ETF Recap: Bitcoin and Ether Funds Rebound With Big Weekly Gains

Bitcoin exchange-traded funds (ETFs) snapped early-week losses to close with a $247 million net inflow, while ether ETFs notched $327 million in gains, with both markets seeing strong institutional participation.

Bitcoin and Ether Post $247 Million and $327 Million Weekly Gains

What began as a bruising start to the week for crypto ETFs turned into a roaring comeback. Investors piled back into both bitcoin and ether funds on Thursday and Friday, erasing earlier outflows and ending the week deep in the green.

Bitcoin ETFs racked up a total $246.75 million in inflow for the week. Blackrock’s IBIT led with $188.92 million, while Bitwise’s BITB added $62.26 million. Grayscale’s Bitcoin Mini Trust brought in $30.58 million, while Vaneck’s HODL added $25.57 million.

Smaller boosts came from Grayscale’s GBTC ($3.40 million) and Franklin’s EZBC ($3.38 million). Fidelity’s FBTC (-$55.18 million), Valkyrie’s BRRR (-$6.44 million), and Ark 21Shares’ ARKB (-$5.76 million) were the only notable laggards.

Source: Sosovalue

Source: Sosovalue

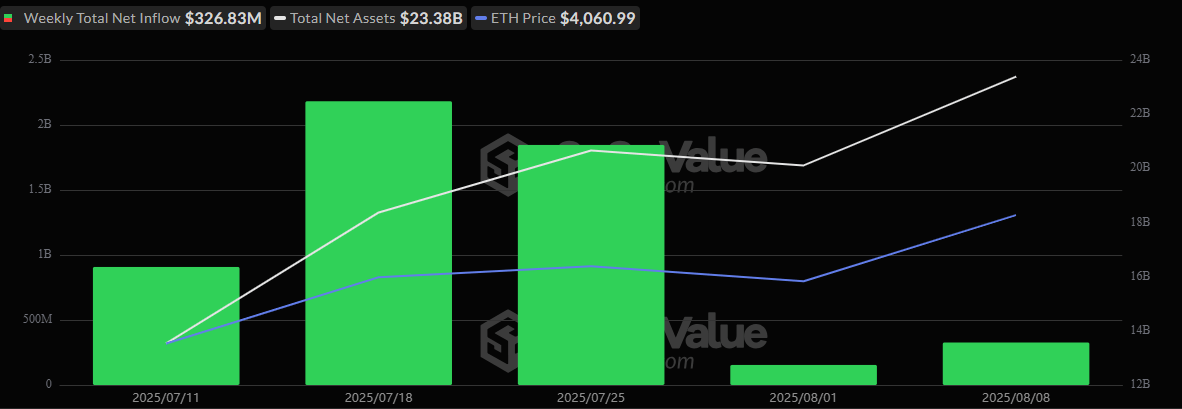

Ether ETFs closed with a $326.83 million net inflow, powered by Blackrock’s ETHA ($105.44 million) and Fidelity’s FETH ($109.05 million). Grayscale’s ETHE (+$28.86 million) and Ether Mini Trust (+$22.74 million) joined the rally.

Bitwise’s ETHW (+$32.63 million) and Vaneck’s ETHV (+$12.27 million) added more fire to the inflows while additional contributions of $5.84 million, $5.08 million, and $3.94 million were seen on Franklin’s EZET, Invesco’s QETH, and 21Shares’ CETH.

Trading volumes remained strong with $3 – $4 billion daily for BTC ETFs and $1 – $2 billion for ETH ETFs, signaling sustained investor appetite. With sentiment shifting sharply midweek, the rebound suggests institutional confidence is alive and well.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Secret Service’s ‘odd’ new suit policy raises eyebrows