Ethereum May Lose Its Title as the Second Largest Cryptocurrency – Here Are the Possibilities

A prediction market launched on the cryptocurrency prediction platform Polymarket has begun pricing in a remarkable scenario for the year 2026.

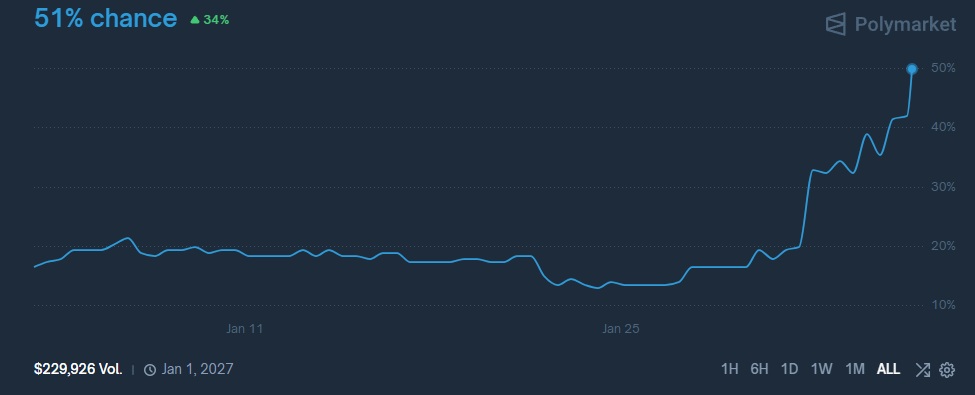

According to data on the platform, the probability of Ethereum losing its second-place position by market capitalization by 2026 has increased to 50%.

A chart on Polymarket showing the probability of ETH being surpassed by another cryptocurrency in market capitalization.

A chart on Polymarket showing the probability of ETH being surpassed by another cryptocurrency in market capitalization.

The market will conclude with a “Yes” if Ethereum is not among the top two cryptocurrencies by market capitalization at any point between January 1, 2026, and December 31, 2026. Otherwise, the market will close with a “No”. CoinGecko will be used as the data source for the final assessment.

Related News: BREAKING: The U.S. House of Representatives Approves Package to End Government Shutdown

According to current market data, Bitcoin maintains its leading position with a market capitalization of approximately $1.47 trillion, while Ethereum ranks second with a market capitalization of approximately $256.9 billion. On the stablecoin side, Tether (USDT) is in third place with a market capitalization of approximately $185 billion. This picture suggests that although Ethereum’s position appears strong in the short term, competition may intensify towards 2026.

The market capitalization of the largest stablecoins, including Tether, is steadily increasing, and demand for stablecoins is expanding worldwide. The possibility of ETH becoming the third-largest cryptocurrency might come not from the rise of another altcoin, but rather from the market capitalization increase experienced by Tether, the largest stablecoin.

The closest non-stablecoin altcoin to ETH is BNB, with a market capitalization of $99 billion.

*This is not investment advice.

Continue Reading: Ethereum May Lose Its Title as the Second Largest Cryptocurrency – Here Are the Possibilities

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator