ETF Recap: Ether ETFs Deliver Blockbuster Week With $2.85 Billion as Bitcoin ETFs Trail Behind

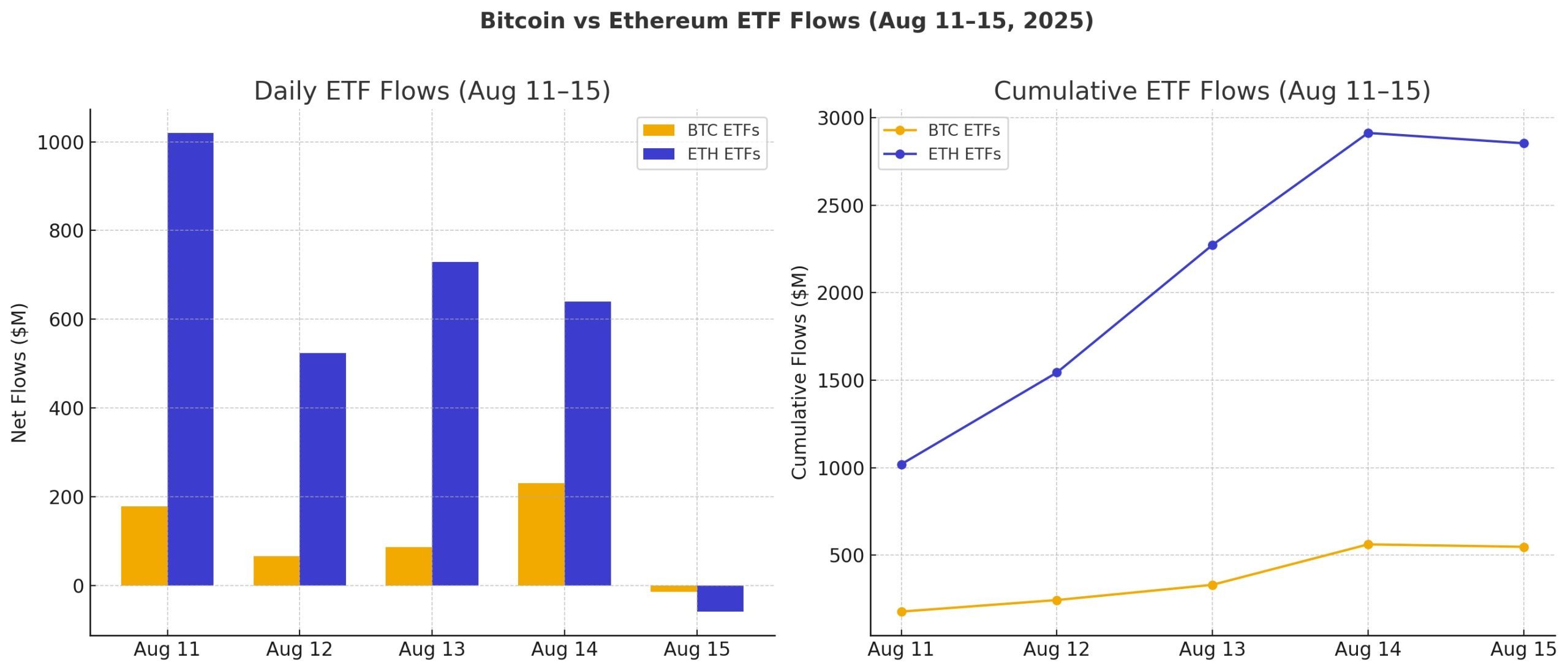

Ether exchange-traded funds (ETFs) stole the spotlight last week with $2.85 billion in inflows, their strongest week on record. Bitcoin ETFs managed $548 million, extending their recovery but falling far short of ether’s dominance.

Crypto ETF Flows Diverge As Ether Shines and Bitcoin Lags

The week of Aug. 11–15 marked a turning point in the ETF race between bitcoin and ether. Investors poured billions into ether ETFs, dwarfing bitcoin’s steady but modest inflows, and signaling a shift in institutional sentiment.

Ether ETFs had an unprecedented week, locking in $2.85 billion in inflows. Blackrock’s ETHA led the charge with a stunning $2.32 billion, followed by Fidelity’s FETH at $361.23 million.

Grayscale’s Ether Mini Trust brought in $219.58 million, although its ETHE counterpart lost $71.57 million. Vaneck’s ETHV added $14.36 million, Franklin’s EZET brought in $8.48 million, Invesco’s QETH added $2.26 million, and 21shares’ CETH added $1.26 million.

On the other hand, bitcoin ETFs recorded a total $547.82 million inflow across the week. Blackrock’s IBIT carried the momentum with $887.82 million, while Grayscale’s Bitcoin Mini Trust picked up $32.97 million, along with Invesco’s BTCO adding $4.90 million.

Despite the net positive for the week, large redemptions were seen on Ark 21shares’ ARKB (-$183.92 million), Grayscale’s GBTC (-$95.96 million), Fidelity’s FBTC (-$73.78 million), Bitwise’s BITB (-$18.36 million), and Vaneck’s HODL (-$5.85 million).

The milestones were unmistakable: ether ETFs posted their largest single-day inflow ever on Aug. 11 ($1.02 billion), followed by their second-highest inflow on Aug. 13 ($729 million). By contrast, bitcoin ETFs never crossed the $500 million daily mark.

Trading volumes told the same story. Ether ETFs traded $14.1 billion across the week, while bitcoin ETFs saw $20.8 billion. Yet ether’s net assets jumped to $28.15 billion, now sitting at 5.3% of ethereum’s market cap.

The data makes one thing clear: institutional money is warming rapidly to ether ETFs, with bitcoin playing defense.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

Witness Bitcoin’s Dramatic Plunge in A Volatile Crypto Market

The new Fed chairman and geopolitical risks affect cryptocurrency outlook. Bitcoin fails to maintain key levels, hitting lowest since October 2023. Continue