Pi Network’s PI Crashed to New ATL, But This Metric Signals More Downside Ahead

The past several weeks have not been kind to the cryptocurrency markets. This trend only intensified on Thursday when the entire market bled out, with multiple double-digit price crashers.

Naturally, Pi Network’s PI token was not spared, and it dumped to fresh all-time lows of under $0.135 (on CoinGecko). This meant that the asset has plunged by over 30% in the last month alone. On a broader scale, PI is down by more than 95% since its all-time high marked on February 26, 2025.

Despite this massive correction, some members of the ever-vocal and optimistic Pi Network community tried to find the silver linings. This one, for example, outlined the skyrocketing PI transaction volume, which, he believes, shows “increased interest in PI despite the manipulation games done by whales.”

This one was even more bullish, predicting a mind-blowing surge to $4 from the current dip in the first six months after the second Mainnet migration and once old Pioneers (Pi Network users and investors) are done selling off.

More Pain to Come?

If we are being realistic, it’s hard to even imagine such a rally happening soon. Not only because the overall crypto market seems to be dominated by the bears, but also due to PI’s recent price performance and the unlocking schedule for new tokens.

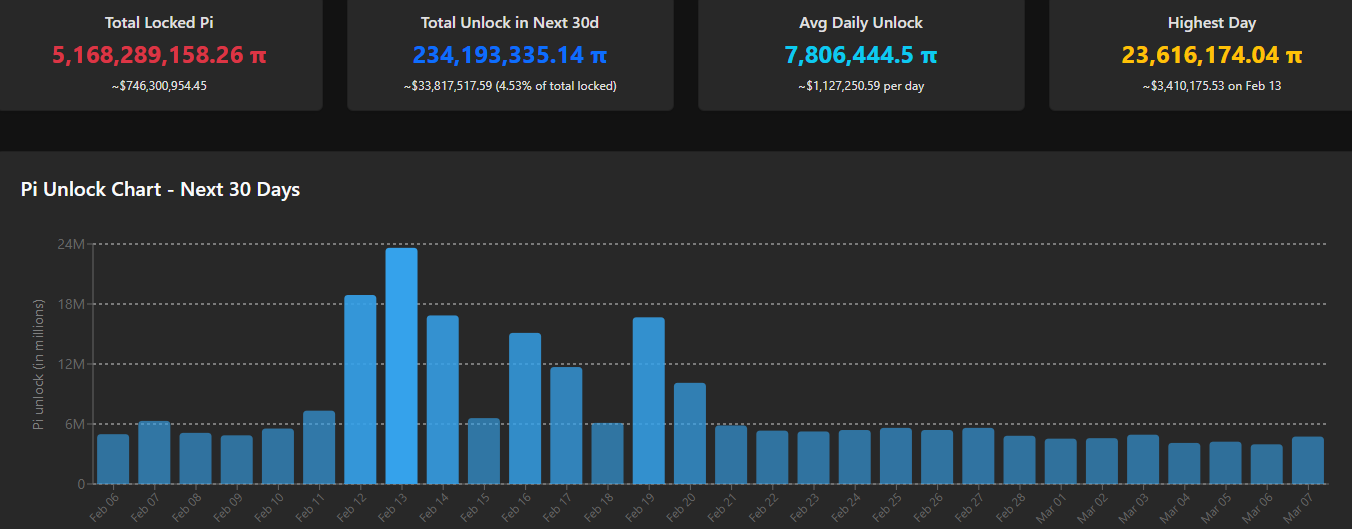

Data from PiScan shows that almost 8 million coins will be freed in the next month on average. What’s even more worrying is the fact that this number will skyrocket to over 18 million on February 12 and to 23.6 million on February 13.

Such a massive number of tokens to be unlocked might result in more immediate selling pressure from investors who have been waiting a long time for their holdings to become available for trading. This is particularly true in such a time of panic.

Pi Token Unlock Schedule. Source: PiScan

Pi Token Unlock Schedule. Source: PiScan

The Good News

On the positive side, the chart above demonstrates that the number of unlocked tokens will decline after February 20 and will normalize, which could ease the selling pressure. Additionally, there are rumors circulating online that one of the largest and oldest exchanges, Kraken, might be planning to list Pi Network’s native token, which could boost its liquidity and legitimacy among investors.

The post Pi Network’s PI Crashed to New ATL, But This Metric Signals More Downside Ahead appeared first on CryptoPotato.

You May Also Like

RFK Jr. may have perjured himself with key vaccines claim: newly revealed emails

ai.com Launches Autonomous AI Agents to Accelerate the Arrival of AGI