Washington’s Fall Agenda Puts Crypto and Banking Rules in Play

The GENIUS Act sets the stablecoin baseline.

But when the House and Senate reconvene in early September, Washington will wade into one of the most consequential financial policy seasons in years – one that could redraw lines between banks, fintechs, and crypto firms.

The GENIUS Act might be revised. The CLARITY Act goes to the House. The SEC and CFTC weigh in on various regulations – and of course, the courts will have their say as well.As lawmakers and regulators advance a mix of statutes and rules that touch everything from stablecoins and token classification to open banking and federal payments, Washington’s fall agenda could set crypto’s course for the foreseeable future.

And it could also set up these three of the best crypto presales for instant post-launch success.

Will GENIUS Be Revised?

In July, the GENIUS Act became the first federal framework for payment stablecoins. It requires full-reserve backing, AML/BSA compliance, and empowers Treasury and the OCC on oversight.

Early commentary noted several potential loopholes and complications with the act. Perhaps that’s to be expected with a ‘first-ever’ piece of legislation, but it has already highlighted the need for further clarification – and perhaps additional legislation. Agencies now must write implementing rules, and Treasury has opened a public comment process through mid-October.

In the meantime, the ICBA wrote an open letter to the US Congress highlighting flaws with the GENIUS Act that could undermine key provisions in US interstate commerce.

Banking trade groups (ABA, BPI, ICBA, and others) support a federal framework but want Congress to repair perceived GENIUS Act loopholes.

Those include treatment of interest/yield on stablecoins via affiliates, limits on non-financial company issuers, and a controversial interstate provision (often cited as Section 16(d)) that they say undermines the dual banking system.Expect lobbying to intensify as committees take up follow-on technical fixes.

The CLARITY Act Is Up Next as Agencies Push Modernization

The CLARITY Act (Digital Asset Market Clarity Act of 2025) would define ‘digital commodities,’ create CFTC registration categories (exchanges, brokers, dealers), and help settle the SEC–CFTC divide on many tokens.

The bill has administration backing and is expected to move when Congress returns. Passage would give market participants clearer lanes for token listings, custody, and disclosures.Regulators aren’t waiting on Congress. The SEC and CFTC continue to stake out interpretation territory on what is a security vs. a commodity. At the same time, the CFPB’s Open Banking Rule (Section 1033) has hit a dramatic twist – the Bureau, under new leadership, moved to have its own rule vacated and is preparing a narrower rewrite.

In the meantime, the fate of the law remains in the courts’ hands. They’ve stayed the rule during the reset, leaving fintech data-sharing rights and obligations in limbo for the fall.

Meanwhile, the White House and Treasury kicked payments modernization into high gear: paper checks for most federal payments end on September 30, 2025.

Over 3M people are employed by the federal government, not to mention contractors, consultants, and everyone else receiving payments.The end of paper checks should rapidly push more Americans toward faster, digital financial rails. That’s the perfect setting to launch a crypto presale.

Bitcoin Hyper ($HYPER) – Hybrid Layer 2 Expands Bitcoin For DeFi, Faster Payments

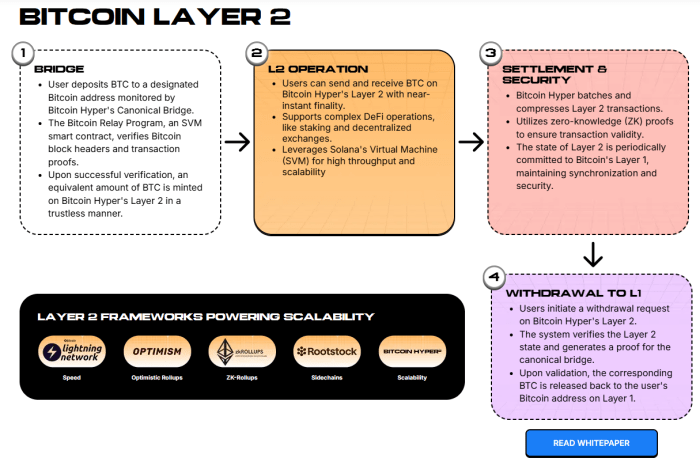

Bitcoin Hyper ($HYPER) gives Bitcoin users faster payments, lower fees, and native on-chain staking – all through a Bitcoin Canonical Bridge that deposits wrapped $BTC on the Solana Virtual Machine (SVM).

It’s an innovative architecture that uses SVM’s lightning-fast payment resolution and ability to execute the complex smart contracts necessary for DeFi. At the same time, Bitcoin Hyper preserves final settlement for the Bitcoin original layer, leveraging the OG crypto’s rock-solid security and dependability.

What is Bitcoin Hyper? It’s the next evolution of Bitcoin, pushing the ecosystem forward without losing the unique features that make $BTC such a great store of value.

Read all the details in our guide on how to buy Bitcoin Hyper, and check out the project whitepaper for more info. We think the project’s price could skyrocket from the current $0.012755 to $0.32 by the end of 2025.

Visit the Bitcoin Hyper presale to learn more.

SUBBD Token ($SUBBD) – Unlock $85B Content Creation Market

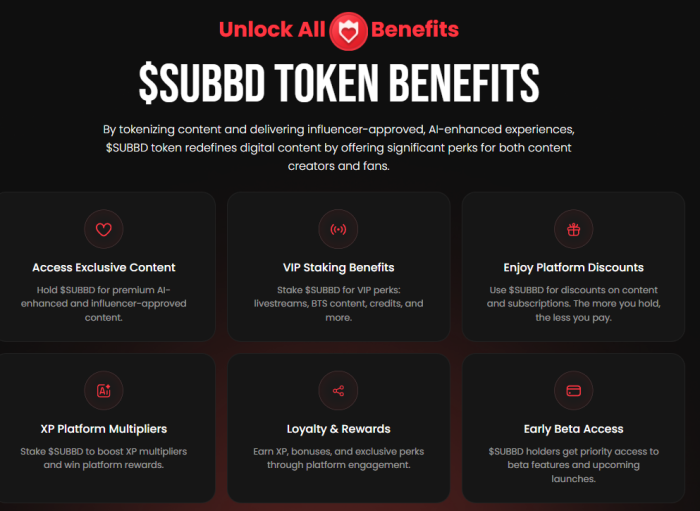

SUBBD Token applies one red-hot market – crypto – to another – content creation. By placing a content creation platform on-chain, SUBBD unlocks new ways for fans and creators to interact, using $SUBBD as a utility token.

Platform staking benefits, platform discounts, early access and behind-the-scenes content – everything is possible to token holders with $SUBBD.

The platform also features a full suite of advanced AI content management tools. Human creators can deploy AI influencers, use AI content workflows, and create AI livestreams to boost their own content.The content creation market is already blisteringly hot, valued at $85B – bigger even than the crypto meme coin market and the best meme coins. That’s one reason we predict $SUBBD’s price could reach $0.301, a 435% increase from its current $0.056225.

The presale has already brought in well over $1M, so check out how to buy SUBBD.

Learn exactly what SUBBD is, then visit the presale page now.

BlockDag ($BDAG) – Directed Acrylic Graphs Achieve True Utility

DAGs – Directed Acrylic Graphs – power BlockDag, one of crypto’s most advanced Layer-1 blockchains. It’s a security-focused ecosystem with the Bitcoin-inspired Proof-of-Work consensus mechanism.

Proof-of-Work, and Blockdag’s security-focused approach, goes a long way to explain why $BDAG has experienced one of the best crypto presales of 2025, raising an incredible $376M.

With 150B coins, $BDAG’s tokenomics prioritizes mining operations, then the presale. Hold $BDAG to pay network fees and stake it to earn more on your tokens.

The testnet is now live as BlockDAG nears the conclusion of the presale.

Key Dates in Fall Agenda as Best Presales Launch

- Early September: Congress returns; watch for CLARITY Act markups and hearings on GENIUS Act fixes.

- End of September: Federal paper checks mostly end.

- By Oct. 17: Treasury comment deadline on GENIUS Act implementation.

- Throughout the fall, there will be court updates and CFPB actions on 1033, SEC/CFTC guidance shaping token classification, and proposed regulations on AI in digital finance.

The US government, under President Donald Trump and a wave of crypto-friendly appointees, could be about to transform the US economy. Digital initiatives and pro-crypto policies are just the beginning, and $SUBBD and $HYPER look ready to profit.

Do your own research – nothing here is financial advice.

You May Also Like

WLFI Bank Charter Faces Urgent Halt as Warren Exposes Trump’s Alarming Conflict of Interest

UNI Price Prediction: Targets $5.85-$6.29 by Late January 2026