Bitcoin’s Dark Day: It Fell Below $63,000 – Why Is It Falling? Here Are the Underlying Factors and Details

Bitcoin fell below $63,000, its lowest level since October 2024, erasing all gains made during the rally that began after US President Donald Trump’s election victory.

Bitcoin plummeted by as much as 14% during the day, falling to $62,267, its lowest level in four months. The sharp decline in the largest cryptocurrency, which has lost approximately half its value since its peak, spread to other digital assets, cryptocurrency ETFs, and companies holding large amounts of Bitcoin on their balance sheets.

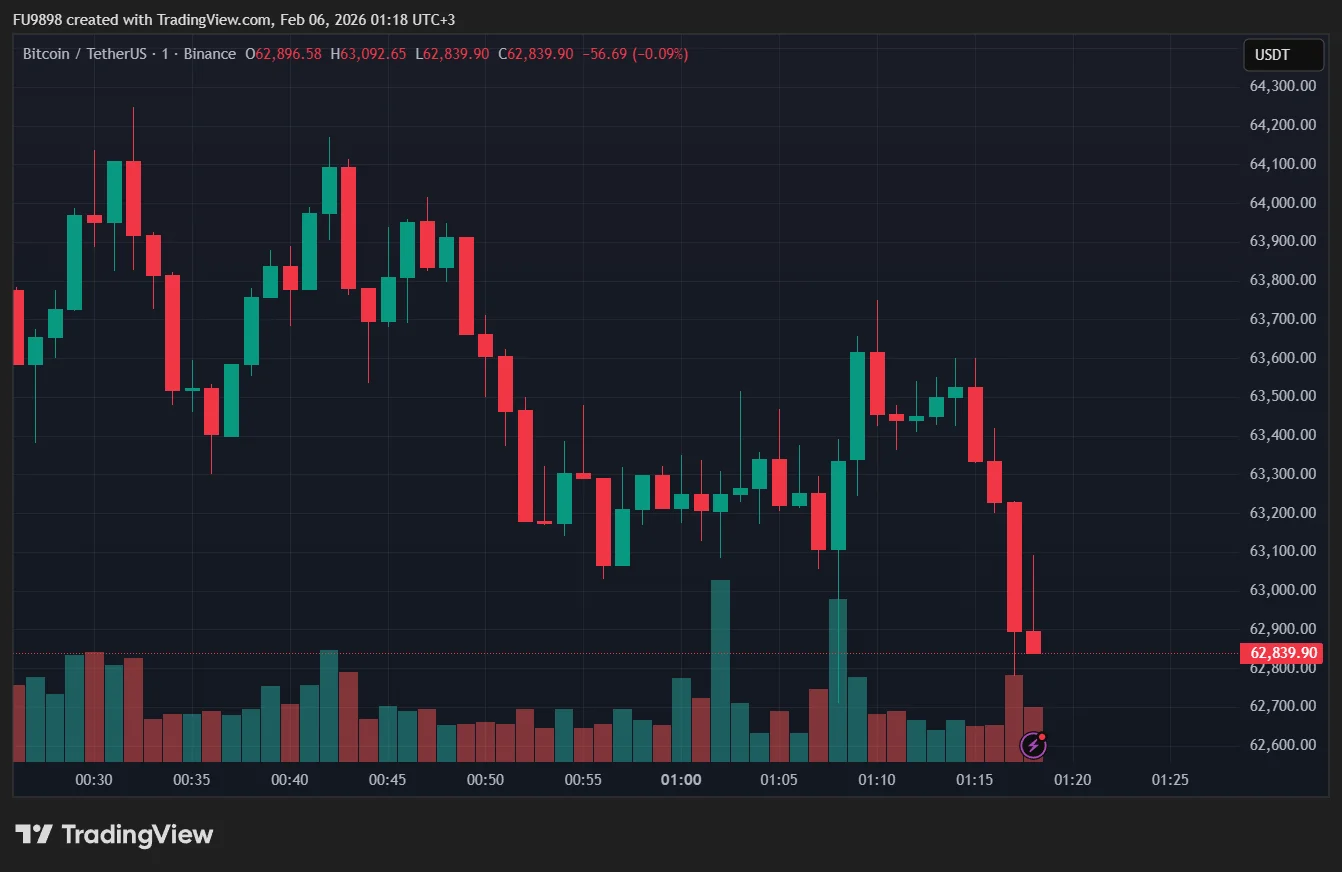

A chart showing minute candles illustrating the decline in BTC price.

A chart showing minute candles illustrating the decline in BTC price.

For much of last year, the expectation that Trump’s return to the White House would lead to a strengthening of crypto-friendly policies drove investors towards digital assets, with Bitcoin reaching its all-time high. However, this month, increased geopolitical tensions and decreased risk appetite in global markets have intensified selling pressure. The decline, which accelerated from mid-January, turned into a self-reinforcing spiral as leveraged positions were liquidated and funds sold assets to meet buyback demands.

Chris Newhouse, Head of Business Development at Ergonia, stated that fear and uncertainty are evident in the market, and the lack of strong buyers is further deepening the decline with each ETF exit and liquidation wave. According to Newhouse, this leads to increased losses at each stage of the sell-off and causes investors to take defensive positions.

The current situation is reminiscent of the sharp pullback experienced in 2022 during the US Federal Reserve’s tightening monetary policy. At that time, the cryptocurrency market saw significant losses in value as the post-pandemic “abundant money” period came to an end.

This time, the crypto market is also competing with alternative speculation avenues such as the proliferation of prediction markets. At the same time, the shift of individual investors towards zero-day options on stocks and high-yield crypto products on decentralized exchanges is limiting interest in digital assets.

Related News: BREAKING: Spot ETF Application Submitted for Surprise Altcoin on a Red Day

While Bitcoin has long been touted as a hedge against inflation or an alternative store of value to gold and the US dollar, it has recently been behaving more like a high-risk asset. Particularly during periods of increased volatility in technology stocks and precious metals, its presence in institutional portfolios makes it more vulnerable to widespread waves of “risk aversion.”

Ryan Rasmussen, research director at Bitwise Asset Management, stated that cryptocurrency bear markets typically end in a period of complacency rather than despair, adding that the current process is in the “desperation phase” and the momentum is shifting towards selling.

The billions of dollars in funds flowing into US spot Bitcoin ETFs throughout 2025 had been a significant support factor for prices. However, it is reported that there has been an outflow of approximately $2 billion in the last month and over $5 billion in the last three months. This reversal in the ETF market is among the factors increasing selling pressure.

Marex senior global markets strategist Ilan Solot said the sell-off was triggered by a combination of factors, including weakness in technology stocks, strong performance in gold, a general risk-aversion trend, and question marks surrounding the valuation framework for crypto assets. Solot added that the short-term outlook is still bearish, but historically, such sharp declines have been seen as buying opportunities for long-term investors.

*This is not investment advice.

Continue Reading: Bitcoin’s Dark Day: It Fell Below $63,000 – Why Is It Falling? Here Are the Underlying Factors and Details

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

PBOC sets USD/CNY reference rate at 6.9590 vs. 6.9570 previous