Bitcoin Price News: DeepSnitch AI Raises $1.50M With 100x Projections As BTC Tumbles and XMR Prepares for a Possible Recovery

BTC headlines remained bearish as BTC tumbled to as low as $65K on February 6, which led to Strategy’s shares falling by 17%, down to $107 in the same time period.

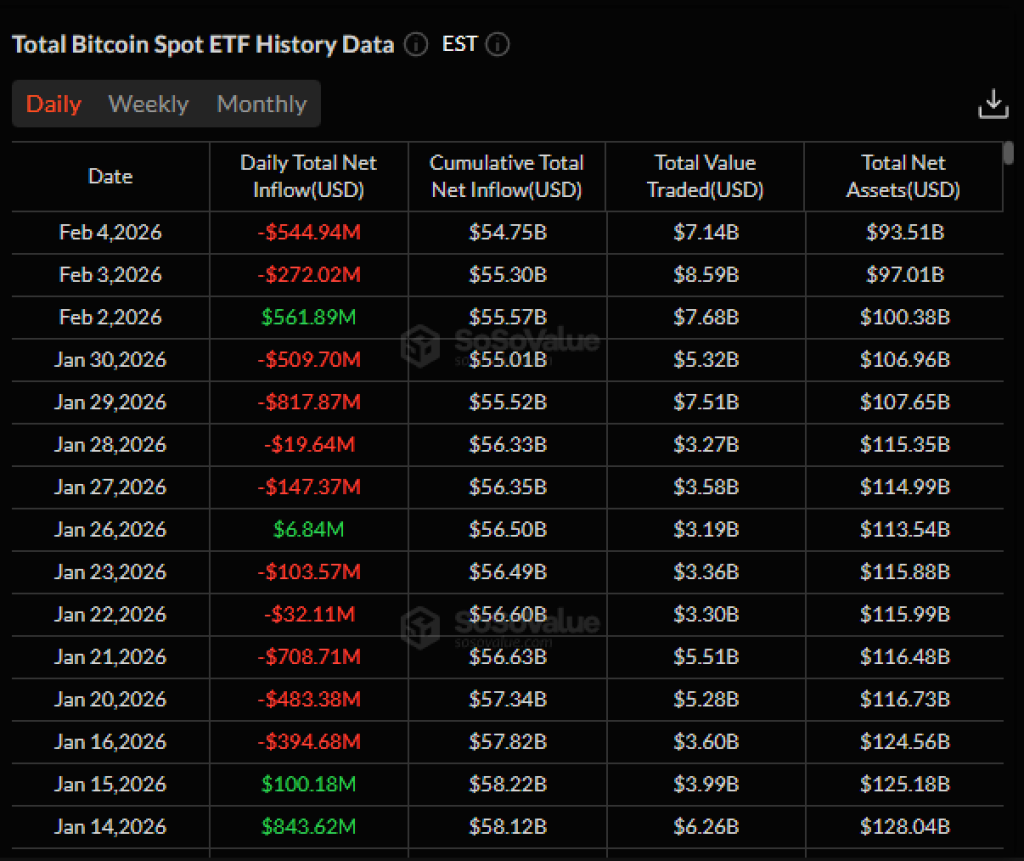

Moreover, Bitcoin price news revealed BTC ETFs recovered $545 of outflows on the day prior, pushing the weekly outflows to $255M in total net outflows.

As both BTC and major altcoins reach new lows, many traders are actually choosing to invest in altcoins, which led to DeepSnitch AI raising $1.50M.

The project reached prominence due to its retail-centric trading/analytics suite powered by five AI agents, which may provide it with mass adoption potential, and by extension, a large upside.

Bitcoin price news today

Strategy reported a staggering $12.4B net loss in Q4 2025, driven by Bitcoin’s 22% quarterly drop. BTC peaked at $126K in early October but fell below $88.5K by year-end and is now down over 30% YTD to $62.5K. This is well below MicroStrategy’s average purchase price of $76K.

Despite the loss, Q4 revenue rose 1.9% YoY to $123M, but shares closed 17% lower Thursday at $107 amid the sell-off.

Meanwhile, spot Bitcoin ETFs saw $545M in outflows that day, pushing weekly flows negative ($255M net outflows) and YTD net redemptions to $1.8B despite $3.5B inflows. Total AUM stood at $93.5 billion at press time.

Moreover, the broader crypto market cap fell 20% YTD from $3T to $2.5T, as the market-moving events continue feeding the bearish sentiment.

While the Bitcoin price news is expected to remain red for the time being, DeepSnitch AI is one of the trending projects that traders are choosing to bet on amid the downturn.

Coins to watch in 2026

- DeepSnitch AI: Best ticket to outsized gains in 2026?

If the recent Bitcoin price news is bringing you down, you’re not alone, as each new update basically deepens the fear. However, you don’t need to play the “majors game” while there are so many new presale projects to pick from.

DeepSnitch AI, like other early-stage ICOs, is somewhat of a hedge against volatility. In fact, the presale is holding strong, pulling in $1.50M at $0.03830 despite the chaos in the market.

The 100x projections are already flowing in as the presale bonuses that offer as much as 300% extra tokens attract whales. Still, DeepSnitch AI is much more than empty buzz. The real juice is the utility: a clean AI platform with five agents doing the heavy lifting and conducting risk scoring, contract audits, and real-time sentiment tracking.

The learning curve is minimal as you can simply paste a CA into the LLM interface and boom, instant risk breakdown plus early heads-up on FUD or sentiment flips before they wreck your bags.

DeepSnitch AI Community is already on fire, and many traders await the next big update that could push the hype to unprecedented heights.

- Bitcoin: Is BTC about to sink further?

According to CoinMarketCap, BTC dropped to the $60K area on February 6 before recovering to $66K.

The aggressive selling has pushed BTC below key zones like $72K and $74K, confirming downside momentum and raising the risk of further collapse back toward the next logical support at $60K.

RSI is deep in oversold territory, signaling the sell-off may be overdone short-term and increasing chances of a relief bounce or short squeeze if buyers defend current lows.

Any rally will face heavy resistance around $79K. Yet, closing above those levels will put the control back in the hands of the buyers.

- Monero: XMR to rally soon?

XMR dropped to around $302 on February 6, according to CoinMarketCap.

A turn down from current levels or overhead resistance signals continued negative sentiment, and traders will sell on the rallies, putting the current price at risk.

On the upside, a strong push above the 20-day EMA would shift momentum, targeting $500, where significant selling is expected. After sharp declines, the price often consolidates before the next leg. In fact, many in the community believe that $590 is the realistic target in the next few weeks.

Considering Bitcoin price news is likely to remain bearish, XMR’s charts and narrative seem bullish in comparison.

Final words: Keep your bag safe

As most traders anticipate the Bitcoin price news to tank other assets, DeepSnitch AI seems like a saving grace due to its presale status.

Like a hedge against the chaos, DeepSnitch brings in real utility that could deliver massive gains that could reach as high as 100x post-launch.

Jumping into the presale now makes it even more worthwhile as the active bonuses unlock an incredible amount of value. For example, DSNTVIP300 unlocks 300% on $30K+ ($90K in extra tokens at current pricing).

Keep your bags safe by participating in the DeepSnitch AI presale and following X or Telegram for the latest updates.

FAQs

- What are the latest Bitcoin price news highlights?

Bitcoin fell to $62K on February 5, with Strategy shares down 17% to $107 after a $12.4B Q4 loss. Spot BTC ETFs saw $545M daily outflows, pushing weekly net outflows to $255M and YTD redemptions to $1.8B.

- Why is DeepSnitch AI attracting investors amid the Bitcoin downturn?

DeepSnitch AI raised $1.50M at $0.03830 despite market chaos, offering five AI agents for instant contract audits, risk scoring, scam detection, breakout spotting, and early FUD/sentiment prediction, which delivers real utility and strong 100x potential.

- What is the current Bitcoin price outlook after the recent drop?

BTC hit $60K before recovering to $66K, breaking below $72K to $74K support. RSI oversold suggests a possible short-term bounce, but further downside toward $60K remains unless price reclaims $79K resistance.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Bitcoin Price News: DeepSnitch AI Raises $1.50M With 100x Projections As BTC Tumbles and XMR Prepares for a Possible Recovery appeared first on CaptainAltcoin.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

USDT Transfer Stuns Market: $238 Million Whale Movement to Bitfinex Reveals Critical Patterns