Best Memecoins to Purchase Today, February 4 – Dogecoin, MemeCore, Shiba Inu

Highlights:

- Dogecoin’s demand zone has historically sparked major rallies, with targets up to $4.00 if it holds above $0.06.

- MemeCore shows potential for a breakout if it breaks above $1.57, after holding steady in a tight range.

- Shiba Inu is testing key support at $0.0000067, and a bounce could trigger massive gains up to 518%.

The crypto market is under pressure as selling pressure intensifies despite yesterday’s modest rebound. The total crypto market cap has declined by 2.20% to $2.57 trillion. The 24-hour trading volume has, however, surged by 20% to $165 billion, indicating increased market activity.

The memecoin sector mirrors the same trend as its market cap slides to $34 billion. Most of the tokens are trading in red, demonstrating the bearish sentiment in the market. Despite these uncertain market conditions, let’s discuss the best memecoins to purchase today, such as Dogecoin, MemeCore, and Shiba Inu.

Best Memecoins to Purchase Today

1. Dogecoin (DOGE)

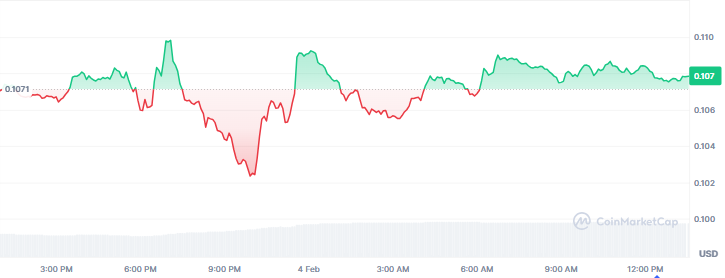

Dogecoin is trading around $0.1070 with a surge of 0.70% over the last 24 hours. The memecoin has declined by 14% and 27% on the weekly and monthly charts, respectively. Despite the continuous downtrend, its trading volume has exploded by 45% to $1.95 billion.

Source: CoinMarketCap

Source: CoinMarketCap

According to Crypto Patel, Dogecoin is in a significant demand zone. The DOGE price is trading between $0.10 and $0.06, a crucial zone that has historically led to massive rallies. DOGE surged by 17,000% in 2021, and the current stage can be viewed as a re-accumulation stage before another possible growth.

The chart shows a multi-year support zone, which has proven reliable since 2021 and has a good history of price explosions following traversal of this zone. DOGE targets are $0.50, $1.50, and $4.00, representing a possible 5500% expansion of the cycle. However, should DOGE close below 0.06, this pattern may be nullified. In addition, the upcoming SpaceX flight, which was confirmed by Elon Musk, might be a crucial initial trigger for the future of DOGE, making it one of the best memecoins to purchase today.

2. MemeCore (M)

Memecore displays a bearish outlook today following the broader market downturn. M price has dropped by 2.75% on the daily chart to trade at $1.46. Its trading volume and market capitalization stand at around $1.85 billion and $13 million, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

Memecore has been standing in a tight range between $1.19 and $1.95 since December. The $1.19 level has, however, proved to be a key support as the price bounced off several times. Currently, the price is trading below the immediate support around the $1.57 region. A break above this point could see the memecoin form a new rally to challenge the key resistance around $1.95.

Source: TradingView

Source: TradingView

Indicators such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) suggest that MemeCore could rally soon. The MACD line is on the verge of making a crossover above the signal line, indicating a shift from the current dynamics. Meanwhile, the RSI is hovering around neutral levels at the 46 index.

3. Shiba Inu (SHIB)

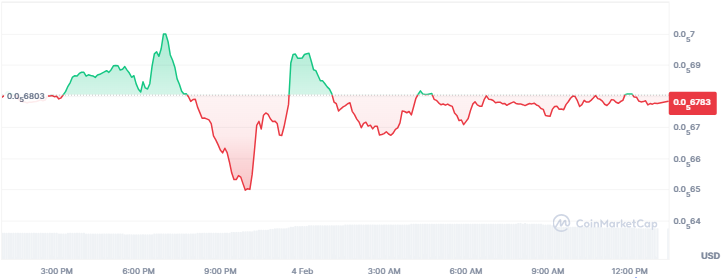

Shiba Inu’s price is consolidating around the $0.000006600 region as bearish momentum holds tight. SHIB has recorded declines of 13% and 20% on the weekly and monthly charts, respectively. As of this writing, the price is resting around $0.000006783, with a market cap of $4 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Shiba Inu is approaching a key support area, with bullish projections. Market analyst KlejdiCuni suggests that SHIB is experiencing long-term accumulation before a potential major upward movement. This level of support, at around $0.0000067, has historically led to severe rebounds, with SHIB previously rallying by more than 800% since bouncing from this level in 2021.

Source: TradingView

Source: TradingView

The analyst noted that it requires patience because investors could consider this a possible long-term accumulation period prior to the next big crypto market boom. Possible targets at $0.0000170, $0.0000320, and $0.0000420, representing an increase of 150%, 370%, and 518%, respectively. As a result, SHIB might be among the best memecoins to purchase today, provided the support holds.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse