How Much Lower Can XRP Price Fall After the Latest Crash?

Crypto markets have seen major dips during the past few days, and the pressure has spread across nearly every large asset. Bitcoin has fallen quickly, and widely followed coins such as XRP have moved in the same direction. XRP began this week near $1.6 before sliding toward $1 as the broader market weakened and confidence faded across risk assets.

A sharp rebound has appeared today, pushing XRP higher by close to 30% within a short period. This sudden recovery creates a moment of uncertainty because strong bounces during fragile conditions do not always confirm a lasting bottom. Price behavior now depends heavily on whether Bitcoin can stabilize and hold its own recovery range.

Continued strength from Bitcoin could allow the wider crypto space to recover step by step, which would support a stronger XRP price outlook. Failure at the Bitcoin level could reopen downside pressure across altcoins and place XRP back near recent lows.

Ripple XRP Price Outlook Depends On Macro Pressure And Market Confidence

Several deeper forces continue to weigh on digital assets despite today’s rebound. Elevated interest rates and recession fears reduce appetite for speculative exposure across global markets. Regulatory tightening across major regions adds friction for capital flows into crypto ecosystems. Expanded tax reporting rules and stricter compliance standards also limit the free movement that supported earlier rallies.

Narrative exhaustion has created another challenge for bullish sentiment. Major catalysts such as the Bitcoin halving cycle, exchange-traded fund approvals, political promises, and legislative optimism now sit in the past. Fresh stories that once attracted new liquidity no longer provide the same excitement.

These combined pressures explain why rebounds can appear strong yet still struggle to develop into sustained upward trends. XRP therefore stands at a delicate balance between stabilization and renewed decline.

Critical $0.8 Support Level Defines The Next Phase For XRP Price

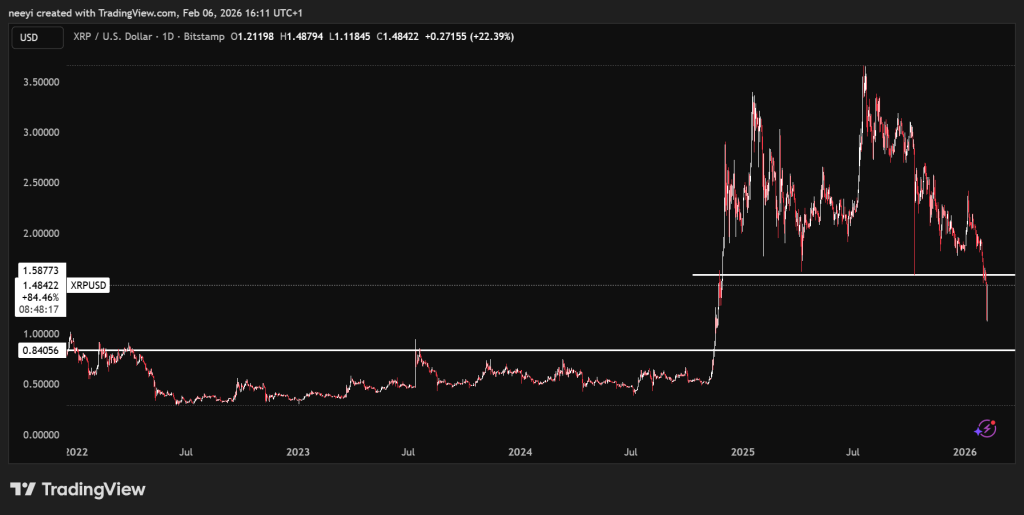

Historical price structure shows a powerful support region near $0.8. This zone previously acted as resistance between 2021 and 2024 before turning into support during later market cycles. Strong historical interaction often gives a level psychological importance, which makes it central to the current XRP price outlook.

XRP Price Chart

XRP Price Chart

Loss of the present recovery could drive XRP back toward this support region. Successful defense of $0.8 could provide a foundation for gradual rebuilding across the Ripple ecosystem. Breakdown below that level would introduce a far more cautious outlook and extend bearish conditions across the chart structure.

Read Also: Is Crude Oil Price About to Repeat Its Most Explosive Pattern from History?

Market direction during the coming weeks will likely depend on Bitcoin stability, macroeconomic clarity, and the ability of XRP to remain above key historical support.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post How Much Lower Can XRP Price Fall After the Latest Crash? appeared first on CaptainAltcoin.

You May Also Like

Three Must-Attend Side Events at Korea Blockchain Week 2025

Kraken's Big Hint: Pi Coin Set for Exchange Listing In 2026