Mysterious 200,000,000 XRP From Ripple Amid Key SEC Update – What’s Going On?

- Ripple shifts $606 million XRP, sparking mystery and speculation.

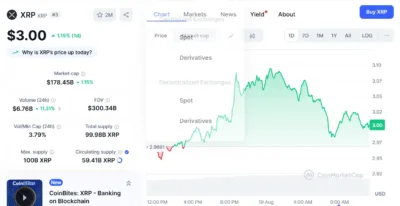

- XRP price holds $3.00 despite Ripple transfer and ETF delay.

- SEC postpones XRP ETF decision, Polymarket odds drop to 78%.

According to Whale Alert, Ripple transferred 200 million XRP, valued at over $606 million, to an unknown wallet. The massive transfer has sparked attention across the crypto sector as investors seek to understand its reason.

Ripple often makes significant token movements, but the mystery in this case lies in the destination. The wallet to which the transfer was made does not have a notable history of activity, which increases the interest in the motive of the move.

The transaction underscores Ripple’s continued influence over XRP supply, but experts note it does not necessarily mean tokens will be sold. These types of transfers are often associated with custodial or internal changes, and not necessarily selling. However, traders are wary and keep a close eye on liquidity levels in case of volatility.

Also Read: Altcoins Deliver Mixed Results as Leading Cryptocurrencies Face Daily Losses

XRP Price Movement Amid Developments

XRP’s price has hovered around $3.00 in the past 24 hours, posting a modest daily gain of 1.15 percent. The token fell slightly below the $2.97 mark, and then rose back, which was a little turbulent and accompanied the announcement of the transfer of Ripple.

Daily trading volume also rose more than 11 percent, reaching $6.76 billion, suggesting increased market participation during the shift..

Source: CoinMarketCap

In addition to the wallet transfer, focus has been on wider regulatory developments. Recently, the Securities and Exchange Commission in the U.S. postponed the decision on XRP exchange-traded funds by 21Shares and CoinShares.

Together, the transfer and regulatory delay have contributed to heightened market activity. The price stability at the $3.00 mark implies that investors are considering short-term speculation as well as long-term opportunities associated with a possible ETF approval.

SEC Delays Decision on XRP ETF

The SEC’s postponement means a final ruling on the ETF proposals is expected by October. In the meantime, Polymarket odds have a 78 percent chance of being approved, compared to 90 percent a month earlier. This drop underlines a change in confidence among traders as they consider the regulator’s timing and the wider market messages.

Speculation has been rife as Ripple moves 200 million XRP as the SEC stalls ETF decisions. With XRP’s price holding steady around $3.00, the market is balancing immediate developments against expectations for October’s regulatory outcome.

Also Read: Jeremy Allaire Celebrates GENIUS Act Approval as Circle’s USDC Nears $70B Market Cap

The post Mysterious 200,000,000 XRP From Ripple Amid Key SEC Update – What’s Going On? appeared first on 36Crypto.

You May Also Like

WLFI Bank Charter Faces Urgent Halt as Warren Exposes Trump’s Alarming Conflict of Interest

UNI Price Prediction: Targets $5.85-$6.29 by Late January 2026