XRP Price Jumps Nearly 20% As Whales Buy Aggressively

XRP has staged a sharp rebound after a steep sell-off rattled investor confidence across the market. The token had suffered heavy losses, triggering fear-driven exits among retail holders.

However, select investor cohorts viewed the decline as an opportunity. Their strategic accumulation has already begun shifting momentum in XRP’s favor.

XRP Holders Exhibit Substantial Support

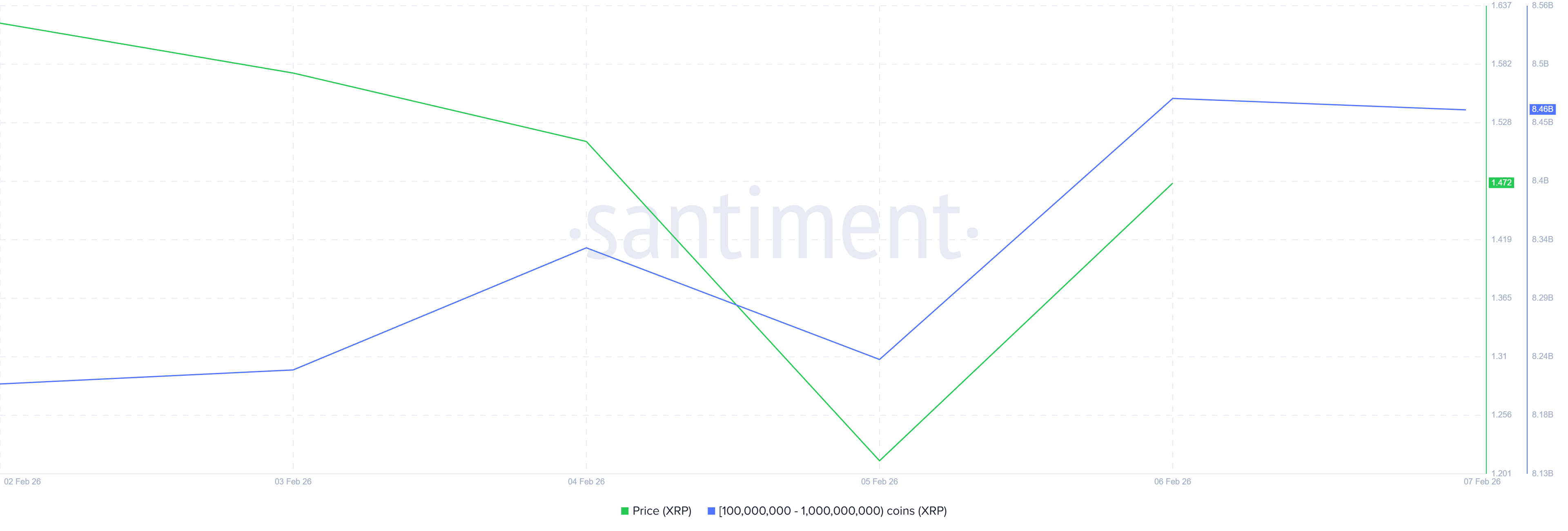

XRP whales have taken an active role in driving the recent recovery. Over the past 48 hours, wallets holding between 100 million and 1 billion XRP accumulated more than 230 million tokens. At current prices, this buying spree exceeds $335 million, signaling strong conviction among large holders.

This accumulation coincided with Friday’s rebound, highlighting whales’ influence on price direction. Large-scale buying reduces circulating supply and absorbs sell-side pressure.

Such behavior often acts as a catalyst during corrective phases, helping stabilize price and restore confidence when broader sentiment remains fragile.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Whale Holding. Source: Santiment

XRP Whale Holding. Source: Santiment

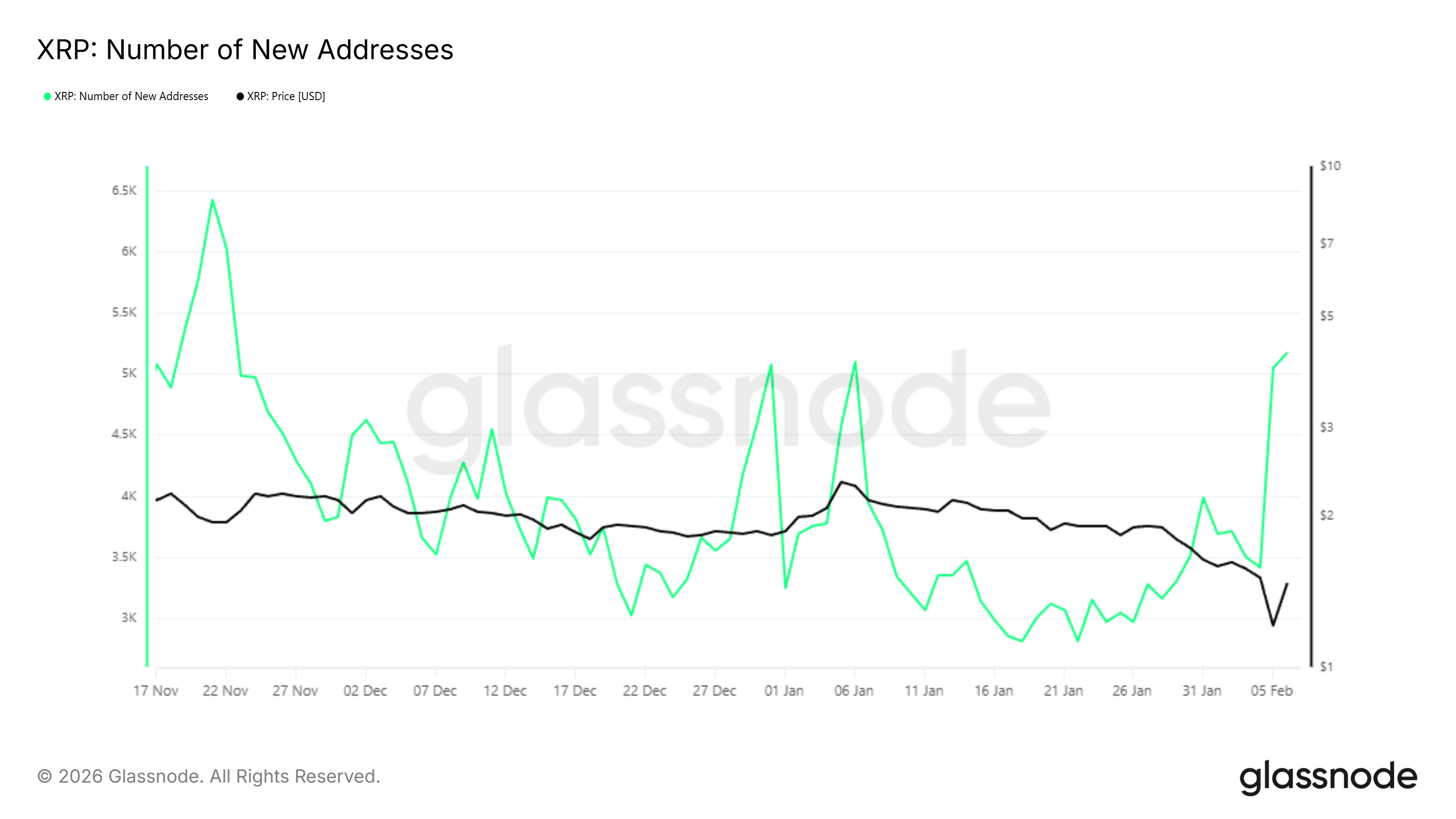

Network activity also supports the recovery narrative. New XRP address creation surged alongside whale accumulation. Over the same 48-hour period, first-time transacting addresses increased by 51.5%, reaching 5,182. This marks the highest level of new participation in roughly two and a half months.

An influx of new investors strengthens rallies by injecting fresh capital rather than recycling existing liquidity. Rising participation suggests growing interest beyond short-term speculation.

With new addresses expanding and whale support present, XRP’s recovery attempt gains structural backing at the macro level.

XRP New Addresses. Source: Glassnode

XRP New Addresses. Source: Glassnode

What Is XRP Price’s Next Target?

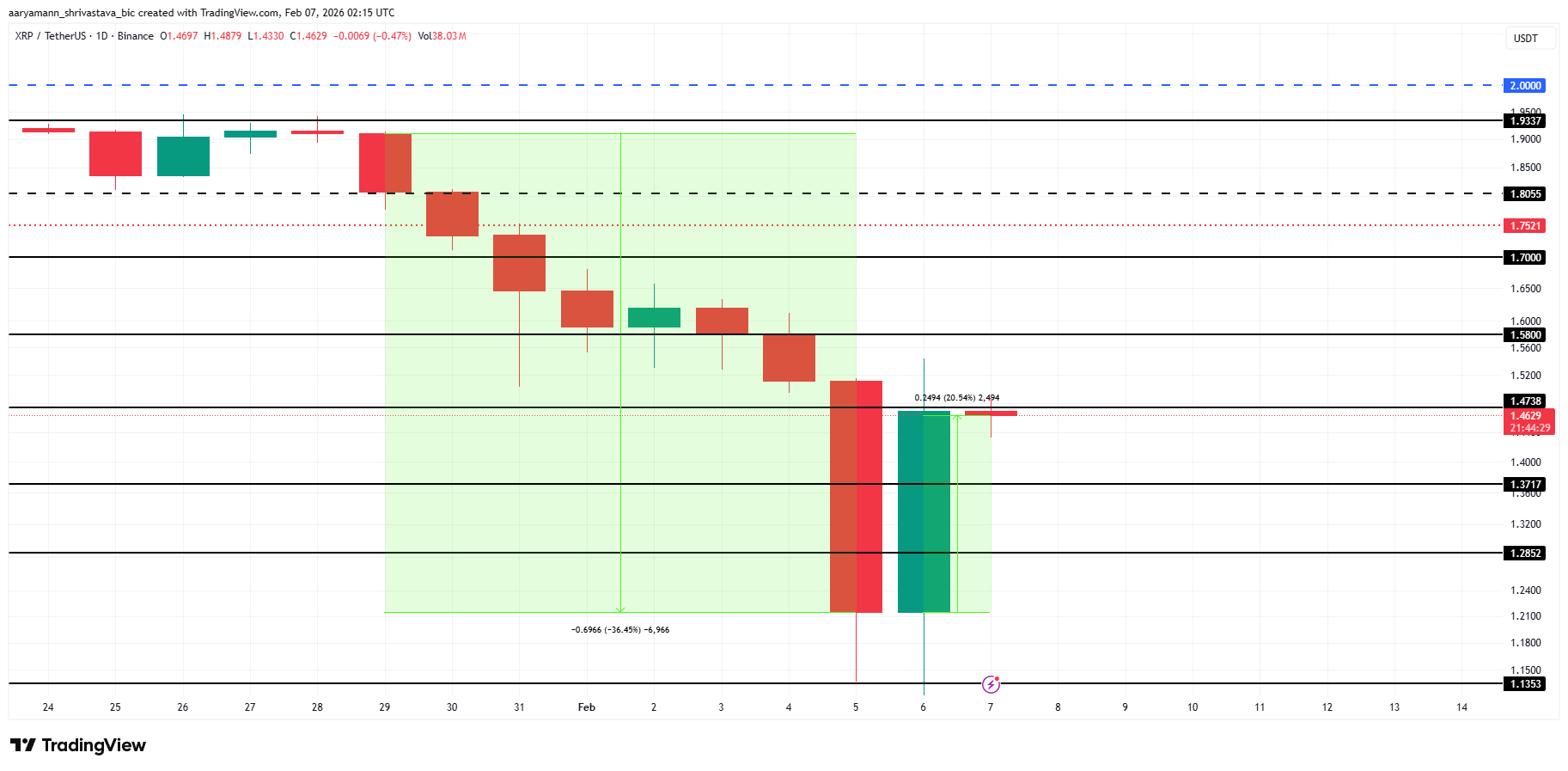

XRP is trading near $1.46 at the time of writing, hovering just below the $1.47 resistance. The altcoin rebounded 20.5% after a severe downturn that erased 36% of its value in a few days. This bounce reflects improving demand conditions following capitulation.

Whale accumulation and rising network activity increase the probability of further upside. A push toward $1.70 appears achievable in the near term. This level represents a key psychological barrier. A successful break would likely attract additional inflows and strengthen the recovery structure.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

Downside risk remains if resistance holds. Failure to clear $1.58 could invite renewed selling pressure. Under that scenario, XRP may fall below $1.37 and slide toward $1.28. Such a move would invalidate the bullish thesis and erase a significant portion of the recent rebound.

You May Also Like

The Arweave network has not produced a block for over 24 hours.

HOT MOMENTS: FOMC Statement Released Following the Fed Interest Rate Decision – Here Are All the Details of the Full Text