NFT sales plunge 20% to $58.3 million as Bitcoin price struggles at $70,000

The NFT market recorded $58.34 million in sales volume over the past week, falling 20.34% from the previous period.

- NFT sales hit $58.34M, down 20%, despite buyers and sellers both rising over 20%.

- Ethereum led with $34.9M in sales, while Bitcoin NFT volume fell 33% week-over-week.

- CryptoPunks rebounded sharply, surging 147% and dominating high-value NFT sales.

NFT buyers climbed 21.97% to 296,018, while sellers jumped 24.63% to 270,495. Transaction volume decreased 4.33% to 660,674.

The overall crypto market has taken a notable hit as Bitcoin (BTC) has dropped to the $70,000 level, while Ethereum (ETH) hovers around $2,000.

The global crypto market cap now stands at $2.41 trillion, down from last week’s $2.83 trillion. This market downturn continues to pressure the NFT sector, with weekly sales volume falling for the second consecutive week.

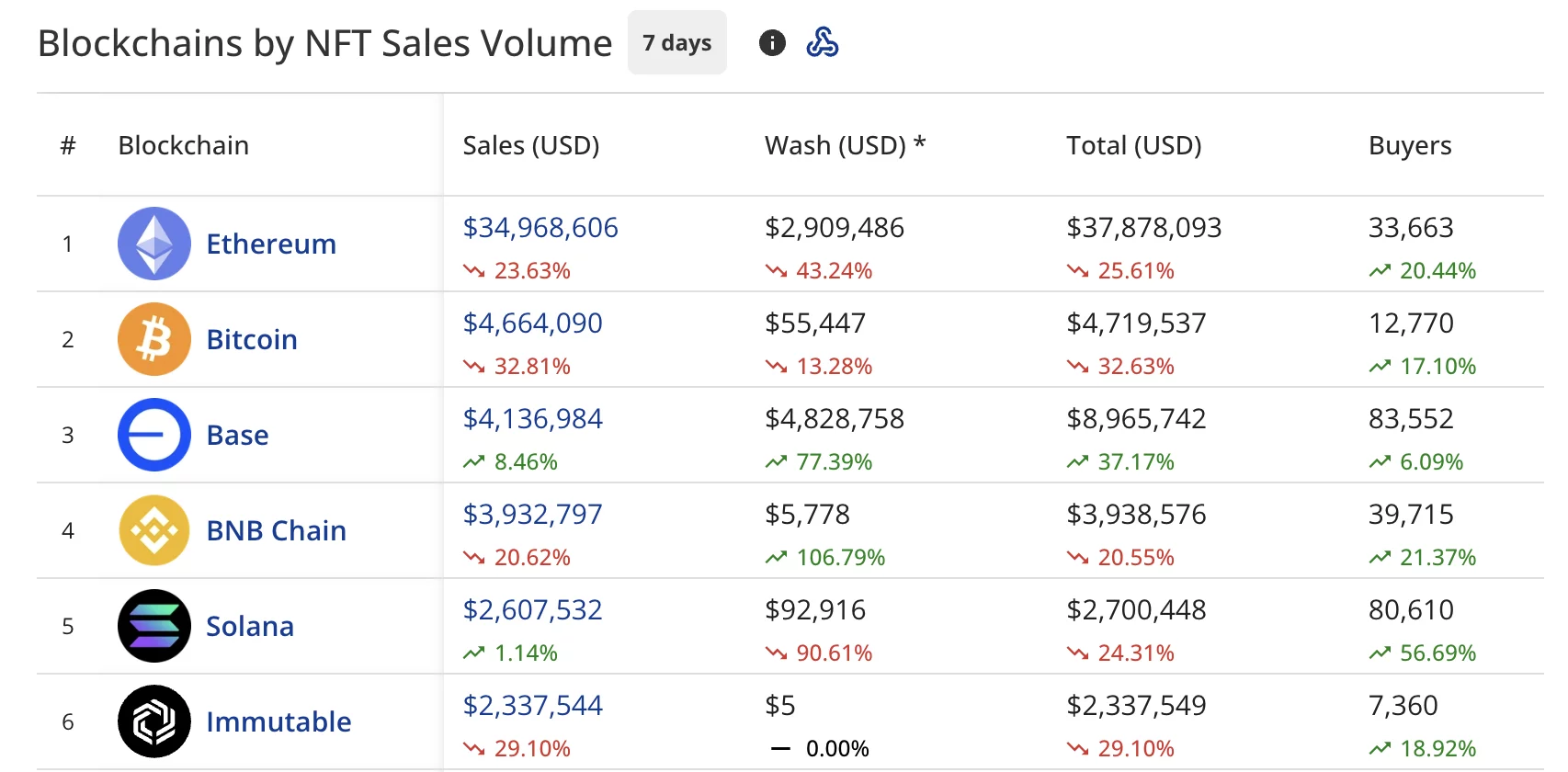

Ethereum leads with $34.9 million despite decline

Ethereum continued to dominate all blockchains with $34.97 million in NFT sales, dropping 23.63% over the seven-day period.

The network drew 33,663 buyers, up 20.44% from the prior week. Wash trading on Ethereum totaled $2.91 million during this timeframe.

Bitcoin secured second place among blockchains with $4.66 million in sales, falling 32.81% week-over-week. The network attracted 12,770 buyers, up 17.10% despite the sales decline.

Base claimed third position at $4.14 million in sales, climbing 8.46% and drawing 83,552 buyers who rose 6.09%.

BNB Chain (BNB) ranked fourth with $3.93 million in sales, declining 20.62% while seeing 39,715 buyers who increased by 21.37%.

Solana (SOL) rounded out the top five with $2.61 million in sales, posting a modest 1.14% gain and drawing 80,610 buyers who surged 56.69% from last week.

Immutable (IMX) dropped to sixth position at $2.34 million, down 29.10%.

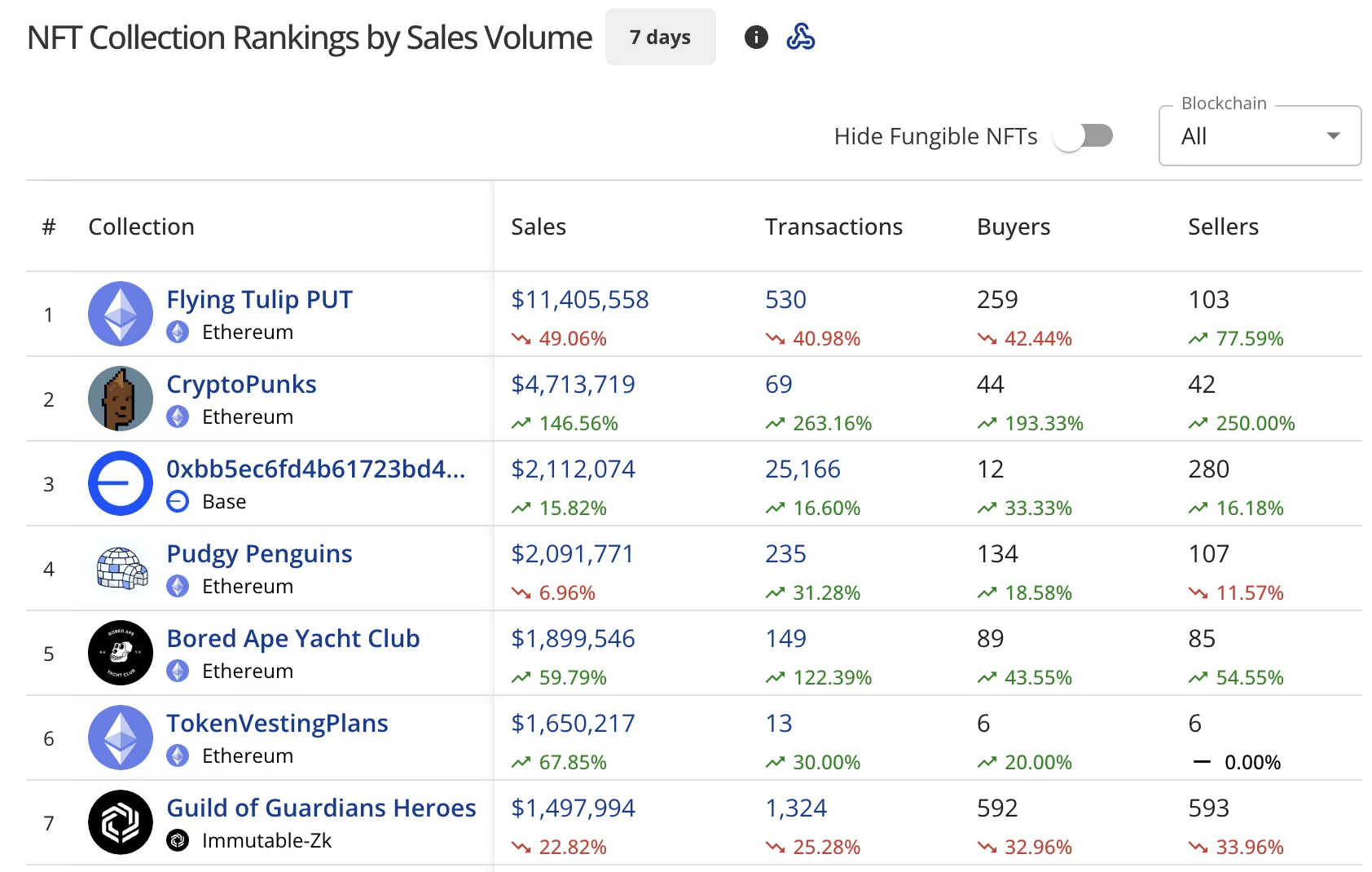

Flying Tulip PUT retains lead, CryptoPunks surge

Flying Tulip PUT on Ethereum maintained its dominance in the collection rankings with $11.41 million in sales, plummeting 49.06% from last week’s performance. The collection processed 530 transactions from 259 buyers.

CryptoPunks on Ethereum claimed second place with $4.71 million in sales, surging 146.56% over the week after last week’s 52.35% decline.

The blue-chip collection completed 69 transactions from 44 buyers, with both metrics more than doubling week-over-week.

A Base collection took third position with $2.11 million in sales, climbing 15.82%. Pudgy Penguins posted $2.09 million in sales, down 6.96%, while Bored Ape Yacht Club recorded $1.90 million with a 59.79% surge.

TokenVestingPlans on Ethereum landed in sixth with $1.65 million, climbing 67.85%, while Guild of Guardians Heroes rounded out the top seven with $1.50 million, down 22.82%.

CryptoPunks dominate high-value NFT sales

CryptoPunks dominated the week’s highest-value sales, claiming three of the top five spots.

- CryptoPunks #5402 led with $265,585 (113.5 ETH) four days ago.

- CryptoPunks #9170 at $139,761 (72 ETH) just 14 hours ago.

- Wrapped Ether Rock #98 sold for $109,128 (109,127.7422 USDC) seven days ago.

- Autoglyphs #256 fetched $105,512 (50 ETH) two days ago.

- CryptoPunks #1112 rounded out the top five at $92,850 (48.48 ETH) one day ago.

You May Also Like

The Arweave network has not produced a block for over 24 hours.

HOT MOMENTS: FOMC Statement Released Following the Fed Interest Rate Decision – Here Are All the Details of the Full Text