MARA Moves 1318 BTC to Institutional Custodians as Bitcoin Price Continues to Decline

Highlights:

- Bitcoin mining company MARA has transferred 1,318 BTC worth $86.89 million to three different destinations.

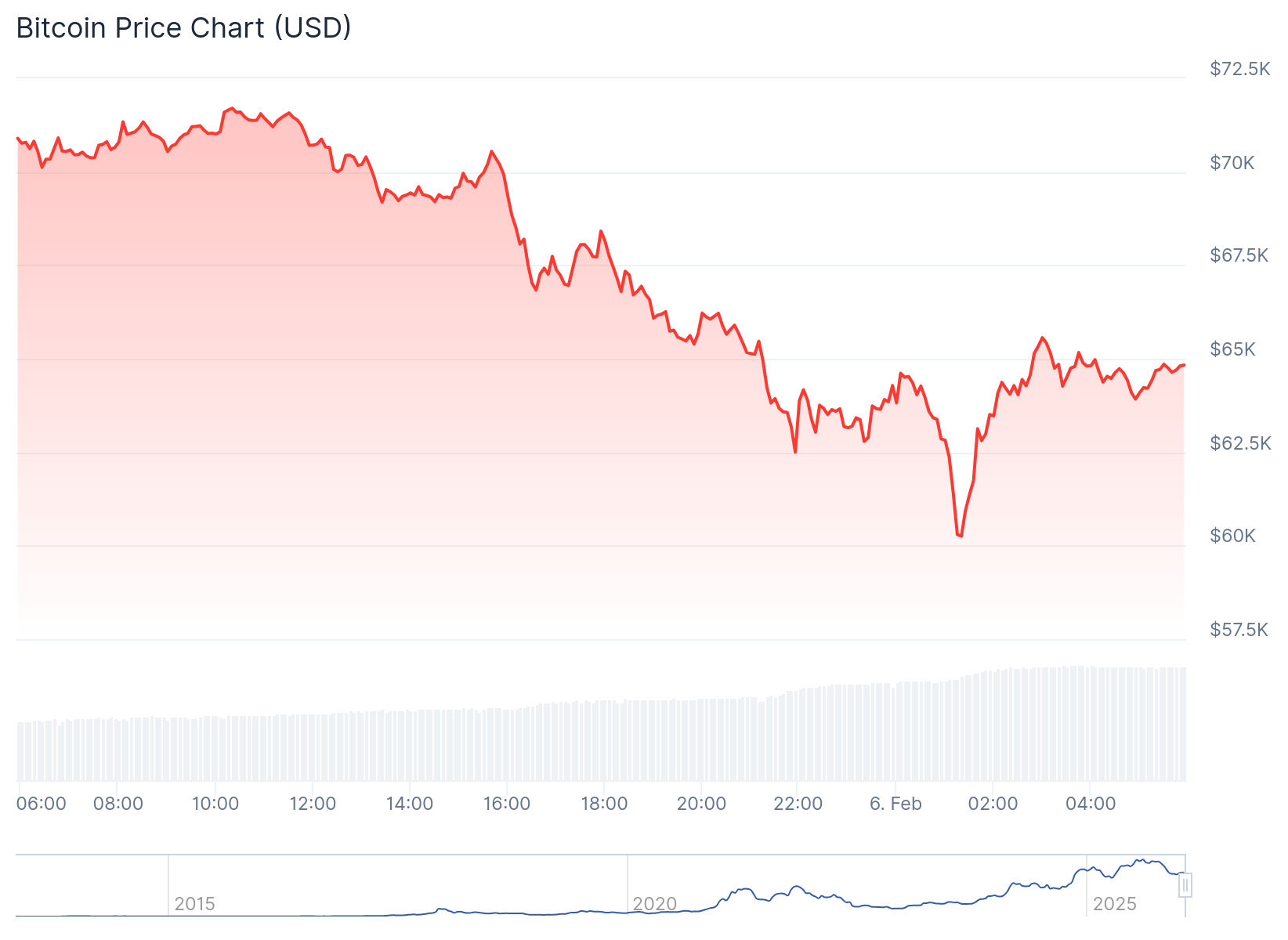

- The transfers came as Bitcoin dipped below $66,000, as institutions continue to deposit their BTC holdings into crypto exchanges and custody firms.

- Despite the persistent dip, some investors have continued to accumulate BTC, reflecting strong faith in the token.

Marathon Digital Holdings (MARA), a Bitcoin (BTC) mining and investment firm, has moved 1,318 BTC, worth roughly $86.89 million, to Two Prime, BitGO, and Galaxy Digital. Lookonchain, a renowned on-chain crypto transactions tracker, identified and reported the token transfers in one of its X posts on February 6. According to Lookonchain, the transactions occurred within ten hours amid Bitcoin’s persistent price declines.

Despite the transfers, MARA still holds 52,850 BTC and still ranks as the second-largest corporate holder of Bitcoin. American company Strategy remains the company with the highest BTC holdings. Strategy announced that it purchased 855 BTC a few days ago, increasing its holdings to 713,502 tokens. Other companies with significant BTC holdings include Twenty One Capital, Metaplanet Inc, and Bitcoin Standard Treasury Company. These firms hold 43,514 BTC, 35,102 BTC, and 30,021 BTC, respectively.

Aside from MARA, other top crypto firms have been moving their BTC holdings to new destinations. For context, Lookonchain had previously reported that Nakamoto transferred 933 BTC, valued at roughly $65 million, to a new wallet. The transfer came after Nakamoto had acquired 5,400 BTC for $376.4 million.

Separately, BlackRock has been depositing digital assets, including BTC, to exchanges. Per Lookonchain, the asset management firm recently deposited 3,900 BTC, valued at approximately $275 million, and 27,197 Ethereum (ETH) tokens worth $56.68 million to Coinbase Prime.

Bitcoin’s Price Dips Below $66,000 as MARA Moves 1318 BTC

At the time of press, the crypto market’s valuation stood at about $2.298 trillion, following a 7.7% decline over the past 24 hours. Within the same timeframe, BTC traded at $65,314 after an 8.6% dip. Its dominance dropped to about 56.4%, as Ethereum maintained a 10% dominance. Meanwhile, Bitcoin’s market capitalization might soon drop below $1 trillion. It currently has a $1.295 trillion valuation and a trading volume of $161.66 billion.

Source: CoinGecko

Source: CoinGecko

BTC’s declines over the past week, month, and year stood at 21.4%, 30.1%, and 33.4%, respectively. Supply inflation was low at 0.86%, with a high volatility at 7.52%. BTC’s “Fear & Greed Index” was on extreme fear while sentiment remained bearish. Notably, 96% of the top 100 cryptocurrencies have outperformed BTC. The asset was also trading below its 200-day Simple Moving Average (SMA), with only 10 profitable days in the past 30 days.

While BTC’s current dip has sparked panic selloffs among holders, particularly retail investors, a few entities have continued to show strong faith in the asset. Per Lookonchain, a whale that has been inactive for seven months recently resurrected to buy the BTC dip. The whale reportedly acquired 482 BTC, valued at approximately $32.5 million. Currently, it holds 1,960 BTC worth $128.3 million.

Elsewhere, Strategy published its financial report for the fourth quarter of 2025, which showed that the company posted one of its largest quarterly losses. According to the report, Strategy’s operational loss was roughly $17.4 billion, while the net loss attributable to common shareholders was approximately $12.6 billion. Notably, unrealized losses on the company’s BTC holdings were the major drivers of the operational loss.

https://twitter.com/saylor/status/2019517425805590717?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E2019517425805590717%7Ctwgr%5E0202e655f33c6ef575fe54c4fd6450322b55f8e0%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fpublish.twitter.com%2F

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

DeFi Platform Operating on BNB Chain Attacked by Hackers! How Much Lost? Here Are the Details