AI in Insurance Claims Statistics 2026: How AI Wins Big

The insurance industry, like many others, is experiencing a wave of transformation powered by artificial intelligence (AI). What was once a slow, manual process is now becoming more streamlined and accurate, thanks to advanced technologies. This shift is not only improving the speed of claims processing but also enhancing the customer experience, all while reducing operational costs for insurers. The role of AI in insurance claims is more critical than ever. Let’s dive into some key transformations and statistics that show how AI is reshaping this industry.

Editor’s Choice

- 66% of insurers globally are already using generative or traditional AI in at least one part of their business, with adoption rising fastest in claims and underwriting.

- AI-driven claims automation is cutting average processing times by up to 75%, shrinking resolution from weeks to days or even minutes for low-complexity claims.

- End-to-end AI claims solutions are reducing processing costs by around 30–40%, freeing adjusters to focus on complex, high-value cases.

- Global AI in insurance revenue is estimated at $26.3 billion this year, with projections to reach $114.52 billion by 2031 at a 34.2% CAGR.

- Generative AI has reached about 90% penetration across insurers, with 44% of carriers having live production deployments embedded in core workflows.

Recent Developments

- 72% of large insurers now run AI-driven claims platforms in production, with over 40% offering fully end-to-end digital claims journeys.

- Around 24% of insurers are piloting or deploying blockchain-plus-AI claims networks to create tamper-proof, auditable claims records.

- Conversational AI and NLP now handle up to 42% of customer service interactions for insurers, cutting contact center labor costs by an expected $80 billion by 2026.

- Remote inspection tools and AI-powered image/video analysis now support more than 35% of property claims assessments, sharply reducing site visits and cycle times.

- AI-powered chatbots are embedded in over 60% of insurers’ claims intake flows, automating first notice of loss and routine status updates.

- Industry forecasts indicate that up to 80–85% of simple claims could be straight-through processed with minimal human touch as AI decisioning matures.

Artificial Intelligence in Insurance Market Growth Overview

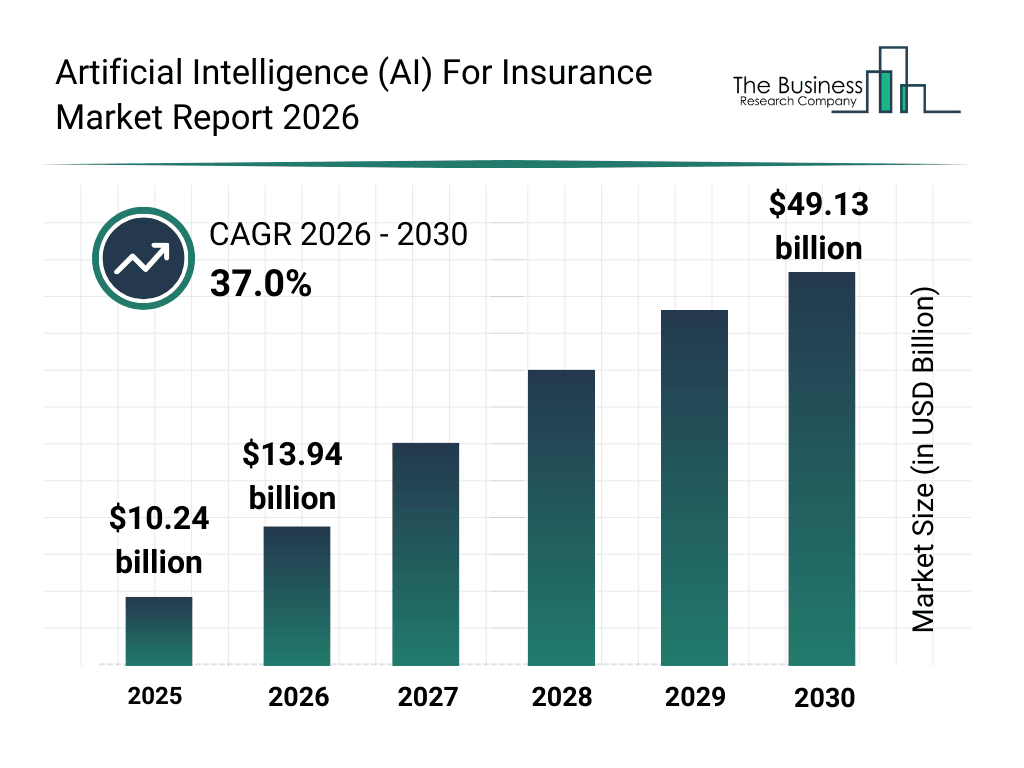

- The AI in the insurance market was valued at $10.24 billion in 2025, reflecting early but accelerating enterprise adoption across underwriting, claims, and fraud detection.

- Market size is expected to increase to $13.94 billion in 2026, signaling a strong year-over-year expansion driven by generative AI and automation tools.

- By 2027, the market is projected to reach $19.10 billion, as insurers scale AI across customer service, pricing models, and risk analytics.

- The market is expected to grow to $26.15 billion in 2028, supported by deeper AI integration in claims processing and predictive modeling.

- In 2029, AI spending in insurance is forecast to hit $35.80 billion, reflecting widespread operational adoption and cost-efficiency gains.

- By 2030, the global AI insurance market is projected to reach $49.13 billion, marking a major transformation in how insurers operate and compete.

- Overall, the market is growing at a rapid 37.0% CAGR from 2026 to 2030, highlighting AI as one of the fastest-growing technologies in the insurance sector.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Adoption of AI in Claims Processing

- Over 85% of insurers now use AI in claims workflows, from intake to adjudication, with adoption strongest in auto and health lines.

- AI-driven systems already handle around 50% of all claims, with straight-through automation expanding each year.

- Routine claims in AI-mature insurers are processed 40–60% faster, cutting settlement time from days to mere hours.

- Computer-vision damage assessment achieves up to 95% accuracy, enabling instant estimates from customer photos.

- Predictive analytics delivers a 25% reduction in overall claims frequency and boosts customer retention by 15–20% via proactive interventions.

- Digital claims assistants have lowered human error by about 40–60% through automated validation of policy and claim data.

- AI-powered virtual agents now manage up to 70–80% of initial claims inquiries and status checks across digital channels.

- Automated validation and decisioning have accelerated approval times by around 60%, driving materially faster payouts and lower handling costs.

Fraud Detection and Prevention with AI

- AI-driven fraud detection systems now reach around 85–90% detection accuracy by scoring every claim in real time across multimodal data sources.

- Advanced machine learning has cut false positives by roughly 40–45%, allowing more legitimate claims to be auto-approved without manual review.

- Predictive fraud analytics and AI pattern recognition are helping insurers avoid an estimated 25–35% of potential fraud losses before payout.

- Some carriers report up to a 60% reduction in confirmed fraudulent claims after rolling out enterprise-grade AI fraud platforms.

- Investigation initiation times on suspicious claims have fallen by about 70–75% thanks to automated triage and risk scoring.

- NLP and document analytics can detect anomalies in claim documents with up to 90%+ accuracy, rapidly exposing forged or manipulated records.

- Network and behavioral analytics map fraud rings with up to 7x higher likelihood scores for the riskiest 10% of claims, sharply improving investigator hit rates.

- Industry surveys indicate more than 50% of insurers have deployed AI-driven fraud tools, with adoption expected to keep rising over the next two years.

Which Regions Lead the AI in Healthcare Market

- North America remains the largest AI in healthcare market with about 54–58% of global revenue, underpinned by advanced infrastructure and high AI adoption.

- Europe is the second-largest region with an estimated 20–25% share, driven by strong hospital digitization and AI-supported diagnostics.

- Asia-Pacific holds roughly 15–20% of current revenue but is the fastest-growing market with forecast CAGRs above 40% through 2031.

- Latin America and the Middle East & Africa together account for under 10% of AI in healthcare spending today, though both are expected to see double-digit growth as digital health investments accelerate.

Predictive Analytics in Insurance Claims

- Insurers using predictive analytics report 15–20% lower operational costs and 3–5% better loss ratios than peers relying on traditional methods.

- Advanced predictive models can cut claims processing times by about 30%, speeding settlements and improving customer satisfaction.

- Telematics-driven predictive analytics has reduced accident rates and associated auto claims by up to 15% for some carriers.

- Health insurers using predictive models and wearable data have lowered chronic-disease claim rates by around 10% while boosting retention.

- Predictive analytics initiatives can improve overall insurer profit margins by roughly 15–20% through better pricing, fraud reduction, and efficiency.

- AI-powered analytics and automation can raise claims team productivity by 60–70%, freeing staff for more complex cases.

- Automating reviews and workflows with predictive analytics has reduced administrative costs by about 30–50% in some insurance operations.

- Churn-focused predictive models are driving 15–25% gains in customer loyalty and retention for insurers using AI-driven retention strategies.

Automation in Claims Processing

- AI and automation now touch roughly 50–60% of all insurance claims, with simple cases increasingly handled straight-through.

- Insurers adopting end-to-end claims automation report claims handling cost reductions in the 25–40% range.

- AI-powered virtual agents and chatbots manage 60–80% of initial claims-related customer contacts across digital channels.

- Intelligent automation can cut overall claims cycle times by up to 40–60%, accelerating approvals and payouts.

- Around 70–80% of insurers say AI-based automation has materially improved operational efficiency in their claims units.

- RPA and document AI can reach data accuracy rates near 98–99.5%, dramatically reducing rework and downstream errors.

- Leading carriers report that automated claims flows can resolve straightforward claims in just minutes instead of days or weeks.

Personalized Claims Experiences through AI

- Around 45–50% of policyholders now say they are more likely to stay with insurers that deliver personalized, AI-enhanced claims experiences.

- Insurers using AI-driven personalization have reported customer satisfaction lifts of roughly 20–30% across claims journeys.

- AI chatbots and virtual assistants handle 50–70% of routine claims-related customer inquiries, often delivering contextual, personalized responses.

- Hyper-personalized outreach and claims support using AI can improve retention and loyalty by about 15–25% for engaged customer segments.

- Generative and multimodal AI are enabling real-time, tailored claims guidance, contributing to 30–40% faster resolutions in some pilots.

- Insurers deploying AI personalization at scale report 10–15% higher cross-sell and upsell conversion rates during and after the claims process.

- Industry outlooks suggest that roughly 70% of insurers aim to embed AI-driven personalization across most customer touchpoints, including claims, within the next few years.

AI’s Role in Telematics and IoT for Claims

- The global telematics insurance market is projected to reach 278.41 million active premiums, up from 216.07 million the previous year, reflecting rapid UBI adoption.

- Today, 82% of policyholders have a positive view of telematics apps, and 60% say they are open to switching to usage-based insurance.

- About 52% of telematics-friendly customers are willing to share existing driving scores in exchange for personalized pricing.

- Telematics-based auto insurance reached a market size of around $3.54 billion last year, with expectations to climb toward $19.34 billion by 2035.

- IoT-enabled claims automation can cut claims processing time by up to 50%, allowing far faster handling of high-volume events.

- Sensor-based IoT data can enhance claims validation accuracy by roughly 35%, lowering disputes and fraud risk.

- Remote assessments supported by IoT can reduce the need for on-site inspections by about 50%, improving speed and safety for adjusters.

- Integrating IoT data into claims workflows can trim claim approval times by around 40%, enabling quicker payouts to policyholders.

Which Industries Use Machine Learning the Most?

- Banking, financial services, and insurance account for around 19–20% of global ML spending, led by fraud detection, credit scoring, and risk modeling.

- IT and technology services contribute roughly 20–22%, using ML heavily for software development, coding assistants, and infrastructure optimization.

- Media and telecommunications together represent about 14–16%, focusing ML on content recommendation, ad targeting, and network performance.

- Healthcare and life sciences capture around 12–15%, deploying ML for diagnostics support, imaging, and clinical decision-making.

- Manufacturing accounts for an estimated 10–12%, where ML drives predictive maintenance, quality control, and supply chain optimization.

- Retail and e-commerce hold close to 10–12%, applying ML to personalization, demand forecasting, and pricing.

- Transportation, logistics, and automotive contribute roughly 8–10%, using ML for route optimization, fleet management, and autonomy features.

AI Adoption Challenges within the Insurance Industry

- Around 52% of insurance leaders say their workforce lacks sufficient AI skills, underscoring talent and training gaps.

- Skill shortages are cited as a core obstacle by about 25% of insurance executives, while only 24% have continuous AI learning programs in place.

- Poor or fragmented data quality affects AI outcomes for roughly 54% of employees, limiting trust in model results.

- More than 40% of insurers report they lack adequate internal AI expertise and must modernize legacy systems to scale deployments.

- About 76% of insurers already use AI in pilots, but just 7% have scaled solutions enterprise-wide, stuck in “pilot purgatory.”

- 77% of senior insurance managers see their teams as unprepared for AI-driven change, highlighting cultural and skills barriers.

- Employee job security concerns are rising, with only 48% feeling secure in their roles, down from 59% a year earlier.

- Fewer than 10% of insurers are redesigning roles to align with AI, contributing to resistance and slower adoption.

Frequently Asked Questions (FAQs)

Nearly 80% of insurers are already experimenting with generative AI or plan to adopt it within the next two years.

Only about 7% of insurance companies have successfully scaled AI systems beyond pilot projects.

About 76% of carriers are running AI in at least one business function.

AI‑leading insurers have generated roughly 6.1× higher shareholder returns relative to AI laggards.

Conclusion

As the role of AI in insurance claims continues to expand, the industry is poised for significant transformation. AI is enabling faster, more accurate claims processing, reducing costs, and improving customer satisfaction. However, challenges remain, including integration issues, costs, and the need for skilled talent. Nevertheless, with rapid advancements in AI technologies, the future of insurance claims is becoming more efficient and customer-centric than ever before. As we move further, insurers who adopt and optimize AI systems will be better equipped to meet the evolving demands of the industry.

The post AI in Insurance Claims Statistics 2026: How AI Wins Big appeared first on CoinLaw.

You May Also Like

The Man Behind a $73 Million Crypto Scam Is Sentenced But He’s Nowhere to Be Found