Positive News, But Crypto Markets Show Limited Reaction

US President Donald Trump enacted a substantial $2 trillion funding measure, effectively concluding a short and temporary four-day federal government shutdown, unlike the record-longest one late last year.

The funding impasse commenced over the weekend as legislators were unable to finalize a consensus on crucial budgetary provisions.

With political uncertainty diminished, the cryptocurrency market, and Bitcoin specifically, should have shown a favorable response to the decision.

Instead, after a brief run-up, cryptos slipped broadly.

The Consolidated Appropriations Act of 2026 was signed into law by President Trump on February 3, 2026. The bill narrowly passed the House of Representatives by a vote of 217 to 215. With the eleven major yearly spending bills passed, the government will continue to operate and pay programs until the end of the fiscal year.

However, there are still some matters that remain unresolved. The budget proposal for the Department of Homeland Security remains in discussion, as Democrats advocate for stricter constraints on enforcement measures.

The legislation revealed rifts within the Republican Party, with certain members expressing dissent regarding aspects of the financial proposal.

House Democratic Leader Hakeem Jeffries stated that the party will not back any further temporary funding for Homeland Security unless significant modifications are implemented.

This poses a potential threat of an impending partial government shutdown in the near future.

The legislation lacks specific regulations for digital currencies; however, it significantly influences the cryptocurrency market in various critical aspects.

Following the signing of the bill, Bitcoin experienced a slight rebound, moving from $75,600 to $77,310.

Crypto approvals and ETF negotiations were slowed significantly during the four-day shutdown since regulators like the SEC and CFTC were not fully active during that time.

We can look forward to the regularly scheduled publication of key economic data like the January employment report and weekly jobless claims now that the government is back in action.

The Federal Reserve's policies are heavily influenced by the insights from these publications, which in turn have a considerable impact on cryptocurrency market values.

Crypto Short By the American 'Big Short'

Michael Burry, a pivotal part in the American movie on the 2008 financial crisis called "The Big Short," has predicted that the Bitcoin market's current downturn would trigger a $1 billion panic selling of precious metals.

Burry said, "It looks like up to $1 billion in precious metals were liquidated at the month’s very end as a result of falling crypto prices."

He made the argument that Bitcoin is being presented as an asset that is only good for speculation in a recent article on Substack. In addition, Burry's "scenarios" are currently playing out as a result of the interplay between cryptocurrency and precious metals.

Burry cautioned that the current downturn in Bitcoin could lead to substantial losses, particularly for firms with considerable BTC holdings. He stated that Bitcoin has not succeeded as a reliable refuge like gold and may drive bold corporate investors towards bankruptcy.

The larger fall in the cryptocurrency market is reflected in Bitcoin's drop of 3.17% in the previous 24 hours, which adds to a total weekly decrease of 14.44%.

On Wednesday, everyone will be talking about the cryptocurrency with the largest market valuation. When Bitcoin hit a low of $72.8K, Michael Burry's predictions were spot on.

However, well-publicized pessimism can speed the flight of capital from risky investments.

Buyers may be hesitant to take advantage of the current price drops after Bitcoin's 17.74% monthly decrease intensified their apprehension.

Burry Marks Down Bitcoin Treasury Firms

The biggest corporate Bitcoin treasury, Michael Saylor's Strategy, which held 713,502 Bitcoin as of Monday, would suffer losses in the millions of dollars, according to Burry, if Bitcoin were to fall another 10%.

If Bitcoin's price drops to $60,000, Burry believes Strategy faces an "existential crisis." As a result, the digital asset treasury company would "find capital markets essentially closed."

Burry anticipated that those overseeing risk would become "more aggressive" should other Bitcoin holders experience a decline of 15% to 20% in their investments.

According to Cryptonews earlier this week, Strategy has proven unprofitable as a result of Bitcoin's collapse, leading to an unrealized loss of more than $900 million.

The company nonetheless managed to snag an additional 855 BTC on Monday, despite the fact that the coin fell below $75K.

According to Burry, Bitcoin is unlikely to halt or reverse its downward trend, as it lacks a fundamental use case.

The cryptocurrency has remained unaffected by various factors, including geopolitical concerns, in contrast to silver or gold. The backing for Bitcoin's price from treasury corporations or spot crypto ETFs is currently insufficient.

According to Burry, almost 200 publicly traded companies possess Bitcoin. “Treasury assets are not a permanent fixture.”

“Bitcoin ETFs have experienced significant single-day outflows recently, with three notable occurrences in the last 10 days of January,” the 'Big Short' investor noted.

He cautioned that if the cryptocurrency's value continues to decline, risk management professionals will begin recommending the liquidation of their Bitcoin holdings.

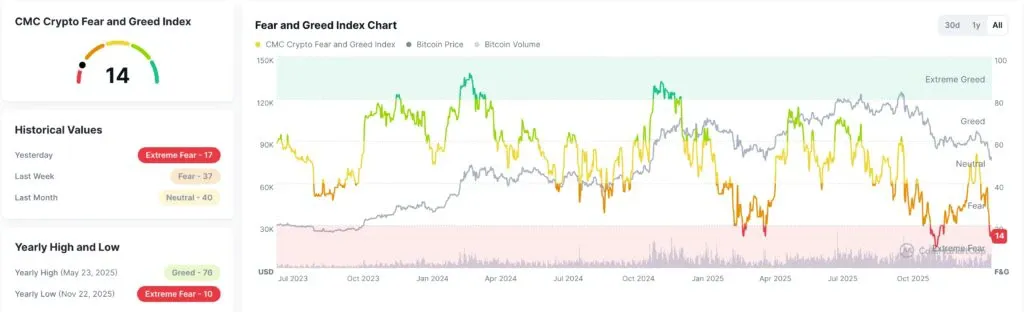

Crypto Fear & Greed Index Shows Signs of Life

The value of Bitcoin fell to its lowest point in fifteen months this week, marking a major decline in the cryptocurrency market. Solana, Hyperliquid, Canton, and Zcash, among other well-known alternative cryptocurrencies, also suffered steep drops.

The catastrophic loss of around $500 billion in value has been caused by this week's decline in the cryptocurrency market.

In preparation for this week's talks in Turkey, geopolitical tensions between the United States and Iran have recently diminished. The conditions Trump has placed on his talks with Iran make a successful outcome quite improbable.

He is hoping that Iran will finally make good on its long-standing pledge to end its nuclear weapons development. This is noteworthy since in June of last year, Trump said that he had entirely terminated the program.

Crude oil prices and market volatility are anticipated to rise in the event of a Middle East crisis escalation.

As a result of losing their status as safe havens, Bitcoin and the cryptocurrency market would also see a decline. In reaction to new global dangers, Bitcoin often undergoes steep drops.

Take October 10th, for example, when Trump warned of tariffs on China and the Bitcoin market crashed. Additionally, it fell in April of last year, when Trump first implemented his reciprocal tariffs.

A positive development, which might be a turning point for the Bitcoin market if the US decides to strike Iran, is seen in the significant decline in the Crypto Fear and Greed Index, which has plummeted to 12 levels.

Source: CMC

Source: CMC

When the index falls into a state of extreme fear, it's common to see a rebound in cryptocurrency prices.

For example, after a decline to 10, the Fear and Greed Index ignited the crypto bull market that propelled Bitcoin over the $100,000 mark.

The fact that the bitcoin market is getting close to the oversold level of 30 is another potential factor.

This can mean that the unstable era is coming to an end.

Burry vs. Tiger

The main question in the crypto markets is whether a big slump is about to happen, given that Bitcoin has fallen 40% from its October highs and altcoins have fallen 20-40% since the January FOMC meeting.

On Tuesday, Bitcoin briefly fell to $73,000, reflecting a 40% drop from its peak of over $126,000 in October.

Burry contended that the cryptocurrency has not fulfilled its promise as a digital refuge and substitute for gold, characterizing the recent ETF-induced increases as speculative rather than indicative of enduring acceptance.

Despite the negative signals, Tiger Research asserts that this decline is fundamentally distinct from earlier cryptocurrency downturns.

Previous internal industry missteps have led to diminished trust and a departure of skilled professionals, evidenced by incidents such as the 2014 Mt. Gox hack, the 2018 ICO downturn, and the 2022 Terra-FTX failure.

The report said, "We didn’t create the spring, so there is no winter either."

Importantly, after regulation, the market has developed into three separate tiers: a regulated sphere with minimal volatility, a speculative sphere with high-risk endeavors, and a shared infrastructure with stablecoins that serves both spheres.

The domino effect that boosted all tokens at the same time as Bitcoin's rise has diminished. Rather than spreading into other cryptocurrencies, capital in ETFs is still concentrated on Bitcoin.

Tiger Research added, "A crypto season where everything rises together is unlikely to come again. The next bull run will come. But it will not come for everyone.”

Two critical elements must align for that bull run to materialize: a strong use case stemming from the unregulated area, and a good macroeconomic background.

The market is in a one-of-a-kind state until then, being in a distinct phase that is neither a downturn nor an upswing.

Blockcast – Licensed to Shill: What's in Store for 2026 – Stablecoins, the Future of DeFi.. and a Return of NFTs?

Licensed to Shill opens 2026 with a forward-looking conversation on the forces shaping the next phase of digital assets. Real-world assets, prediction markets, NFTs beyond the hype cycle, and the role of SMEs in pushing practical adoption all feature as the panel weighs what’s likely to matter – and what’s likely to fade – in 2026.

Thanks for tuning in! If you enjoyed this episode, please like and subscribe to Blockcast on your favorite podcast platforms like Spotify and Apple.

Be at the heart of TradFi–DeFi collaboration at Money20/20 Asia 2026.

Are you looking to forge partnerships with banks and fintechs? To expand into new markets across Asia, or to secure funding from top-tier investors? This April, the world of digital assets, blockchain, and Web3 converges with the biggest players in APAC’s financial ecosystem at Money20/20 Asia 2026 and its brand new ‘Intersection’ zone, complete with a dedicated content stage, TradFi-Defi innovator showcase, and curated networking spaces. From traditional banking giants to decentralised innovators, private equity leaders, and cutting-edge fintech disruptors, this is where they meet to forge partnerships, spark dialogue, and shape the future of finance.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse