Bitcoin Dips to $60k as TRM Labs Joins Crypto Unicorn Club

Crypto markets endured a brutal week as liquidity worries resurfaced in the wake of a high-profile Federal Reserve nomination. Investors watched US liquidity signals tighten while Bitcoin ETFs experienced notable outflows, contributing to choppy price action across the sector. The period also featured a string of high-profile financing moves and notable risk events that underscored the fragility of liquidity and risk appetite in crypto markets. Bitcoin and other large assets began to show resilience only after a brief slide, with traders assessing how policy shifts could shape funding conditions in the months ahead.

Key takeaways

- Bitcoin ETFs saw three consecutive days of outflows totaling about $431 million, underscoring persistent liquidity concerns even as spot prices fluctuated and regained ground.

- The crypto market’s largest price swing this week came as BTC traded near the $60,000 neighborhood before reclaiming the $64,000 level, highlighting a delicate balance between selling pressure and support at key levels.

- TRM Labs closed a $70 million Series C, valuing the blockchain intelligence firm at $1 billion and signaling continued investor confidence in on-chain analytics as a bulwark against AI-augmented cybercrime.

- Avalanche’s on-chain tokenization activity surged in Q4, with real-world asset tokenization rising to more than $1.3 billion in TVL and daily momentum aided by BlackRock’s BUIDL fund and other institutional partnerships.

- Jupiter secured a $35 million strategic investment from ParaFi Capital, marking the first time Solana-based Jupiter accepted outside capital while expanding beyond swaps into perpetuals, lending and stablecoins.

Tickers mentioned: $BTC, $AVAX, $JUP, $SOL, $ZEC

Sentiment: Bearish

Price impact: Negative. The week’s liquidity concerns and continued selloffs pressured prices, with intraday volatility driven by ETF outflows and leveraged-liquidation activity.

Trading idea (Not Financial Advice): Hold. The near-term setup suggests sensitivity to macro signals and policy cues, but liquidity adaptations by major players could offer selective opportunities in risk-managed positions.

Market context: The period reflected broader crypto-market liquidity dynamics, policy expectations around the Federal Reserve, and ongoing flows into and out of crypto-related products that influence price trajectories and risk appetite.

Why it matters

The week highlighted how macro policy choices and liquidity conditions remain core to crypto pricing. The nomination of Kevin Warsh to head the Federal Reserve has sparked debate about whether policy will tilt toward stabilizing liquidity flows or sustaining tight funding conditions. Traders closely watched whether the nomination would translate into a more cautious stance on rate reductions and balance-sheet expansion, potentially placing continued pressure on risk assets, including digital currencies and DeFi platforms.

Meanwhile, institutional interest in on-chain analytics and risk-management tools continued to rise. TRM Labs’ unicorn status after a $70 million Series C underscores the market’s belief that blockchain intelligence and anti-fraud capabilities will be central to enterprise risk management as digital asset ecosystems grow in scale and complexity. The round, led by Blockchain Capital with participation from Goldman Sachs and others, signals ongoing appetite among traditional financial players to integrate crypto-native risk controls into broader financial operations.

On the product and network side, tokenization within Avalanche continued to gain momentum, a trend amplified by the involvement of traditional finance players. The platform’s growth in tokenizing real-world assets, combined with the launch of BlackRock’s BUIDL fund and the S&P Dow Jones partnership with Dinari, demonstrates how tokenized money markets, loans and indexes are becoming more central to institutional experimentation. The quarter’s numbers—an increase of tokenized real-world asset value by hundreds of percent year over year—underscore a shift from speculation toward utility in tokenized finance at scale.

In parallel, Jupiter’s infusion of outside capital marked a turning point for a Solana-based protocol that has long driven on-chain trading and liquidity aggregation. The ParaFi-led investment, coupled with the company’s expansion into on-chain perpetuals, lending and stablecoins, reinforces the trend of traditional funds seeking strategic exposure to fully on-chain ecosystems that promise deeper liquidity and more resilient product suites. The market also watched for the token’s performance, with Jupiter’s native token price rising in response to the news.

Still, the week wasn’t without turbulence. The Solana ecosystem saw a significant breach in treasury management on one DeFi platform, and other episodes highlighted the ongoing cybersecurity and operational risks that confront decentralized finance as activity scales. While some platforms have moved toward more centralized governance or governance-sharing arrangements, the overarching arc remains: innovation is accelerating, but risk controls must keep pace to sustain long-term confidence.

In aggregate, the DeFi universe ended the week with a mixed risk lens. While several projects advanced tokenization and institutional collaboration, broader market momentum remained tethered to policy signals and the health of traditional liquidity channels. The week’s data points—ranging from ETF withdrawals to multi-billion-dollar liquidation events—reflect a crypto market in transition: not only growing in sophistication but also increasingly sensitive to macro policy and systemic liquidity dynamics.

Avalanche tokenization hits Q4 high as BlackRock’s BUIDL expands onchain

Blockchain network Avalanche demonstrated notable institutional traction in tokenizing traditional assets during the fourth quarter. Total value locked (TVL) in tokenized real-world assets on Avalanche rose 68.6% quarter over quarter and nearly 950% year over year, surpassing $1.3 billion, according to Messari’s state-of-Avalanche Q4 2025 report. The surge was driven in part by the November launch of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), alongside broader deployments in tokenized money markets and loans.

The momentum was helped by strategic collaborations—Fortune 500 fintech FIS teamed with Avalanche-based Intain to bring tokenized loans to market, enabling securitization of billions of dollars in credit activity. The S&P Dow Jones Digital Markets 50 Index, launched in partnership with Dinari on Avalanche, tracks a cross-section of crypto-linked stocks and tokens and underscores the ongoing push to tie traditional benchmarks to on-chain exposure. The combination of these partnerships has supported a notable expansion of tokenized assets on the platform, contributing to a broader middleware layer that bridges real-world value with blockchain rails.

Change in Avalanche real-world asset tokenization over the last 12 months. Source: MessariTraditional finance institutions are increasingly comfortable experimenting with tokenization, and the Securities and Exchange Commission’s more constructive stance toward crypto products has further lowered the regulatory headwinds facing such projects. This backdrop helps explain why on-chain asset issuance and tokenized funding mechanisms have gained traction on Avalanche, with real-world assets expanding beyond conventional crypto collateral and into more diversified financial instruments.

ParaFi Capital makes $35M investment in Solana-based Jupiter

Jupiter, a Solana-based on-chain trading and liquidity-aggregation protocol, announced a $35 million strategic investment led by ParaFi Capital. The deal marks the first time Jupiter has accepted external capital after years of bootstrapped growth. The investment included token purchases at market prices with no discount and an extended lockup period, settled entirely in Jupiter’s JupUSD stablecoin. The terms also included warrants allowing ParaFi to acquire additional tokens at higher prices, aligning long-term incentives with Jupiter’s growth trajectory.

The capital infusion comes as Jupiter broadens its product suite. After delivering a beta on-chain prediction market with Kalshi, the project rolled out JupUSD, a Solana-native stablecoin designed for on-chain settlement. Jupiter’s trading volume has surpassed $1 trillion in the past year, reflecting a rapid acceleration of liquidity and on-chain efficiency on Solana. The company has since expanded beyond swaps to perpetuals and lending, signaling a broader push to become an all-in-one on-chain liquidity hub.

Source: CoinGecko

Source: CoinGecko

Jupiter’s native token (JUP) responded to the news, rising roughly 9% over the prior 24 hours, underscoring investor appetite for Solana-native ecosystems that couple high throughput with diversified on-chain products. This momentum reflects a broader trend of cross-platform collaboration, where on-chain trading, governance, and liquidity provisioning are increasingly integrated with real-world asset workflows and institutional-grade risk controls.

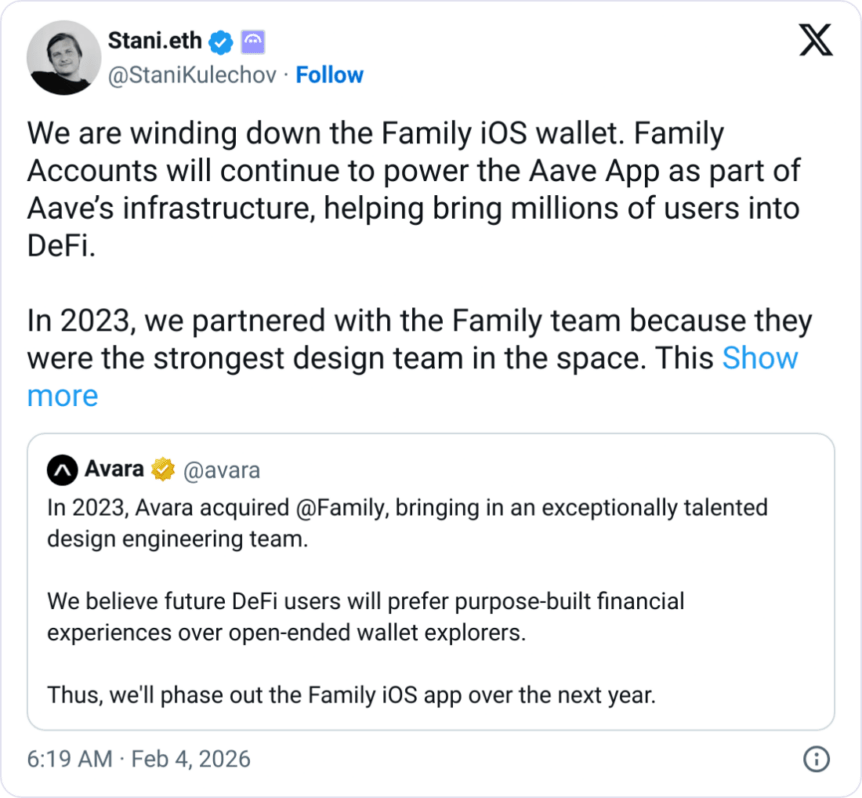

Aave winds down Avara, phases out Family wallet in DeFi refocus

Aave Labs announced a strategic refocusing by winding down its umbrella brand Avara, which encompassed projects including the Family wallet and Lens, as the group doubles down on core DeFi initiatives. Stani Kulechov, Aave’s founder and CEO, noted that Avara is no longer required as the company concentrates on delivering broad DeFi access to users, with onboarding millions of users requiring purpose-built experiences rather than generic wallet interfaces.

The move aligns with Aave’s broader strategy to reallocate resources toward its flagship lending protocol and other core DeFi products. As governance and ecosystem partnerships evolve, projects like Lens have seen stewardship shifts to other collaborations, enabling Aave to focus on what it terms “DeFi for everyone.” The decision underscores the ongoing recalibration within the market as crypto firms chase product-market fit at scale and navigate regulatory expectations alongside user growth.

Source: Stani Kulechov

Source: Stani Kulechov

Kulechov indicated that the total effort within the team remains focused on unifying engineering and design toward a singular mission: bringing DeFi to a broad audience. The development trajectory suggests continued emphasis on user-friendly, accessible financial primitives and streamlined onboarding processes rather than sprawling, multi-brand architectures.

What to watch next

- Next batch of ETF outflow data and liquidity indicators to gauge whether funding conditions stabilize or deteriorate.

- Federal Reserve policy signals and potential implications for risk assets as the Warsh nomination progresses through confirmation and policy debate.

- Continued institutional participation in tokenization and on-chain finance, including Avalanche’s RWAs and partnerships with traditional finance players.

- Jupiter’s ongoing product expansion and ParaFi’s involvement in governance and token strategies.

Sources & verification

- Data on Bitcoin ETF outflows and price movements from Farside Investors and Cointelegraph coverage.

- Record of the Jan. 31 liquidation event reported by CoinGlass and related market data.

- TRM Labs’ Series C funding round and unicorn status as announced in its press release.

- Messari’s State of Avalanche Q4 2025 report, detailing RWAs and TVL growth.

- ParaFi Capital’s $35 million investment in Jupiter and the terms of the deal.

This article was originally published as Bitcoin Dips to $60k as TRM Labs Joins Crypto Unicorn Club on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Why Bitcoin Fell 53% in 120 Days Without Any Major Bad News

Trump Ignites Speculation with National Bitcoin Venture