Lido lays off 15% of its staff, marking a turning point for the Ethereum staking ecosystem.

Author: TechFlow

On August 4, Vasiliy Shapovalov, co-founder of the decentralized staking platform Lido, announced that he would lay off 15% of his employees.

At a time when almost everyone believes that an institutionally driven ETH bull market is imminent, and the SEC has shown signs of approving the ETH spot ETF pledge application, this news clearly goes against everyone's expectations.

As one of the leading projects in the ETH staking sector, Lido may be considered by most people to be the biggest beneficiary of the news of the SEC approving the ETH staking ETF, but is this really the case?

Lido’s layoffs are not just a simple organizational adjustment, but more like a microcosm of the turning point facing the entire decentralized staking track.

The official explanation is "for long-term sustainability and cost control," but what lies behind this is a deeper industry change:

As ETH continues to flow from retail investors to institutions, the living space of decentralized staking platforms is being continuously compressed.

Let's rewind to 2020, when Lido launched and ETH2.0 staking had just begun. The 32 ETH threshold for staking was prohibitive for most retail investors. However, Lido's innovative liquid staking token (stETH) allowed anyone to participate in staking and maintain liquidity. This simple yet elegant solution enabled Lido to grow into a staking giant with over $32 billion in TVL in just a few years.

However, changes in the crypto market over the past two years have shattered Lido's growth story. With traditional financial giants like BlackRock beginning to invest in ETH staking, institutional investors are reshaping the market with familiar methods. Several key players in this institutional-driven ETH bull run have each offered their own solutions: BMNR chose Anchorage, SBET chose Coinbase Custody, and ETFs like BlackRock all adopted offline staking.

Without exception, they prefer centralized staking solutions over decentralized platforms. This choice is driven by compliance considerations and risk appetite, but ultimately points to one thing: the growth engine of decentralized staking platforms is stalling.

Institutions go left, decentralized staking goes right

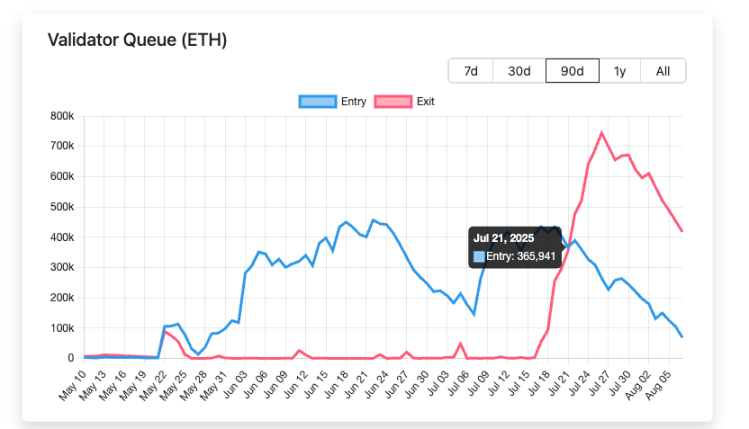

To understand the selection logic of institutions, we need to first look at a set of data: starting from July 21, 2025, the number of ETH waiting to be unstaked began to be significantly higher than the number entering staking, with the maximum difference reaching 500,000 ETH.

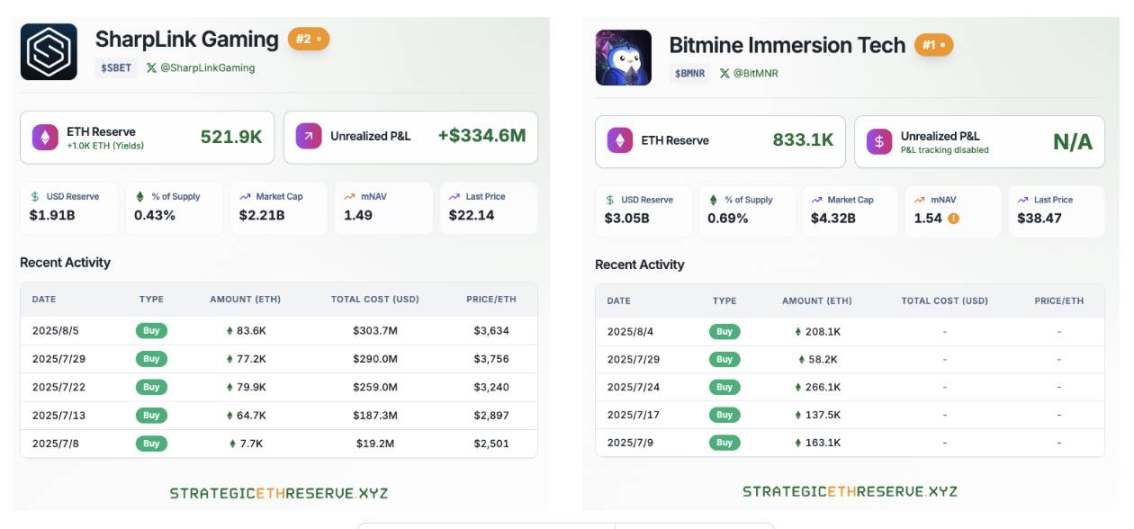

At the same time, ETH strategic reserve companies led by BitMine and SharpLink are continuing to purchase ETH in large quantities. Currently, the total number of ETH held by these two companies alone exceeds 1.35 million ETH.

Wall Street institutions such as BlackRock have also continued to purchase ETH after the SEC approved the ETH spot ETF.

Based on the above data, it's clear that ETH is steadily flowing from retail investors to institutional investors. This dramatic shift in holdings is redefining the rules of the game for the entire staking market.

For institutions managing billions of dollars in assets, compliance is always a top priority. When reviewing BlackRock's application for an ETH-collateralized ETF, the SEC explicitly required applicants to demonstrate the compliance, transparency, and auditability of their collateralization service providers.

This hits a crucial weakness in decentralized staking platforms. Node operators for decentralized staking platforms like Lido are distributed globally. While this decentralized structure enhances the network's censorship resistance, it also complicates compliance reviews. Imagine how decentralized protocols would respond if regulators demanded KYC information for every validating node.

In contrast, centralized solutions like Coinbase Custody are much simpler. They have a clear legal entity, robust compliance processes, traceable fund flows, and even insurance coverage. For institutional investors who need to answer to limited partners, the choice is obvious.

When evaluating a pledge plan, the institution's risk control department will focus on a core issue: Who is responsible if something goes wrong?

In Lido’s model, losses caused by node operator errors are shared by all stETH holders, and the specific person responsible may be difficult to track. However, in centralized staking, service providers will assume clear compensation responsibilities and even provide additional insurance protection.

More importantly, institutions require not only technical security but also operational stability. When Lido replaced its node operator through a DAO vote, this "people's vote" became a source of uncertainty for institutions. They prefer a predictable and controllable partner.

Regulatory relaxation, but not entirely beneficial

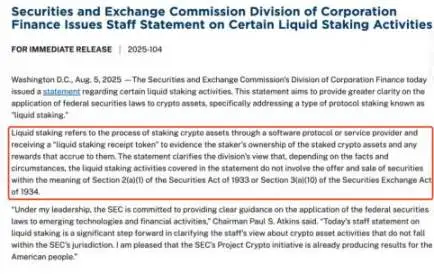

On July 30, the SEC announced it had received an application from BlackRock for an ETH-collateralized ETF. On August 5, the SEC issued updated guidance: Certain types of liquidity pledges are not subject to securities law.

It seems that everything is moving in a positive direction. On the surface, this is the good news that decentralized staking platforms have been waiting for a long time. However, after in-depth analysis, it can be found that this may also be the sword of Damocles hanging over the heads of all decentralized staking platforms.

The short-term benefits of regulatory relaxation are clear. Tokens on major decentralized staking platforms, such as Lido and ETHFI, saw prices surge by over 3% immediately following the announcement. As of August 7th, the liquidity staking token PRL saw a 19.2% increase, while SWELL saw an 18.5% increase. This price increase, to some extent, reflects the market's optimistic outlook for the LSD sector. More importantly, the SEC's announcement clears compliance hurdles for institutional investors.

Traditional financial institutions have long worried about potential securities law violations when participating in staking. Now, that concern has largely dispelled, and it seems only a matter of time before the SEC approves an ETH-collateralized ETF.

However, behind this thriving scene lies a deeper track crisis.

The SEC's regulatory relaxation not only opens the door for decentralized platforms but also paves the way for traditional financial giants. When asset management giants like BlackRock begin to launch their own collateralized ETF products, decentralized platforms will face unprecedented competitive pressure.

The asymmetry of this competition lies in the gap in resources and channels. Traditional financial institutions have mature sales networks, brand trust, and compliance experience, which are difficult for decentralized platforms to match in the short term.

More importantly, the standardization and convenience of ETF products are naturally attractive to ordinary investors. When investors can purchase staked ETFs with one click through their familiar brokerage accounts, why bother learning how to use decentralized protocols?

The core value propositions of decentralized staking platforms—decentralization and censorship resistance—pale in the face of institutionalization. For institutional investors seeking maximum returns, decentralization is more of a cost than a benefit. They prioritize yield, liquidity, and operational convenience, precisely the strengths of centralized solutions.

In the long term, loosening regulations may accelerate the "Matthew Effect" in the staking market. Funds will increasingly concentrate on a few large platforms, while small decentralized projects will face a survival crisis.

A deeper threat lies in the disruption of business models. Traditional financial institutions can lower fees through cross-selling and economies of scale, or even offer zero-fee staking services. Decentralized platforms, however, rely on protocol fees to maintain operations, putting them at a natural disadvantage in price wars. How will decentralized platforms with a single business model respond when competitors can subsidize staking services through other business lines?

Therefore, although the SEC's regulatory relaxation has brought market expansion opportunities for decentralized staking platforms in the short term, in the long run, it is more like opening Pandora's box.

The entry of traditional financial forces will completely change the rules of the game, and decentralized platforms must find new ways to survive before being marginalized. This may mean more radical innovation, deeper DeFi integration, or - ironically - some degree of centralized compromise.

At this moment of regulatory spring, decentralized staking platforms may not be facing a moment of celebration, but a turning point of life and death.

The dangers and opportunities of Ethereum’s staking ecosystem

Standing at the critical juncture of 2025, the Ethereum staking ecosystem is undergoing unprecedented transformation. Vitalik’s concerns, regulatory shifts, and the entry of institutions—these seemingly contradictory forces are reshaping the entire industry landscape.

Admittedly, challenges are real. The shadow of centralization, intensified competition, and the impact of business models could each be the final straw that breaks the camel's back for the ideal of decentralization. But history tells us that true innovation is often born in times of crisis.

For decentralized staking platforms, the wave of institutionalization presents both a threat and a driving force for innovation. When traditional financial giants introduce standardized products, decentralized platforms can focus on deep integration into the DeFi ecosystem. When price wars become inevitable, differentiated services and community governance will become new moats. When regulation opens the door to everyone, the importance of technological innovation and user experience will become even more prominent.

More importantly, the expansion of the market means the pie is getting bigger. When staking becomes a mainstream investment option, even niche markets will be large enough to support the prosperity of multiple platforms. Decentralization and centralization don't have to be a zero-sum game; they can serve different user groups and meet different needs.

The future of Ethereum will not be determined by a single force, but will be shaped by all participants together.

The tide ebbs and flows, and only the fittest survive. In the crypto industry, the definition of "fittest" is far more diverse than in traditional markets, which may be a reason for optimism.

You May Also Like

Transocean stock is even more attractive following the Valaris deal

New Crypto Investors Are Backing Layer Brett Over Dogecoin After Topping The Meme Coin Charts This Month