ChatGPT Go Arrives in India Offering Higher Usage Limits, Extended Memory

TLDRs:

- OpenAI launches ChatGPT Go in India at ₹399, offering higher usage limits and extended memory.

- India becomes a test market for regional pricing strategies to expand AI adoption.

- ChatGPT Go features larger file uploads, more image generations, and increased message caps.

- OpenAI focuses on growth and product refinement, postponing any IPO plans for now.

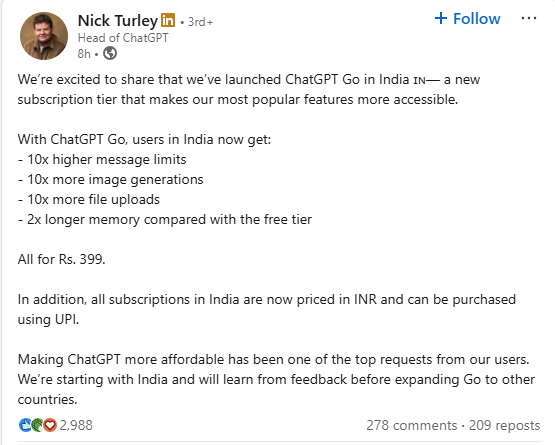

OpenAI has officially launched ChatGPT Go, a new subscription tier of its popular AI chatbot, in India, aiming to make advanced AI tools more accessible to a broader audience.

Priced at ₹399 (US$4.78), the tier introduces enhanced features such as higher message caps, extended memory, increased image generation, and larger file uploads, distinguishing it from the free version of ChatGPT.

Users in India can conveniently pay through UPI, reflecting OpenAI’s commitment to aligning with local payment preferences.

Nick Turley, Head of ChatGPT

Nick Turley, Head of ChatGPT

Affordable AI for Indian Users

The introduction of ChatGPT Go comes as part of OpenAI’s strategy to adopt regional pricing models, tailored to match local purchasing power. At ₹399, the subscription is nearly 80% cheaper than OpenAI’s existing Plus plan, which costs ₹1,999 per month.

This approach responds directly to user feedback in India, where many found the standard $20 subscription prohibitive and expressed interest in a lower-cost alternative.

OpenAI’s strategy mirrors the successful approaches of streaming platforms like Netflix, which have used localized pricing to expand in emerging markets. For the Indian market, the pricing appears well-calibrated: despite accounting for only 9.42% of global traffic, India now leads the world in monthly ChatGPT active users, surpassing even the United States in engagement levels. Analysts suggest that this market has substantial untapped potential, particularly when AI subscriptions are priced in line with local expectations.

India as a Strategic Test Market

By launching ChatGPT Go exclusively in India, OpenAI is treating the country as a proving ground for global AI product strategies. The goal is to gather user feedback before considering expansion to other regions.

India’s combination of a tech-savvy population, diverse use cases, and price sensitivity provides OpenAI with invaluable insights for tailoring AI offerings in other emerging markets with similar economic conditions and digital infrastructure.

The integration of UPI payments, for instance, reflects OpenAI’s commitment to making AI accessible in a manner that resonates with local users. This testing strategy could serve as a template for launching subscription tiers in Southeast Asia, Latin America, and Africa, where affordability and payment flexibility are critical factors for adoption.

Meeting Growing Demand for Advanced AI

The launch of ChatGPT Go coincides with India becoming a global hub for AI adoption. OpenAI continues to innovate, offering more features and higher usage limits at an affordable price helps consolidate its position in the country’s rapidly growing AI ecosystem.

Users can now enjoy a more capable AI experience, whether for content generation, research, or creative tasks, without the limitations imposed by the free tier.

OpenAI’s Broader Vision

This move is part of OpenAI’s larger expansion strategy, which includes ongoing research, hardware development, and talent acquisition.

The company recently added executives from Meta, Tesla, and xAI to its leadership team and granted retention bonuses to a significant portion of its workforce, signaling a strong commitment to growth.

CEO Sam Altman has previously emphasized that while OpenAI continues to expand its offerings and capabilities, an IPO is not currently a priority, allowing the company to focus on operational excellence and innovation rather than public market pressures.

The post ChatGPT Go Arrives in India Offering Higher Usage Limits, Extended Memory appeared first on CoinCentral.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

US Senate Releases Draft Crypto Bill Establishing Clear Regulatory Framework for Digital Assets