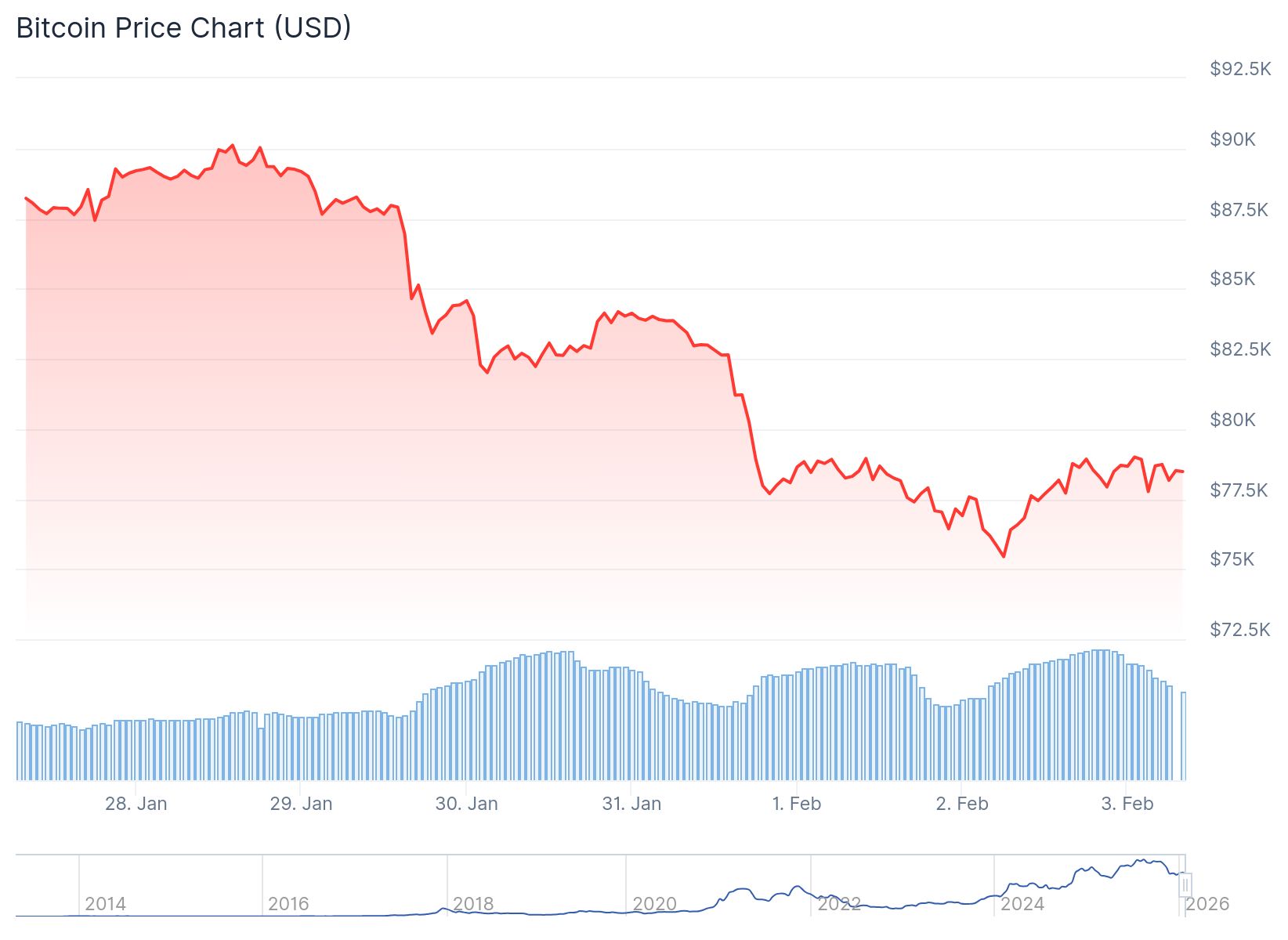

Bitcoin recovered to nearly $79,000 during Asian trading hours on Tuesday after a brutal weekend crash that saw the cryptocurrency fall below $75,000. The rebound marks a relief rally for crypto markets following billions of dollars in liquidations over the past few days.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Ether climbed above $2,340 while other major cryptocurrencies including Solana, BNB, XRP and Cardano gained between 3% and 6% in the past 24 hours. Despite the bounce, most large-cap tokens remain down sharply over the past week with losses reaching up to 20%.

The weekend crash triggered massive long liquidations as thin liquidity amplified selling pressure. Traders faced broad risk-off flows while U.S. tech giants delivered mixed earnings reports.

Gabe Selby, head of research at CF Benchmarks, said the sell-off may have completed a bearish sequence that began with an October 10, 2025 deleveraging event. Bitcoin briefly undercut its April 2025 lows around $74,000 during the weekend decline.

Failure to hold above the $74,000 level keeps downside risks alive toward liquidation clusters below $70,000. Selby pointed to regulatory headwinds including stalled U.S. crypto market structure legislation as factors weighing on Bitcoin prices.

Stock Markets Stage Comeback

U.S. stock futures rose on Tuesday morning following Monday’s broad rally. S&P 500 futures moved up 0.3% while Nasdaq 100 futures climbed roughly 0.7%. Dow Jones Industrial Average futures showed little change after the blue-chip index gained 500 points on Monday.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Asian markets rebounded sharply after their worst selloff in over two months. The MSCI Asia Pacific Index jumped 2.4% in its strongest session since April’s rally. South Korean stocks surged more than 5% as risk sentiment improved.

Tech Stocks Mixed on AI Concerns

Palantir shares surged roughly 6% in after-hours trading after the data analytics firm delivered stronger-than-expected fourth-quarter results. The company issued optimistic guidance for the coming quarters.

Nvidia fell nearly 3% during regular trading on news that OpenAI is delaying the close of a $100 billion deal. OpenAI reportedly expressed dissatisfaction with Nvidia chips and is seeking alternative hardware suppliers.

Advanced Micro Devices is set to report results on Tuesday. Tech giants Amazon and Alphabet will release earnings later this week.

Investors are watching tech earnings closely for evidence that artificial intelligence investments are translating into stronger margins and earnings growth. Microsoft received a lukewarm market response to its results last week.

Gold and silver futures ended Monday lower after suffering steep losses late last week. Bitcoin steadied after falling to its lowest level since April during weekend trading.

Over 100 S&P 500 companies are scheduled to report earnings this week. Data releases including Friday’s monthly jobs report face postponement after the U.S. government entered another partial shutdown.

The post Daily Market Update: Bitcoin Rebounds to $79,000 as Stocks Continue February Rally appeared first on CoinCentral.

You May Also Like

‘Huge’ investor demand for apartment buildings

Trump has 'collapsed' with 'core voters' on 3 key issues