Saylor Signals Another Bitcoin Buy—Orange Dots Strike Again

On Sunday morning, Michael Saylor—the co-founder and executive chairman of Strategy (formerly Microstrategy)—teased another potential bitcoin ( BTC) buy by posting a fresh chart from the Strategy portfolio tracker.

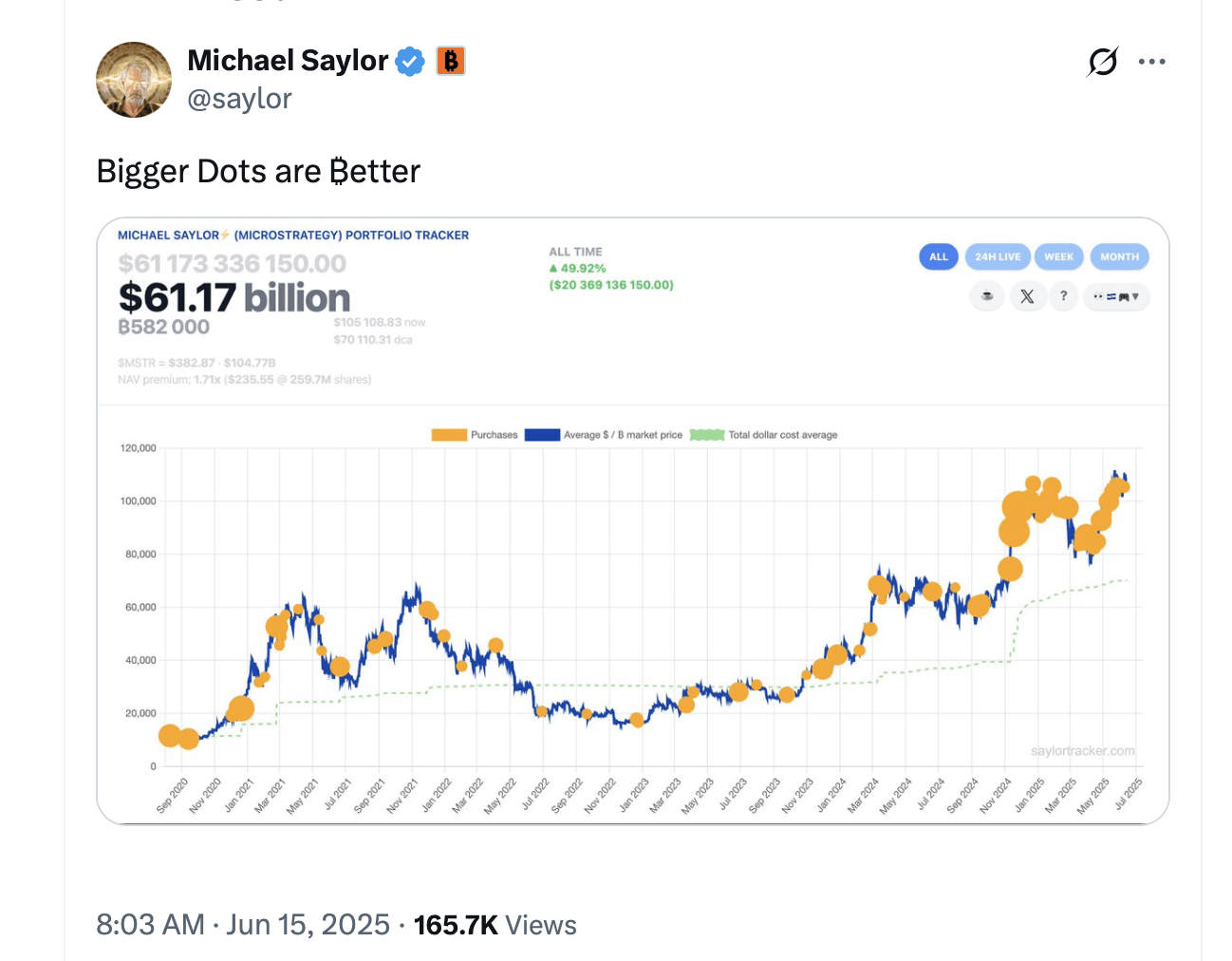

“Bigger Dots are Better,” Saylor declared on X on Sunday morning. He’s become known for this Sunday ritual, where he shares a snapshot of Strategy’s bitcoin stash on X (formerly Twitter), often plucked from saylortracker.com. These posts usually come with playful or cryptic one-liners like “Send more orange” or “needs more orange”—a wink to bitcoin’s signature color in crypto circles.

Saylor’s X post on Sunday, June 15, 2025.

Saylor’s X post on Sunday, June 15, 2025.

Every new orange dot on the chart signals a fresh BTC addition, and true to form, Strategy typically announces the buys the following Monday morning. As of 9 a.m. Sunday, June 15, 2025, Strategy’s bitcoin count sits at 582,000 BTC, carrying a value of $61.17 billion.

You May Also Like

How to Pair Pearl Necklaces with Your Bridal Neckline

Shell (SHEL) Stock; Falls Modestly on U.S.-Iran Thaw and Lower Crude Prices

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more