Norway’s $1.7T Sovereign Wealth Fund Boosts Bitcoin Holdings 84% Via Strategy, Metaplanet Buys

Norway’s Norges Bank, the world’s largest sovereign wealth fund with $1.7 trillion in assets, has boosted its Bitcoin holdings by almost 84% in the second quarter, mainly by buying shares in Michael Saylor’s Strategy and Japan-based Metaplanet.

That’s according to Standard Chartered, which says Norges Bank raised its total indirect holdings to 11,400 BTC from 6,200 BTC during the period.

Standard Chartered’s head of digital asset research Geoffrey Kendrick described the surge as a “proactive position,” reflecting a broader trend of sovereign wealth funds and government entities boosting indirect Bitcoin exposure via treasury-focused firms.

Kendrick reached his conclusions by analyzing 13F filings with the US Securities and Exchange Commission (SEC) by companies with holdings in BTC ETFs (exchange-traded funds), Strategy, and Metaplanet.

Kendrick recently raised his year-end BTC target to $200K, aligning with Canary Capital CEO Steven McClurg, which predicts BTC could hit $140K–$150K this year even amid expected Federal Reserve rate cuts.

Norges Bank Ups Bitcoin Exposure To 11,4K BTC

Norges Bank has built its BTC exposure by mainly holding shares in Strategy. With the latest analysis, however, Kendrick noted that the fund has diverted from this trend somewhat and has also bought shares in Metaplanet, which is often seen as “Japan’s Strategy.”

While Norges Bank may appear to be diversifying its holdings in Bitcoin treasury companies, Kendrick said the fund still has a heavy concentration towards Strategy. Currently, the fund’s holdings in Metaplanet account for an equivalent of 200 BTC.

Strategy and Metaplanet have been among the most active Bitcoin treasury firms in recent months.

Strategy (MSTR) is currently the largest corporate Bitcoin holder with 628,946 BTC on its balance sheets, according to data from BitcoinTreasuries. Meanwhile, Metaplanet is ranked at number 7 with its holdings of 18,113 BTC.

Kendrick Adjusts Year-End Target To $200K By The End Of The Year

The analysis by Kendrick follows an observation made earlier in the year, when he said that sovereign wealth funds and government entities were boosting their indirect exposure to Bitcoin in the first quarter by mainly buying shares in Strategy. He also predicted that this trend will continue throughout the year.

Just last month, the Standard Chartered analyst raised his Bitcoin price target to $135K by Sept. 30. He also reiterated a $200K price target for the end of the year.

Those targets are in line with ones shared by Canary Capital CEO Steven McClurg.

Speaking to CNBC on Aug. 15, he said that there is still the possibility that BTC will soar to the $140K-$150K range “this year before the bear market next year.”

McClurg added that he is not confident in the current macroeconomic outlook, and warned of a broader bear market ahead.

He argued that there should have already been an interest rate cut in the US, adding that he expects cuts to be announced in September and October.

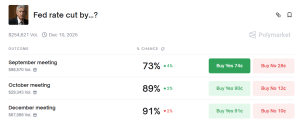

Polymarket bettors also believe that interest rate cuts will be announced sometime soon. A contract on the decentralized betting platform asking when the earliest Federal Reserve interest rate cut will be shows increased odds for September and October.

Fed rate cut odds by month (Source: Polymarket)

As of 2:03 a.m. EST, odds that the next cut will be in September stand at 73% after a 4% rise in the last 24 hours, while odds of an October cut stand at 89% after a 2% increase.

You May Also Like

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps

USD/INR edges lower as Indian Rupee gains on improving equity inflows