Crypto Market Today Rebounds as Bitcoin, XRP Rally After Panic Sell-Off

The post Crypto Market Today Rebounds as Bitcoin, XRP Rally After Panic Sell-Off appeared first on Coinpedia Fintech News

The crypto market showed early signs of recovery today after a sharp sell-off, with Bitcoin climbing back above the $71,000 level. The rebound followed a wave of panic selling that pushed market sentiment to an extreme level of fear, leaving investors unsure whether this move marks a real recovery or just a short-term bounce before another decline.

The Crypto Fear & Greed Index dropped to 5, one of its lowest levels ever, indicating the extent of negative sentiment. Similar levels were last seen during major market crashes, including the COVID crash and the collapse of FTX, highlighting the scale of fear that recently gripped the market.

Bitcoin and Altcoins Recover as Oversold Conditions Ease

Bitcoin briefly dipped close to the $60,000 level before finding support and bouncing back. At the same time, major altcoins also posted strong short-term gains. Ethereum rose nearly 9%, Solana jumped over 14%, and XRP surged more than 20% at its peak during the rebound.

Despite the recovery, prices remain well below recent highs, showing that the broader market is still fragile. Analysts say the bounce is likely driven by traders closing short positions and fresh liquidity entering the market, rather than strong long-term buying confidence.

Tether has minted nearly $2 billion in USDT over the past few days, which may have helped support prices in the short term by adding liquidity to the market.

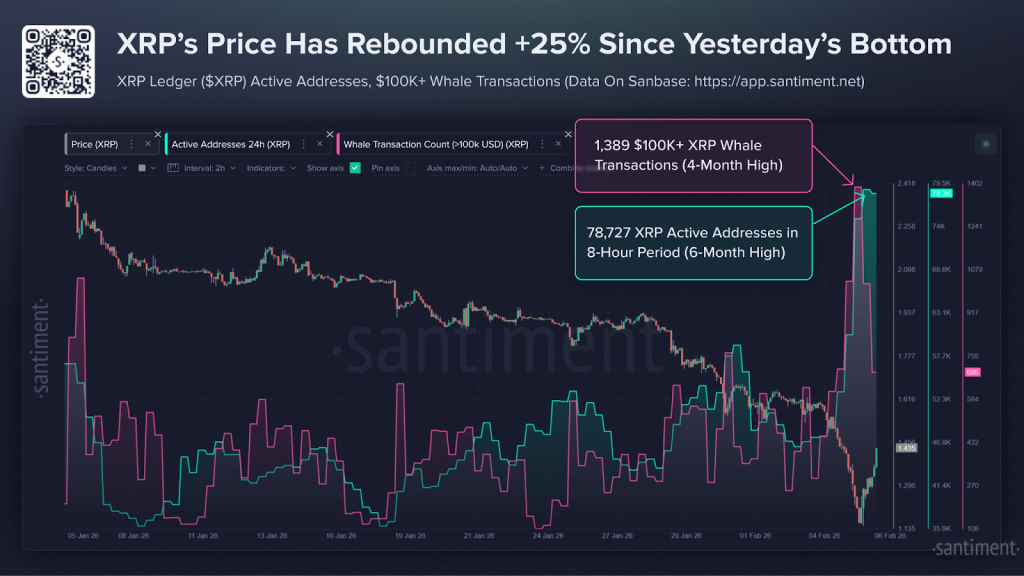

XRP Price Shows Strong Recovery Signs Amid Whale Buying

XRP stood out during the rebound, posting sharper gains compared to the broader market. According to Santiment data, XRP price recovered from below $1.15 to above $1.50 in less than a day.

The rally was supported by heavy whale activity, with over 1,389 transactions worth more than $100,000 recorded, the highest level in four months. At the same time, the number of active XRP Ledger addresses surged to a six-month high, suggesting renewed interest during the dip.

These signals point to strong buying during panic conditions, often seen near short-term market bottoms.

Bitcoin Relief Rally or More Downside Still Possible?

Bitcoin has not yet confirmed a full trend reversal. Buy signals are appearing on shorter timeframes, but a stronger confirmation would require a weekly signal, which is still missing.

Past market cycles show that initial rebounds are often followed by weeks of choppy price action or even another leg lower. Similar setups in recent months resulted in breakdowns after brief optimism.

Bitcoin could move toward the $75,000–$80,000 range in the short term. However, a sustained move above $80,000 is seen as necessary before confidence in a new bull phase can return.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Korean Regulators Probe Bithumb After 620,000 Bitcoins Mistakenly Sent to Users

Highlights: Bithumb mistakenly sent 620,000 Bitcoins to 695 users during a promotion event. The exchange recovered 618,212 Bitcoins, covering almos