Governments Will Try to Buy 1 Million Bitcoin Each Within 3 Years: Pantera CEO

Pantera Capital CEO Dan Morehead told attendees at Ondo’s conference that sovereign competition could become the next big driver of bitcoin demand, predicting what he called a “global arms race” for BTC “within the next two or three years” as countries rethink reserve strategy in a more fractured geopolitical environment.

“I would say my one very out of consensus view is I think there will be a global arms race for Bitcoin within the next two or three years,” Morehead said. “Countries like the United States are establishing strategic Bitcoin reserves. Countries that are aligned with us like the UAE are acquiring cryptocurrencies, Bitcoin.”

He argued the larger shift would come when adversarial blocs decide it’s strategically reckless to warehouse national savings in assets seen as vulnerable to US pressure. “The big one though is… countries that are antagonistic to the United States will realize like China, super crazy to have a thousand years of your life savings stored in an asset that Scott Bessent can’t cancel,” Morehead said. “That is crazy. It’s way smarter to buy Bitcoin.”

Morehead then sketched out the scale he believes could follow. “I think within two or three years there will be an arms race with three or four groups, regions each trying to buy a million bitcoins,” he said. “and you just want to be long before that happens.”

Morehead Stays Structurally Bullish On Bitcoin

After the arms-race thesis, Morehead stepped back to explain why he thinks recent market weakness fits a familiar pattern rather than a broken narrative. He admitted 2025 surprised him given what he described as a more favorable policy backdrop. “If you had asked me on New Year’s Day 2025… you would have said crypto up or down I would have said up and it was down 9% last year,” he said.

His takeaway: crypto still trades in hype cycles, and the psychology repeats. “This is actually our fourth cycle in 13 years of trading,” he said, describing the swing from “we all think we’re geniuses” in bull markets to “it’s failed” in down markets. The antidote, he argued, is time horizon: “five ten years down the road” and respect for bitcoin’s four-year rhythm.

Morehead pointed to a past Pantera call as evidence the cycle framework can still map price behavior. The firm projected bitcoin would hit $117,452 on Aug. 11, 2025—“and it did literally that day,” he said. He also acknowledged the usual temptation to declare an exception: “I was like, ‘Oh, no. This time’s different.’” Then he added: “and it wasn’t different.”

On demand, Morehead highlighted two relatively new channels that, in his view, pulled forward large amounts of buying: “publicly listed ETFs and then publicly listed digit[al] treasury companies.” He said investors “piled into them” and that “collectively they bought over a hundred billion of crypto,” before suggesting the market can cool once that first wave is absorbed.

Morehead’s longer-term case centered on monetary debasement and bitcoin’s fixed supply. “The willingness of all constituents just to print money is just off the charts now,” he said. He described steady erosion in fiat purchasing power as a rational catalyst for hard-asset allocation. “Paper money is being debased at 3% every year,” he said, arguing that it makes assets with constrained supply like gold or bitcoin structurally attractive.

He also addressed the gold-versus-bitcoin tug-of-war, saying rotations are normal and pointing to ETF flows as evidence both trades are now institutionalized. “The total inflows to ETFs for both gold… and digital gold, Bitcoin are about the same over the last couple years,” he said. Over a longer horizon, his conviction was explicit: “In 10 years from now, Bitcoin will massively outperform gold.”

On institutions, Morehead argued skepticism at the top remains a bullish signal because positioning is still light. “How can you have a bubble nobody owns?” he said, adding that “the median holding for institutional investors… is literally 0.0.” In his view, the list of reasons to avoid bitcoin has shortened dramatically, even if adoption at the largest firms is lagging.

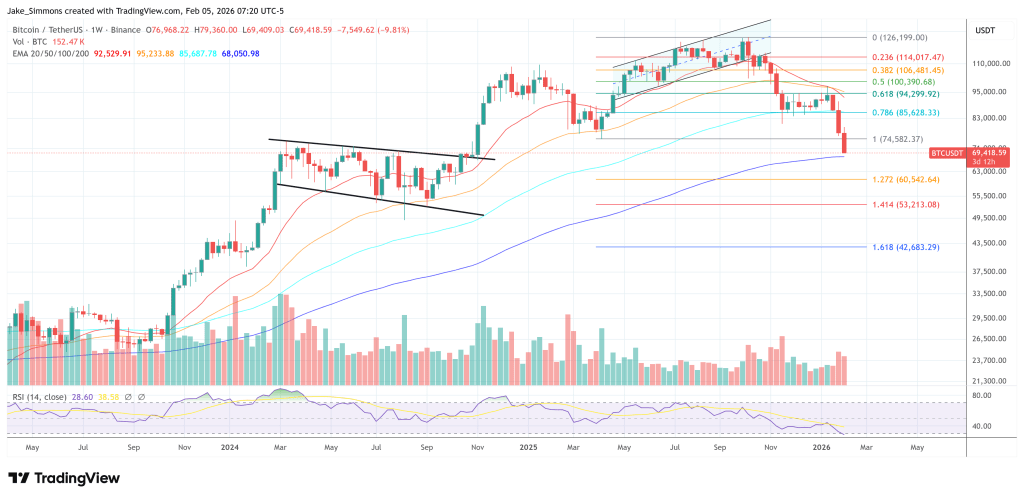

At press time, BTC traded at $69,418.

You May Also Like

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities