BlackRock Bitcoin ETF IBIT Records $10 Billion Daily Trading Volume as Bitcoin Drops 12%

TLDR

- BlackRock’s IBIT Bitcoin ETF recorded $10 billion in daily trading volume on Thursday, breaking its previous record of $8 billion set in November

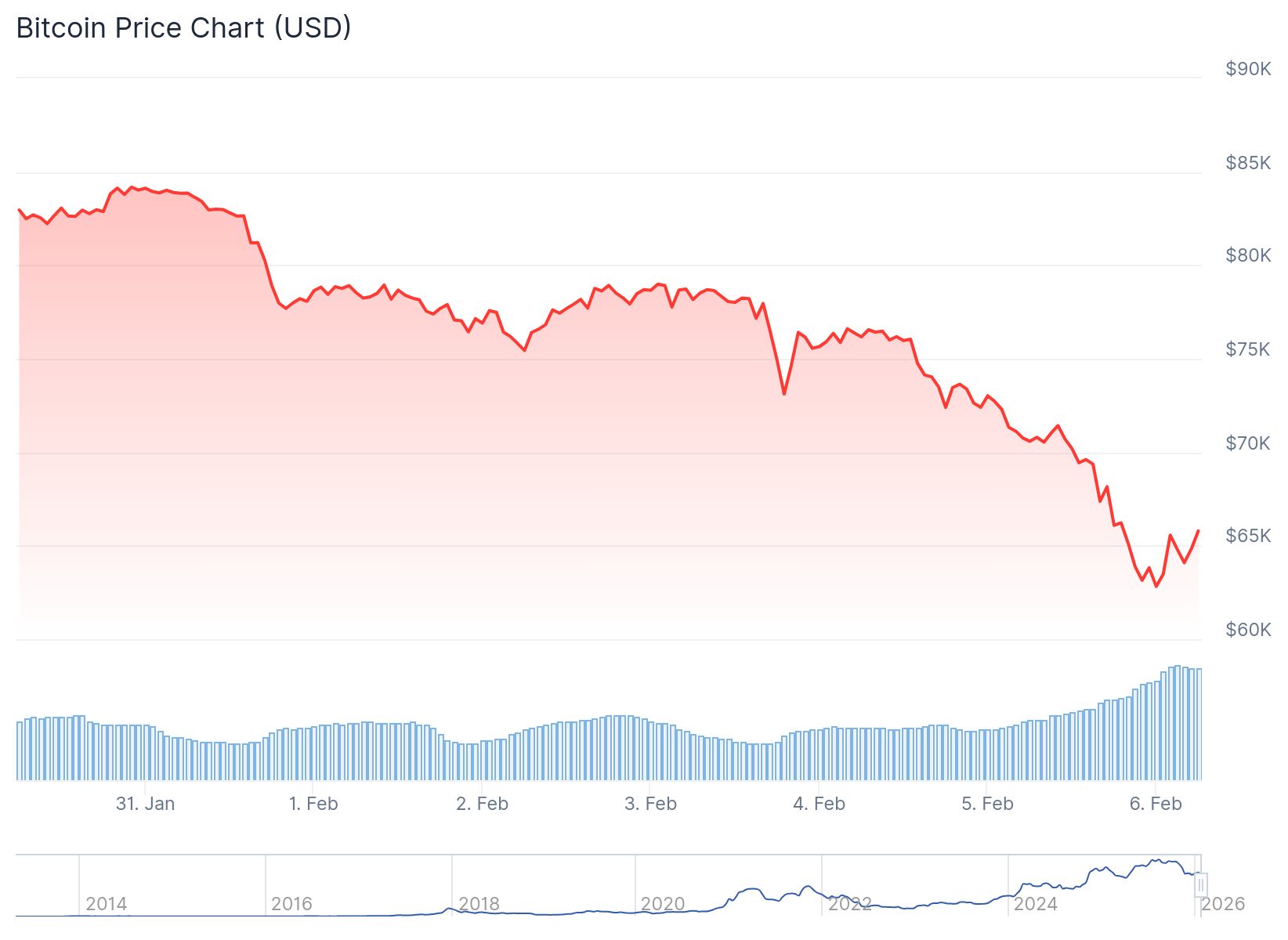

- Bitcoin fell 12% in 24 hours to $64,000, marking its first drop below $70,000 in 15 months

- IBIT dropped 13% on Thursday, its second-worst daily price decline since launch

- The ETF posted $373.4 million in net outflows on Wednesday with only 10 days of net inflows in 2026

- Bitcoin has fallen approximately 50% from its October peak of $126,000, with IBIT down 48% from its high

BlackRock’s spot Bitcoin exchange-traded fund set a new record for daily trading volume as cryptocurrency prices continued their steep decline. The iShares Bitcoin Trust ETF, known as IBIT, saw $10 billion worth of shares change hands on Thursday.

Bloomberg ETF analyst Eric Balchunas reported the record-breaking volume on social media platform X. The previous record stood at approximately $8 billion, set on November 21, according to data from SoSoValue.

IBIT typically processes between $2 billion and $3 billion in daily trades. The fund has recorded multiple high-volume sessions above $5 billion during the recent market downturn.

The ETF’s price dropped 13% on Thursday. This marks the second-worst daily decline since IBIT launched in January 2024. The fund’s largest single-day drop was 15% on May 8, 2024.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Bitcoin fell from roughly $73,100 at market open to a low near $62,400 on Thursday. This represented a nearly 15% intraday decline. The cryptocurrency later recovered to around $64,000.

Outflows and Performance Struggles

IBIT recorded net outflows of $373.4 million on Wednesday. The fund has experienced only 10 trading days with net inflows so far in 2026. The ETF has struggled to attract consistent investor money since a crypto market crash in early October.

Bitcoin has dropped approximately 50% from its all-time high of around $126,000 reached in early October. IBIT has followed a similar trajectory, falling roughly 48% from its October peak of nearly $70 to $36.10 at Thursday’s close.

Bob Elliott, investment chief at Unlimited Funds, stated that the average dollar invested in IBIT is now underwater as of Friday’s market close. This means most investors who bought shares are currently holding losses.

Market-Wide Crypto Decline

The broader cryptocurrency market experienced widespread losses. Total crypto market capitalization fell from over $3 trillion at the end of January to approximately $2.16 trillion.

XRP was the worst-performing major cryptocurrency on Thursday, declining about 25%. TRON held up best among the top 50 coins by market cap, losing only 4%.

Bitcoin’s drop below $70,000 marks the first time the asset has traded at this level in 15 months. The decline affects both small-cap and blue-chip cryptocurrencies as well as crypto-related equities.

Trading Activity and Market Conditions

The spike in IBIT trading volume reflects increased market activity during periods of price volatility. Traders appear to be actively responding to Bitcoin’s rapid price movements.

IBIT remains the largest spot Bitcoin ETF by assets under management, holding approximately $56 billion. The fund launched in January 2024 as part of the first wave of approved spot Bitcoin ETFs in the United States.

The recent market decline comes as investors react to weak US job market data and concerns about capital allocation in the artificial intelligence sector. Veteran trader Peter Brandt noted on Wednesday that Bitcoin shows signs of “campaign selling” with limited buyer support.

IBIT experienced $373.4 million in net outflows on Wednesday, continuing a pattern of investor withdrawals that has persisted through much of 2026.

The post BlackRock Bitcoin ETF IBIT Records $10 Billion Daily Trading Volume as Bitcoin Drops 12% appeared first on CoinCentral.

You May Also Like

USDT Transfer Stuns Market: $238 Million Whale Movement to Bitfinex Reveals Critical Patterns

The market value of NFTs has fallen back to pre-2021 levels, close to $1.5 billion.