Why is XRP Price Crashing Heavily Today?

- XRP crashes 10.4%, bringing its price down to $1.30.

- Liquidations surge as XRP faces sharp downturn in volatile market.

- Market struggles with Bitcoin, Ethereum, and Solana also losing value.

XRP has faced a significant blow today, with its price dropping by 10.4% to $1.30, a sharp decline that has caught the attention of both investors and traders, raising concerns about the cryptocurrency’s immediate future, especially as its price movements are often seen as a barometer for the broader cryptocurrency market, reflecting a troubling trend that is reverberating throughout the digital asset space.

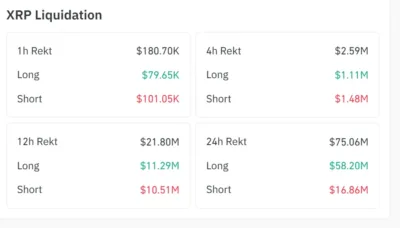

Along with the price drop, XRP has seen massive liquidations, with over $75 million worth of positions liquidated in the past 24 hours alone, the bulk of which came from long positions, totaling $58.20 million, while short positions accounted for $16.86 million, suggesting that many traders who were optimistic about XRP’s performance were caught off guard as the price sharply reversed.

Source: Coinglass

Also Read: Ripple CEO Brad Garlinghouse Shares Buffett’s Wisdom: ‘Be Greedy When Others Are Fearful!

Market Indicators Point to Oversold Conditions

Looking at XRP’s price chart, the latest candlestick pattern shows a significant bearish trend. The Relative Strength Index (RSI) is currently at a low 24.14, signaling that the cryptocurrency is deeply oversold. Typically, such low RSI readings can indicate that the asset may be due for a rebound, but the ongoing price drop suggests that market sentiment remains weak.

The Bollinger Bands are also showing signs of heightened volatility, as the price has fluctuated beyond the upper and lower bands. This could suggest that the current drop may not be over yet, and the price may continue to face downward pressure before finding support.

Source: Tradingview

Despite these indicators, the general mood in the XRP market remains uncertain. While some traders anticipate a potential recovery, others believe the bearish trend could persist for longer. With such a volatile environment, investors are likely to remain cautious, adjusting their positions in response to the unpredictable market movements.

Broader Cryptocurrency Market Decline

The XRP crash comes as part of a broader downturn in the cryptocurrency market, affecting several major players. Bitcoin, the leader in the cryptocurrency space, saw a sharp decline of 8.1%, bringing its price down to $65,091.10.

Ethereum followed suit with a 9.3% drop, falling to $1,911.63. Even Solana, which had previously shown strength, faced heavy losses, contributing to the market’s overall negative sentiment. Binance Coin (BNB), another major cryptocurrency, also dropped by 9.9%, now priced at $623.54. These losses are particularly concerning given that these coins are some of the most widely traded and established in the market.

The sharp declines in the cryptocurrency space are signaling broader market challenges, and XRP’s performance today is a reflection of this wider trend. The overall sentiment remains negative, and with these heavy losses, the outlook for recovery in the short term appears uncertain.

In conclusion, XRP’s drastic price drop today can be attributed to a combination of heavy liquidations, weak market sentiment, and technical indicators suggesting oversold conditions. The broader downturn in the cryptocurrency market, with Bitcoin and Ethereum leading the way in losses, only adds to the uncertainty surrounding XRP’s future price movements. As the market continues to react to these shifts, traders and investors will need to stay alert for further developments.

Also Read: Pump.fun Strengthens Its Trading Infrastructure with Vyper Acquisition

The post Why is XRP Price Crashing Heavily Today? appeared first on 36Crypto.

You May Also Like

USDT Transfer Stuns Market: $238 Million Whale Movement to Bitfinex Reveals Critical Patterns

The market value of NFTs has fallen back to pre-2021 levels, close to $1.5 billion.