Ethereum Price at a Crossroads Defending $2,000 While Eyeing $2,700 Break

TLDR

- ETH continues to defend the $2,000–$2,100 demand zone despite sustained bearish pressure.

- Descending resistance keeps rallies capped, with $2,400 needed to shift structure.

- Loss of rising support signals a structural reset rather than trend continuation.

- Liquidity clusters near $2,000 make this level critical for short-term direction.

Ethereum (ETH) price remains at a pivotal point as traders assess whether recent downside indicates exhaustion or further weakness. Technical analysts point to firm defense near $2,000–$2,100, while upside recovery depends on reclaiming higher resistance levels. Attention is centered on $2,400 and $2,700 as potential gateways back into a stronger market structure.

Ethereum Price Holds Key Support Below Macro Resistance

According to analyst Ted, the broader structure shows Ethereum price trending lower since rejection near the $3,800–$4,000 resistance zone. Each recovery attempt has been capped by descending resistance, confirming sustained seller control. Red-marked rejection zones highlight how former support continues to act as supply.

SOURCE: X

Most importantly, price has defended the $2,000–$2,100 zone despite heightened volatility. This zone aligns with prior consolidation and heavy trading volume, making it a logical demand zone. The hold suggests long-term participants remain active, limiting immediate downside acceleration.

However, Ted suggested that defense alone does not confirm recovery. Ethereum price must reclaim $2,400 decisively to re-enter the previous value area. Without acceptance above this level, rebounds risk remaining corrective within a broader bearish structure.

Rising Support Breakdown Signals ETH Price Structural Reset

Meanwhile, according to analyst Dami-Defi, Ethereum price lost a rising support trendline that guided late-2025 price action. The sequence of higher lows suggested resilience, but the eventual breakdown confirmed structural weakness. Once support failed, price declined sharply, validating downside risk.

The sell-off extended into the $2,150 demand zone, where historical buying interest is concentrated. Long downside wicks suggest forced liquidation rather than deliberate distribution. Such price behavior often reflects a liquidity-driven flush instead of trend continuation.

The analyst noted that holding $2,150 could lead to a rebuilding phase. This phase may involve range trading between $2,150 and $2,700. A structural bullish shift requires reclaiming $2.7k, followed by sustained acceptance above $2.85k.

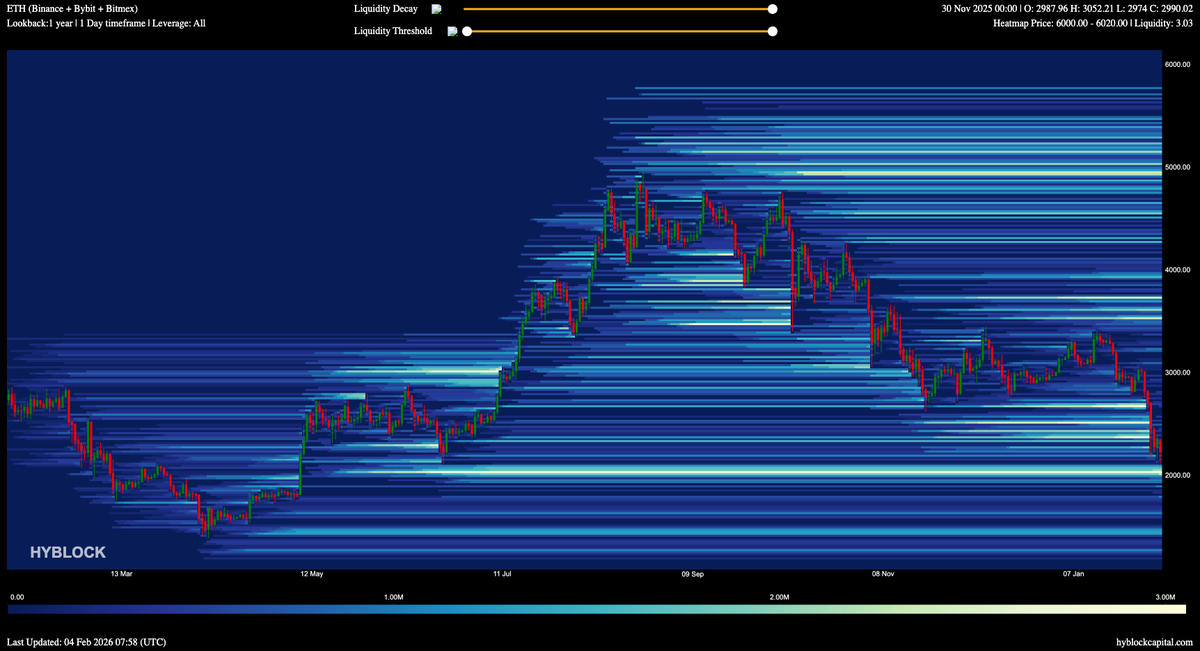

Liquidity Clusters Make $2,000 a Critical Threshold

Furthermore, analyst Ardi’s analysis highlights dense liquidation liquidity clustered near $2,000. One-year data shows substantial long exposure resting just below the current price. This concentration makes the level both a technical support and a major liquidity magnet.

From a market mechanics view, such clusters attract price during volatility. A decisive breakdown below $2,000 could trigger cascading liquidations, accelerating downside momentum. This is why the zone is described as an essential defense level.

Conversely, a successful hold above $2,000 suggests the recent decline was a controlled reset. It keeps shorts cautious and supports base formation. In this context, Ethereum price behavior around this threshold shapes near-term structure and positioning.

The post Ethereum Price at a Crossroads Defending $2,000 While Eyeing $2,700 Break appeared first on CoinCentral.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more