WLFI Token Trades at $0.1315 Following 2% Daily Gain and Higher Volume

- WLFI trades near $0.1315 with a 24-hour gain of 2% and higher trading volume of $141.28 million.

- The token remains well below its all-time high, with price influenced by market activity and company developments.

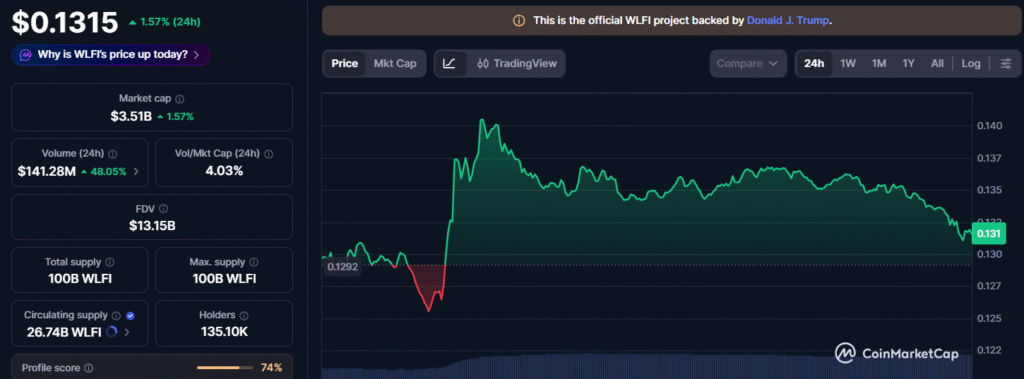

World Liberty Financial’s native token WLFI is trading near $0.1315, according to CoinMarketCap data, which shows a 24-hour gain of approximately 2% and increased trading volume of about $141.28 million. The WLFI market capitalization is reported at around $3.51 billion. Over the past 24 hours, WLFI’s trading range has seen a low near $0.1254 and a high near $0.1408.

(Source: CMC)

(Source: CMC)

The broader crypto market was mixed today, with major assets like Bitcoin and Ethereum showing weakness while WLFI registered a modest uptick, reflecting selective buying interest in the token. WLFI’s price remains well below its all-time high of approximately $0.46 from its September 2025 market debut.

Meanwhile, WLFI’s associated stablecoin USD1 remains near its peg at about $0.9997, with a market cap exceeding $5.1 billion and significant on-chain transaction volume.

WLFI Price Moves Reflect Short-Term Trading Activity Amid Scrutiny Over UAE Stake Sale

World Liberty Financial, a decentralized finance protocol initially launched in 2024, is closely associated with the Trump family and has drawn sustained market and political attention. This week, reports confirmed that the company sold a 49% stake valued at around $500 million to investors linked to the United Arab Emirates, just before President Donald Trump’s second inauguration. The transaction has drawn scrutiny over potential conflicts of interest, though company representatives and administration officials have denied any inappropriate influence on policy.

Overall, WLFI’s price movement reflects a short-term response to increased trading activity rather than a broader shift in market structure. While the token has shown resilience amid mixed conditions across the wider crypto market, it continues to trade well below previous highs, highlighting ongoing caution among investors. Market participants are likely to remain focused on liquidity conditions, volume trends, and further disclosures related to World Liberty Financial’s ownership and operations, as these factors may influence price behavior in the near term.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For