BitMEX Launches Hyperliquid Copy Trading to Bring Top PerpDEX Traders to Its Platform

- BitMEX Copy Trading, which was created for easy trading, saves time by letting novice traders learn from successful pros.

- It lets traders speculate on asset values without an expiry date by fusing the flexibility of spot trading with the advantages of futures contracts.

The launch of Hyperliquid Copy Trading, which allows users to imitate the top Hyperliquid perps traders, has been announced by cryptocurrency derivatives exchange BitMEX. The release combines the user experience and security of the BitMEX platform with access to Hyperliquid’s top traders, giving traders the best of both worlds.

BitMEX’s Copy Trading feature, which enables users to automatically duplicate the trading positions and strategies of professional traders, has seen a significant expansion with Hyperliquid Copy Trading. Without being exposed to the underlying DeFi risk, this guarantees access to the most smart trader tactics. BitMEX Copy Trading, which was created for easy trading, saves time by letting novice traders learn from successful pros.

With more than 60% of all open interest, hyperliquid continues to dominate the decentralized perpetual exchange (PerpDEX) market. It lets traders speculate on asset values without an expiry date by fusing the flexibility of spot trading with the advantages of futures contracts.

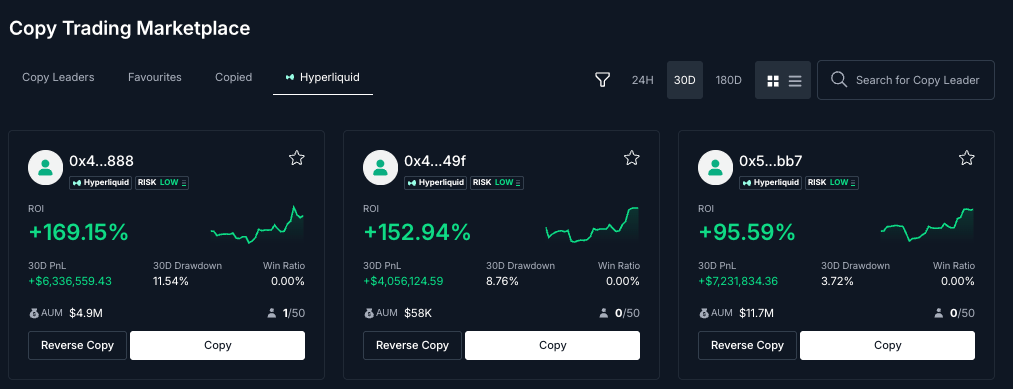

There is a Hyperliquid sub-tab visible to users that visit to BitMEX’s Copy Trading Marketplace. They may duplicate or reverse copy trades from here, which shows a scoreboard of the top hyperliquid traders. On BitMEX, positions are opened automatically, mimicking the Hyperliquid trader’s approach. It is simple to discover top-performing traders since each hyperliquid trader is evaluated according to parameters like PnL, Drawdown, Win Ratio, and AUM (Assets Under Management).

BitMEX CEO Stephan Lutz said:

With BitMEX’s Copy Trading Marketplace, customers may copy up to five hyperliquid traders at once and set up their chosen risk management parameters for each, including Take Profits and Stop Loss. They may automate their trading of cryptocurrency derivatives and make better selections by selecting a Copy Leader that meets their demands.

The OG cryptocurrency derivatives exchange, BitMEX, offers experienced cryptocurrency traders a platform that meets their demands with low latency, deep crypto native, and particularly BTC liquidity, as well as unparalleled dependability.

Because no cryptocurrency has been lost due to hacking or infiltration since BitMEX’s inception, customers may trade with assurance that their funds are safe and that they have access to the resources and goods they need to be successful.

Additionally, BitMEX was one of the first exchanges to provide Proof of Reserves and Proof of Liabilities data on the chain. In order to guarantee that consumer funds are securely kept and separated, the exchange nonetheless releases this data twice a week. Users may follow Discord, Telegram and Twitter, as well as visit the BitMEX Blog or www.bitmex.com, for further information.

You May Also Like

The Arweave network has not produced a block for over 24 hours.

HOT MOMENTS: FOMC Statement Released Following the Fed Interest Rate Decision – Here Are All the Details of the Full Text