Germany Missed Out on $3B From Selling BTC Before the Rally

Key Takeaways:

- In 2024, Germany sold nearly 50,000 BTC for $2.89 billion, missing out on an estimated $3.17 billion in profit.

- By August 2025, those holdings would have been worth around $6 billion.

- Although no longer a top-four government BTC holder, Germany supports crypto adoption and regulation.

With BTC making new all-time-highs, countries like Germany are missing out on a significant opportunity to boost their economy, potentially by billions of dollars, had they kept their holdings instead of selling.

Germany was ranked as the fourth-largest government holder of Bitcoin in January 2024. It had seized 50,000 BTC, worth approximately $2.2 billion at the time, from the operators of Movie2K, a movie piracy network.

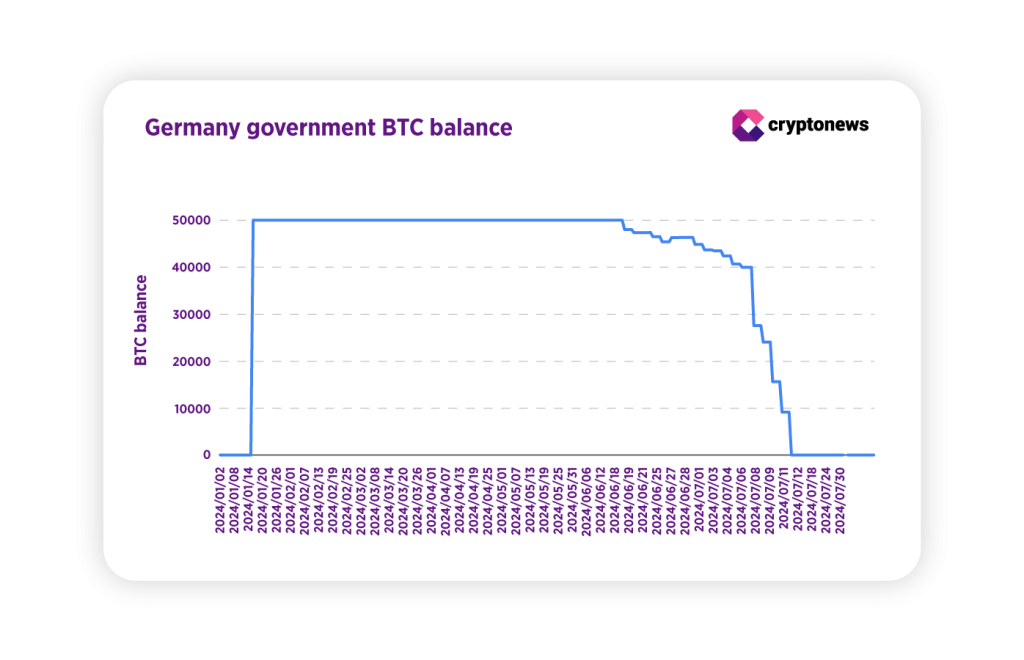

However, by July 12, 2024, the German government, through its Federal Criminal Police Office (BKA), had sold a total of 49,858 BTC for approximately $2.89 billion, at an average sale price of $57,900 per BTC. The decision to sell was not purely an investment move but was made in compliance with German law, which mandates the sale of seized assets prone to significant market volatility to prevent further losses.

Barely a year later, the price of BTC has more than doubled, surging above $122,000 on August 11, 2025. Had the government kept the seized Bitcoin, its value would be approximately $6.06 billion, representing a missed profit of $3.17 billion compared to the average sale proceeds. This would place Germany among the world’s four largest government holders.

German lawmaker Joana Cotar argued in a July 4 letter to members of the German government that Bitcoin should have been held as a strategic reserve, stating:

Meanwhile, the United States has taken a different approach to managing its Bitcoin holdings. The U.S. government holds approximately 198,022 BTC, valued at over $24 billion, primarily acquired through seizures. Earlier this year, it established a Strategic Bitcoin Reserve with no announced plans to sell.

Is Germany Still Interested in Crypto?

Although Germany has slipped from its rank as the fourth-largest government Bitcoin holder and missed the chance to earn an additional $3 billion, the country is actively supporting crypto adoption and regulation.

Following the approval of the Markets in Crypto Assets (MiCA) regulation, crypto assets have become legal in Germany. However, exchanges are required to obtain necessary licenses from the Federal Financial Supervisory Authority (BaFin) to operate in the country.

Crypto users in Germany were projected to reach 27.32 million, with GenZ and millennials accounting for up to 50%. Institutional adoption is also rising, with Deutsche Bank reportedly planning to launch a digital assets custody service in 2026. Revenue from the German crypto market is expected to reach $2.5 billion in 2025 and about $2.9 billion by the end of 2026, with a compound annual growth rate (CAGR) of 16.33%.

Germany is also creating a favourable tax policy for long-term crypto holders. Gains from crypto are tax-free if held for more than one year, while short-term gains (less than one year) are subject to progressive income tax of up to 45%.

The government is also working to improve its tax transparency through the Directive on Administrative Cooperation (DAC 8), which mandates crypto asset providers (CASPs) to report transaction details to tax authorities. This will take effect from January 1, 2026.

Closing Thoughts

With Bitcoin’s role in global markets continuing to grow and other countries reassessing their crypto strategies, Germany’s early Bitcoin liquidation and missed financial opportunity have become a case study in the importance of long-term planning for managing digital asset holdings.

You May Also Like

Today’s Biggest Crypto Movers: Market Dips Across Top Coins

Wallet Usage Statistics 2026: Market Size, Adoption & Regional Insights