Ethereum Foundation Backs Tornado Cash Developer with $500K Legal Defense Fund

The Ethereum Foundation has once again thrown its support behind Tornado Cash developer Roman Storm, pledging $500,000 in donations to fund the privacy-protocol developer’s legal defense.

This announcement comes just days after the Tornado Cash co-founder was convicted on one of three federal charges that legal experts warn could set a dangerous precedent for criminalizing open-source development.

In an August 7 announcement, Hsiao-Wei Wang, co-executive director of the Ethereum Foundation, disclosed details of the donation and called upon the broader crypto community to contribute to the Tornado Cash developer’s legal defense fund.

Ethereum Foundation Support Ambitious $7M donation goal as Storm Faces 5-Year Prison

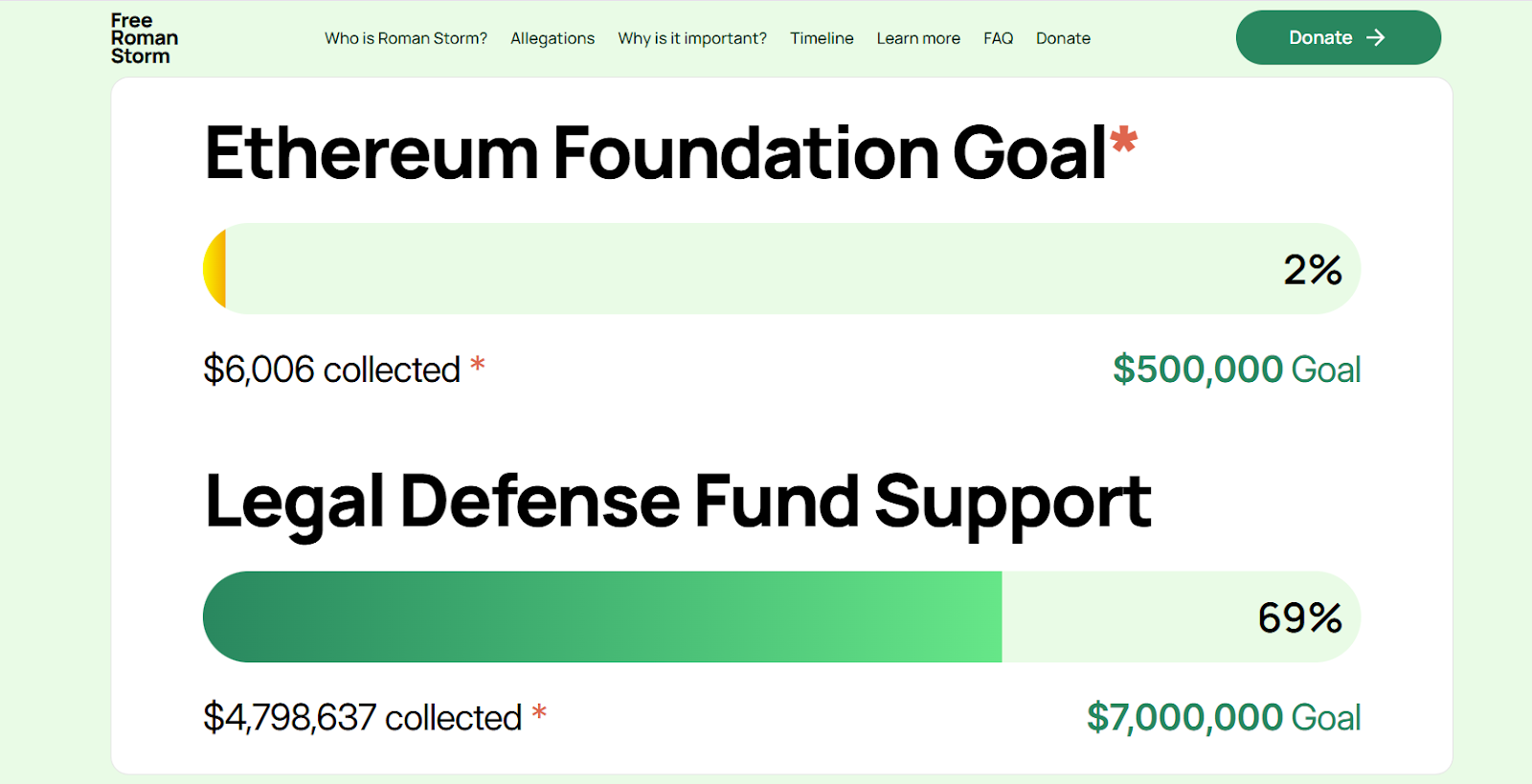

According to the “freeromanstorm” donation tracker, the Ethereum Foundation has contributed only 2% of the $500,000 target, while total legal fund support received by the Tornado Cash developer currently exceeds $4.7 million, still 31% short of the ambitious $7 million goal.

Source: Free Roman Storm

Source: Free Roman Storm

Supporting Roman Storm’s cause, Wang emphasized that “Privacy is normal, and writing code is not a crime.”

Storm himself has been actively soliciting public contributions to his legal defense fund.

A July 26 X post from the Tornado Cash developer urgently stated: “We’re running out of time — legal costs are piling up fast, and we urgently need your help.”

The current legal urgency and plea for donations comes as a Manhattan jury on August 6 found Storm guilty of conspiring to operate an unlicensed money transmitter.

However, jurors remained deadlocked on separate conspiracy charges for money laundering and sanctions evasion after four days of deliberation.

Under 18 U.S. Code Section 1960, Storm was convicted of operating an unlicensed money transmitting business, which stipulates that anyone who “knowingly conducts, controls, manages, supervises, directs, or owns all or part of an unlicensed money transmitting business, shall be fined under this title or imprisoned not more than 5 years, or both.”

The Free Pertsev & Storm legal aid organization highlighted the urgency of continued funding, confirming that Storm “risks up to 5 years of jail time if he doesn’t win the appeal, and potentially decades if the government decides to retry Counts 1 & 3.”

Counts 1 and 3, which remain in legal deadlock, include charges of conspiracy to commit money laundering and conspiracy to violate U.S. sanctions, respectively.

The organization noted that this case’s outcome “will set a major precedent for developers worldwide.”

“Sad Day for DeFi”: Crypto Lawyers And Community Rally Support for Tornado Cash Developers

The crypto community has widely criticized the unfairness of Storm’s case.

On August 6, crypto lawyer Jake Chervinsky called the recent verdict “a sad day for DeFi,” arguing that “the government should never have brought this case.”

He contended that Section 1960 should not apply to developers of non-custodial protocols who lack control over user funds.

Chervinsky urged the case to proceed on appeal, expressing hope that “the Second Circuit will correct this (and many other) errors.”

Storm’s legal difficulties stem from his role in developing Tornado Cash, a cryptocurrency mixer that enables users to obscure transaction histories by pooling funds with other users.

The U.S. Treasury Department sanctioned the protocol in August 2022, alleging that $7 billion had been laundered through the platform since 2019, including frequent use by North Korea’s Lazarus Group hackers.

Federal prosecutors characterized Storm as someone who profited from “hiding dirty money for criminals.” At the same time, his defense team argued that Tornado Cash was designed as a privacy tool for legitimate users, not specifically for illicit activities.

Storm was indicted on these charges and sanctions violations alongside Tornado Cash co-founder Roman Semenov and Alexey Pertsev, another developer associated with the cryptocurrency-mixing platform.

Tornado Cash users, developers, and crypto executives continue challenging the Treasury’s sanctions in court, arguing that the platform’s immutable smart contracts should not be subject to OFAC restrictions.

On March 24, Coinbase’s Chief Legal Officer, Paul Grewal, demanded a final court judgment in the Tornado Case, despite the U.S. Department of the Treasury’s decision to delist the crypto mixer.

You May Also Like

Transocean stock is even more attractive following the Valaris deal

New Crypto Investors Are Backing Layer Brett Over Dogecoin After Topping The Meme Coin Charts This Month